Why Learn Accounting?

Accounting is the systematic process of presenting and communicating financial information about an individual or entity. In simpler terms, it involves how a business records its financial data organisationally. Those in charge of accounting tasks, such as accountants, aim to accurately capture a snapshot of an organisation’s financial health at a given time. Some regular accounting tasks include writing down transactions, gathering money-related details, putting together financial records and reports, preparing tax paperwork, and ensuring a company follows the rules for taxes and money records.

People often think only finance and accounting experts need to know about accounting, but understanding financial accounting is essential for everyone in business. Whether you’re a business owner who needs to organise your company’s money records, a business person wanting to grasp and help with money choices in your company, or someone who wants to understand your finances better, learning the basics of accounting can be helpful.

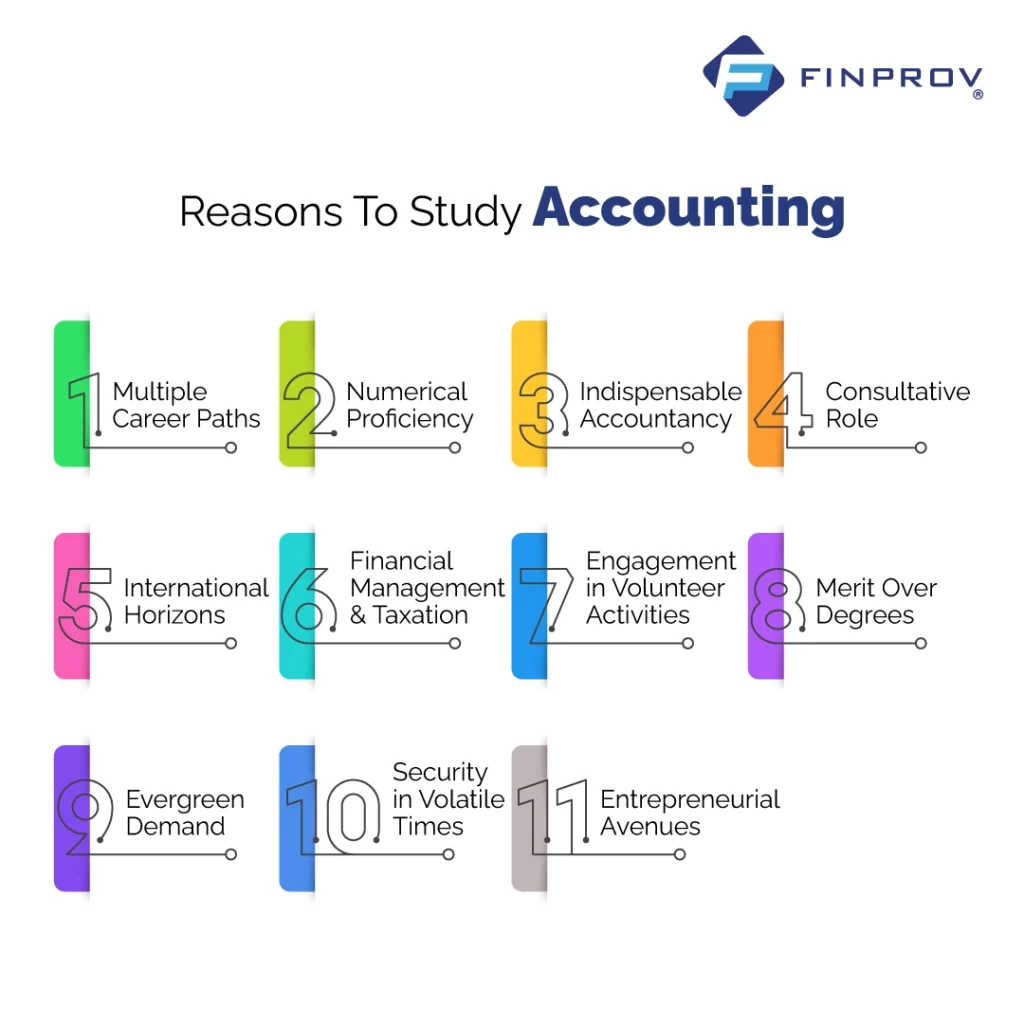

Reasons To Study Accounting

Accounting Proficiency causes to get Multiple Career Paths

Gaining proficiency in accounting lays a solid groundwork for virtually any professional journey. The value of an accounting certification endures over time. Such a credential can be a stepping stone towards a prospective career in finance or economics and a versatile asset if you venture into a different field. Possessing an accredited certification communicates to potential employers that you have a knack for numbers, excel in maintaining meticulous records and generating reports, and are familiar with budgeting and financial foresight. These capabilities remain highly desirable across a spectrum of job roles. Importantly, excelling as an Accountant doesn’t necessitate being a maths prodigy.

