As a salaried individual, your employer usually deducts taxes from your salary via Tax Deducted at Source (TDS). However, if you are self-employed or have additional income besides your paycheck, such as rental income, the taxes deducted at source may not cover your total income tax liability. To accurately determine the amount of Tax you owe or check if you are eligible for a refund, you must file your income tax returns.

Filing your income tax returns is a crucial process involving reporting all your income sources, claiming eligible deductions, and calculating the final tax liability. By doing so, you can ensure that you have paid the correct amount of Tax, and if you have paid excess Tax through TDS, you can declare a refund for the extra amount.

If you work for yourself or generate income from other sources besides your salary, it is crucial to maintain thorough records of your earnings and expenditures. Doing so will enable you to calculate your taxable income precisely and claim any applicable deductions and exemptions. The income tax filing process varies from country to country, and it is essential to comply with your specific jurisdiction’s tax laws and regulations.

In many countries, there are specific deadlines for filing tax returns, and failure to file within the due date may lead to penalties or fines. To ensure a smooth tax filing process and accurate tax computation, consider seeking assistance from a qualified tax professional or using reliable tax filing software. They can guide you through the process, help you identify all possible deductions, and ensure compliance with tax laws.

How to Pay Income Tax Online: Steps to Pay Income Tax Online

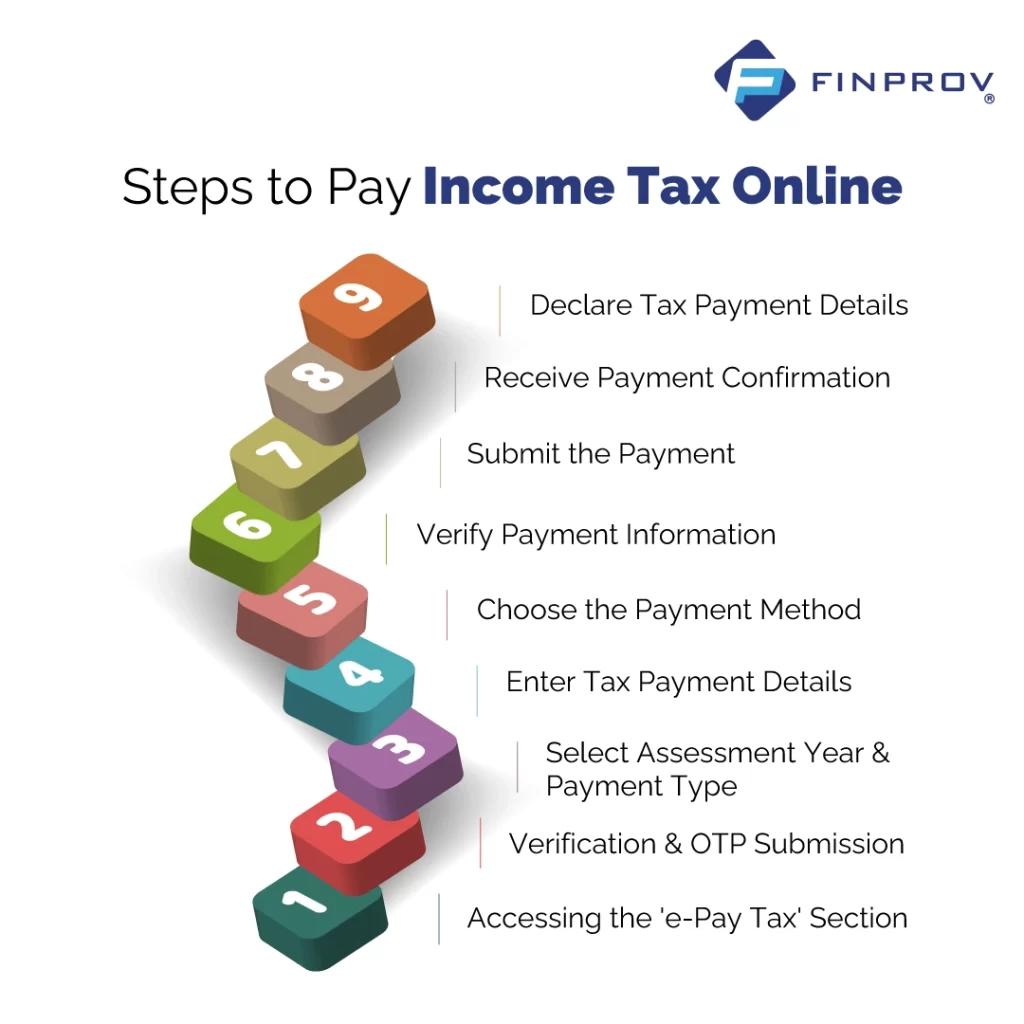

Step 1: Accessing the ‘e-Pay Tax’ Section

To begin, go to the official Income Tax Portal by typing its URL in your web browser and hitting Enter. Look for the ‘Quick Links’ section on the left-hand side of the portal’s homepage. Next, click the ‘e-Pay Tax’ option from the provided list of quick links. Similarly, you can use the portal search bar to find ‘e-Pay Tax’ by typing it into the search field and clicking on the relevant search result.

