Income tax payment is a significant cornerstone of government revenue, pivotal in funding public welfare initiatives and infrastructure projects. The central government exercises its legitimate authority to gather these tax funds, channelled to fuel societal progress and development. However, the responsibility of meeting income tax obligations rests upon taxpayers, and failure to fulfil these commitments can lead to adverse repercussions. In such instances, taxpayers may incur additional charges in the form of interest or penalties. Individuals and entities alike need to honour their tax responsibilities to ensure the continued advancement of our society.

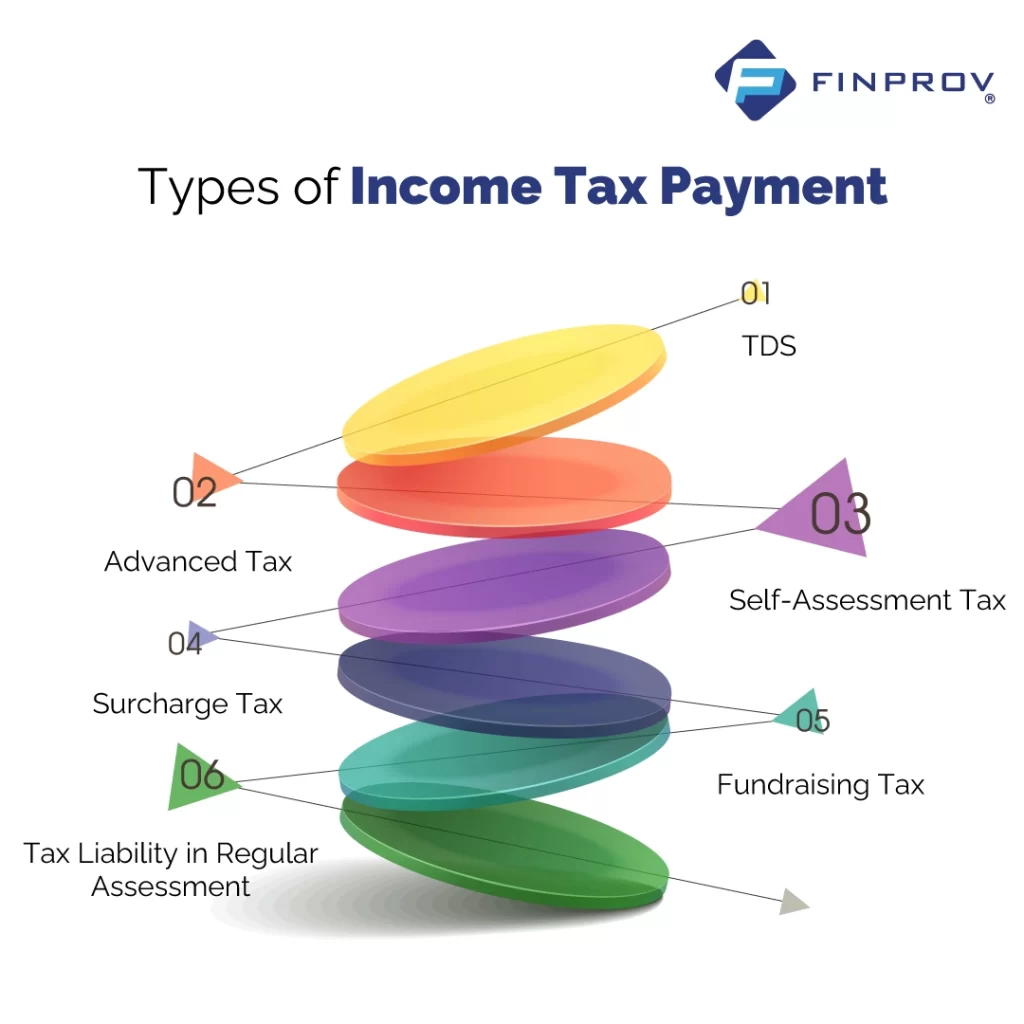

Types of Income Tax Payment

TDS

Tax Deducted at Source (TDS) ensures taxes are withheld from income when it’s generated. Its purpose is to prevent tax evasion by placing the responsibility of deduction on the payer. When an individual or entity (called the deductor) is responsible for disbursing payments to another individual or entity (named the deductee), they must deduct a predetermined percentage of tax (TDS) before completing the payment. The deducted tax amount is then remitted to the government by the deductor on behalf of the deductee.

The amount of tax deducted is reflected in Form 26AS or a certificate provided by the person who removed it. This tax deduction applies to various payments such as salary, interest, commission, brokerage, professional fees, royalty, and contract payments. The Income Tax Act determines the deduction thresholds and rates and depends on the payment type.

