Every business dislikes making decisions without knowing what they’re doing. To prevent that, it’s crucial to have fast and accurate accounting. The reports created by accounting teams help us see if a business is growing properly. Investors and others who care about the business use these reports to make significant decisions. This blog will explain the top 5 best practices for maintaining accounting accuracy in every business.

What does Accuracy means in Financial Reporting?

Accounting accuracy is how well a company’s financial statements and records show its financial status. It’s all about ensuring that every money transaction is recorded correctly and that the information is trustworthy without mistakes or misstatements. Being accurate is a crucial rule in accounting. It forms the base for making decisions, analysing finances, and following the applicable regulations and laws.

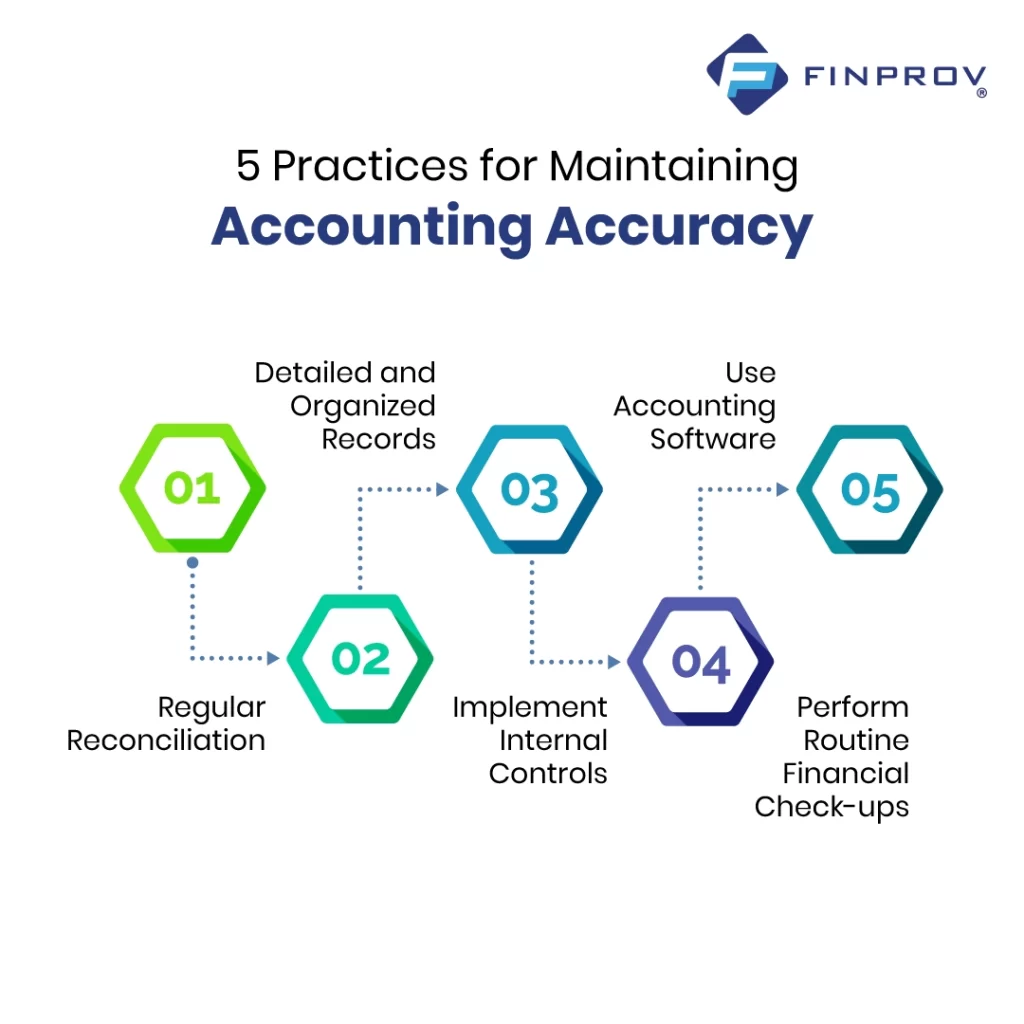

5 Best Practices for Maintaining Accounting Accuracy

Maintaining accuracy in accounting is crucial for a healthy financial management system. Here are some best practices for maintaining accounting accuracy to ensure precision:

1. Regular Reconciliation

Check and match accounts like bank statements, credit cards, and vendor statements to promptly catch any mistakes or discrepancies.

2. Detailed and Organized Records

Keep well-organised records by correctly categorising and storing financial documents such as invoices, receipts, and bank statements. This simplifies tracking and verifying transactions.

3. Implement Internal Controls

Set up internal controls like segregating duties, approval processes, and regular audits to prevent fraud and maintain accuracy. Involving multiple people in important financial tasks reduces the risk of errors or fraud.

4. Use Accounting Software

Integrate trustworthy accounting software to simplify record-keeping and minimise human errors. These tools automate calculations, monitor transactions, and produce precise financial reports.

5. Perform Routine Financial Check-ups

Consistently review financial statements and reports to spot any differences or unusual patterns. This practice enables prompt investigation and correction of errors, guaranteeing accuracy in the financial records.

Why is Accounting Accuracy Important?

Maintaining accurate financial data is essential for a business to succeed and uphold high operational standards. Here are the key reasons why your organisation must prioritise accounting accuracy:

Knowledgeable decisions based on dependable information

Accounting accuracy enables businesses to make well-informed decisions grounded in reliable information. Accurate financial statements offer insights into the company’s profitability, liquidity, and overall financial health. Without precise records, decision-makers may be misled by incorrect data, leading to poor choices with significant consequences for the business.

Proper financial analysis and evaluation

Getting the numbers right is like building the base for understanding how well a company is doing. We use these numbers to figure out trends and essential measurements of the company’s performance. It helps us see where the company can improve and compare it to similar ones. If the numbers are correct, our understanding can be correct, and we might make the wrong decisions.

Keeping with legal and regulatory requirements

Businesses must keep accurate money records and share information following the rules. The company could get weighty fines, legal problems, and a bad reputation if the financial statements need to be corrected or clarified. Investors, creditors, and others who care about the business need the correct financial info to trust the company and decide if they want to invest or lend money. Keeping things accurate follows the rules and makes everyone trust and feel confident in the business.

Credibility and transparency

Dependable financial information enhances a company’s credibility and transparency, making it more appealing to potential investors, lenders, and business partners. It also showcases a commitment to sound financial practices and responsible management. Conversely, inaccurate or unreliable financial information undermines trust and can cause a loss of credibility, which is challenging to restore.

Dive into accounting with online job oriented courses from Finprov, a leading ed-tech institute. Our comprehensive accounting training includes courses such as CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel, tailored to cater to the diverse needs of learners at various career stages. Focused on hands-on practical training, these courses equip you with skills essential for real-world application.

At Finprov, we are dedicated to empowering graduates and professionals, extending beyond educational offerings to ensure your success. We provide a 6 months diploma course in Kerala, coupled with placement assistance, unlock opportunities for some of the best jobs, paving the way for enhancing your skills towards a more promising and prosperous future. Begin your journey to success with Finprov, where education seamlessly aligns with opportunity.