Step 2: Verification and OTP Submission

Enter your PAN (Permanent Account Number) or TAN (Tax Deduction and Collection Account Number) and re-enter it to confirm accuracy. Add your registered mobile number to the designated field and click ‘Continue.’ Shortly after, a 6-digit OTP will be dispatched to the registered mobile number that you have given. Put the OTP you received on your mobile and click ‘Continue’ to verify your identity securely.

Step 3: Select Assessment Year and Payment Type

On the portal, locate and click on the first box labelled ‘Income Tax’ and then click ‘Proceed.’ From the dropdown menu for ‘Assessment Year,’ select ‘2023-24’ to ensure the correct financial year. Under the ‘Type of Payment’ section, choose ‘Self-Assessment Tax (300)’ from the options provided. After selecting the appropriate Assessment Year and Payment Type, click ‘Continue’ to proceed to the next step.

Step 4: Enter Tax Payment Details

Enter the payment amounts accurately under the relevant categories. These categories may include Income Tax, Surcharge, Education Cess, and other applicable taxes or penalties. To ensure accurate payment amounts, refer to the pre-filled challan. This pre-filled challan will contain the necessary details based on your income and tax calculations.

Step 5: Choose the Payment Method

Choose the desired payment method and your preferred bank from the available options. The available payment methods may include internet banking, debit card, credit card, RTGS/NEFT, UPI, or payment at the bank counter. Select ‘Continue’ to move on to the next step.

Step 6: Verify Payment Information

Once you click ‘Continue’, you can see a preview of the challan details. Double-check all the payment information to ensure accuracy and correctness. If everything is in order, click ‘Pay Now’ to proceed with the payment. If you need to change the payment details, click ‘Edit’ to modify the information before proceeding with the price.

Step 7: Submit the Payment

Before proceeding with the payment, tick the checkbox to indicate that you agree to the provided Terms and Conditions. Click ‘Submit To Bank’ to initiate and complete the payment process securely.

Step 8: Receive Payment Confirmation

Upon successfully submitting your tax payment, you will receive a confirmation indicating that the payment has been processed and completed.

Step 9: Declare Tax Payment Details

After making the tax payment, updating the payment information for accurate record-keeping and tax filing is essential. Navigate to the ‘Tax Summary’ page and click ‘Add Paid Tax Details’.

By following these steps, you can ensure a seamless tax payment process, receive payment confirmation, and accurately update the tax payment details on the tax platform for further tax-related purposes.

Benefits of Tax Payment

Electronic tax payments have revolutionized how individuals and businesses pay their taxes, bringing many benefits to taxpayers. One of the most significant advantages of online payments is its time-saving convenience. Taxpayers can now make payments anytime and from the comfort of their homes or offices, avoiding the need to endure long queues at physical payment centres.

Moreover, online payments streamline the tax payment process by automating record updates. Once a payment is made electronically, the tax department’s records are automatically updated without the taxpayer taking additional measures. This automated process ensures accurate and timely recording of tax payments, reducing the chances of discrepancies and delays.

Another valuable benefit of online payments is the instant generation of tax payment receipts. An electronic receipt is generated when the payment is processed, providing immediate proof of payment. Tax payers can easily access and store these receipts for their records or future reference. Furthermore, the online payment verification feature adds to the transparency of the tax system. Taxpayers can conveniently verify the status of their tax payments online, ensuring that their prices have been received and duly processed by the tax authorities.

Joining an Income Tax course helps candidates to acquire more knowledge. Finprov‘s online Income Tax course offers a comprehensive opportunity for learners to increase their understanding of income tax filing. The course equips participants with essential knowledge and skills for accurate tax preparation and filing. Covering critical concepts like income heads, tax frameworks, TDS & TCS, due dates, and more, practical training is incorporated to reinforce learning. This experimental approach enables learners to gain valuable experience and a deeper grasp of the subject matter.