Advanced Tax

If you expect to owe more than INR 10,000 in taxes, you must pay a portion before the official tax payment deadline. This is known as Advance income tax payment, which is required by law. You must make four instalments throughout the fiscal year, each payment due on the 15th of the quarter. If you are operating under the presumptive taxation scheme, you must pay your taxes by March 15th for the 2016-17 fiscal year.

According to the Income Tax Act, income is taxed at specific rates or based on predetermined income brackets. Taxpayers must calculate their taxable income by applying the appropriate rate for their income category. Additionally, when computing the amount of advance tax to pay, any taxes already paid through methods like Tax Collected at Source (TCS) or Tax Deducted at Source (TDS) should be subtracted.

Self-Assessment Tax

Self Assessment Tax is a term used to describe the responsibility of taxpayers to calculate and pay their tax liabilities directly instead of having them deducted at the source. If a taxpayer’s total tax liabilities are less than the combined amount of advance Tax and Tax Deducted at Source (TDS), there is no obligation to pay any additional tax.

Surcharge Tax

The surcharge is an additional tax the government imposes on individuals who earn over INR 50 lakhs and companies who make over Rs 1 crore. It is calculated based on the income tax amount, not gross income. The surcharge is imposed according to a tiered structure with different slab rates based on the total taxable payment declared by the taxpayer during the relevant assessment year.

Fundraising Tax

The government imposes a cess to fund specific education, healthcare, and more initiatives. Unlike the above-mentioned taxes, cess is collected in a particular period and can be modified or discontinued. The Indian Government imposes different types of cess, including Education Cess, Swachh Bharat Cess, Krishi Kalyan Cess, Infrastructure Cess, and more. The deduction rate depends on the financial policy applicable for a specific assessment year.

Tax Liability in Regular Assessment

Each person is responsible for accurately calculating and paying their taxes. If the Income Tax department finds that someone has spent less than the actual amount owed, they will take corrective action to determine the correct tax liability. This is known as the tax on regular assessment, which is the amount the individual must pay. The payment must be made within 30 days of receiving the demand notice.

Tax Penalties

Each of the taxes mentioned above has a specific deadline that must be met. Please meet these deadlines to avoid penalties being imposed. Below are some of these penalties that may occur.

TDS Penalties

| Penalty/Interest | Consequences |

| 234E | Failure to file TDS by the due date incurs a daily penalty of INR 200 until the default is rectified. |

| 201A | Interest is applied when the deductor fails to deduct or deposit TDS to the government by the due date. |

| Section 271H | Incorrect return filing results in a minimum penalty of INR 10,000 for deductors/collectors. |

| Section 276B | Non-payment of the credited amount may lead to a minimum 3-month imprisonment term and a fine. |

Advance Tax Penalties

| Penalty/Interest | Consequences |

| Section 234B | Interest at a rate of 1% per month is levied if there is no payment or if the taxpayer fails to pay 90% of assessed tax liability during the assessment year. |

| Section 234C | Interest at a rate of 1% per month is levied for the postponement of tax during the financial year. |

Self-Assessment Tax Penalties

| Penalty/Interest | Consequences |

| Section 221(1) | If taxpayers do not pay their taxes on or before the due date, they must settle a penalty amount determined by the assessing officer. |

How to pay Taxes in India?

Taxpayers have the flexibility to choose between two methods for making tax payments: online or offline.

Online Income Tax Payment

To make income tax payments online, navigate to the Income Tax portal, select the INTS 280 option, and input the required information. This process allows for online tax payment, with the opportunity to either log in to the portal or proceed without logging in.

Offline Income Tax Payment

For offline tax payment, visit the nearest bank branch to obtain the challan form (Form 280). Complete the necessary details on the form and submit the structure and the payment to a bank official. A receipt will be equipped as confirmation of the transaction.

To check the status of income tax payments online, access the TIN NSDL e-payment portal. You can download the challan status inquiry form to inquire about the current status of your tax payment.

Enrolling in an Income Tax course provides individuals a valuable avenue to enhance their understanding of income tax filing. An online Income Tax accounting course, in particular, presents a remarkable opportunity for learners to grasp this intricate subject matter thoroughly. At Finprov, we offer an Income Tax course meticulously crafted to equip learners with the knowledge and proficiencies to accurately and efficiently prepare and file income tax returns.

Our comprehensive Income Tax course encompasses a wide array of foundational concepts. It delves into crucial aspects such as the various heads of income, intricate tax frameworks, both traditional and contemporary tax schemes, essentials of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS), critical due dates, penalties, maintenance of accounting books, and accounting principles.