Numerical Proficiency

While computers have streamlined the work of accountants by handling intricate calculations, a fundamental grasp of mathematics remains essential. Technology takes complex computations in today’s accounting landscape, sparing you the need to wield convoluted formulas for significant figures. However, comfort with numbers is still imperative. Modern accountants are also expected to possess robust communication skills, enabling effective interaction with clients spanning diverse industries.

Indispensable Accountancy

The role of an accountant extends across every sector, as every establishment or corporation requires a skilled professional to manage their financial operations. Consider the intricate financial web within businesses – the necessity of overseeing funds, engaging with financial institutions, addressing tax matters, and more. If you hold the relevant qualifications, organisations are eagerly seeking your expertise.

Entrepreneurial Avenues

For accomplished accountants, the potential to venture into entrepreneurship beckons, fueled by an in-depth understanding of market dynamics. Your proficiency opens doors to comprehending diverse industries and market nuances. You can embark on an independent journey with the proper credentials and skills, establishing your accounting firm and employing others.

International Horizons

Qualifications like those offered by the Association of Chartered Certified Accountants (ACCA) unfurl the globe as your potential workspace. You can access opportunities in over 120 countries with ACCA and similar credentials. Your expertise might lead you to affiliations with prominent firms that seek your understanding across borders. Consider it a professional passport to the world.

Consultative Role

Prospective accountants need not fret over complex mathematical equations. Their primary role revolves around providing expert advice to clients. Accountants are not solely mathematicians; they serve as advisors, proficient bookkeepers, and effective communicators, guiding clients through financial intricacies.

Financial Management and Taxation

In accountancy, you’ll encounter phases of heightened activity and earnings. As an accountant, you’ll be deeply engrossed in financial planning and taxation. Throughout the fiscal year, you’ll engage in quarterly audits, end-of-year assessments, tax deliberations, speculative projections, and the formulation of financial strategies for upcoming periods. This period is characterised by bustling activity for accountants.

Engagement in Volunteer Activities

Non-Government Organisations (NGOs) seek volunteers for charitable and welfare efforts and professionals like accountants to ensure smooth operations. Prominent organisations like WHO, WFO, WWF, UN, and Amnesty, among others, actively require skilled volunteers to support their work due to limited resources. By volunteering your expertise as a qualified accountant, you’ll interact with accomplished individuals who can propel your career. They may provide recommendation letters, networking opportunities, or job placements.

Merit Over Degrees

Your academic grades or the institution you attended don’t exclusively dictate your employability or client appeal. Instead, the focus lies on possessing the requisite skills and qualifications for an accounting career. Accountancy centres on competence and professional certifications. You can self-educate or enrol in institutions that offer relevant qualifications. ACCA, for instance, provides an avenue for early employment, competitive remuneration, and global recognition.

Evergreen Demand

Professionals adept in finance, particularly accountants, enjoy perpetual demand across industries. In realms where financial transactions are integral, the role of an accountant remains indispensable. The need for financial expertise endures as businesses navigate fiscal intricacies and various monetary undertakings.

Security in Volatile Times

A career in accounting remains relatively insulated from the turbulence of political shifts and budgetary reductions. Companies often tighten their belts during challenging economic phases and downsize their workforce. This belt-tightening typically affects marketing and sales while the accounting department remains resilient. It’s a domain that can’t easily afford staff reductions, provided the necessary qualifications are in place.

Furthermore, political transformations hold limited sway over this realm. Should policies, governments, or regulations undergo alterations, accountants are well-positioned to grasp and accommodate these changes swiftly. They might be among the first to become aware of such shifts and adeptly adjust their practices. However, it’s essential to acknowledge that no circumstance is guaranteed with absolute certainty, and while accounting offers resilience, adaptability remains critical.

Finprov stands out as a premier institution for accounting courses, offering an exceptional array of specialized learning opportunities. Our institute is dedicated to equipping graduates and professionals with the necessary skills and knowledge required in accounting. With a diverse range of courses, including CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, MS Excel, and more, we ensure a comprehensive curriculum that caters to various facets of the accounting domain.

Our meticulously crafted course modules cater to the unique needs of our students, irrespective of their backgrounds. Graduates looking to embark on a rewarding career and professionals aiming to enhance their expertise will find our courses tailored to their aspirations. The integration of theoretical foundations with hands-on practical training sets our institute apart. Not only do we impart knowledge, but we also foster a deep understanding of how to apply these principles in real-world scenarios. At Finprov, we understand the importance of career prospects. That’s why we extend our support beyond the classroom. Our placement assistance program empowers graduates to secure their dream jobs while professionals can leverage their enriched skills to advance their careers.