The double-entry accounting system has been a fundamental finance and accounting principle for centuries. Luca Pacioli is credited with inventing this system in the 15th century, and it has since become the foundation of modern financial management. The system’s continued popularity is due to its numerous benefits, which improve financial records’ accuracy, transparency, and reliability. This blog will explore the benefits of double-entry accounting system in businesses and how financial professionals gain from using this time-tested method.

What is Double-Entry Accounting System?

The double-entry accounting system is a primary accounting method that recognizes the dual nature of every financial transaction. It is based on the principle that every transaction involves two aspects, which must be systematically recorded in the books of accounts. Essentially, the system embodies the idea that an equivalent value must be given for every value received. This fundamental concept ensures a comprehensive and balanced representation of financial activities, promoting accuracy and integrity in financial reporting.

Two Fundamental Principles of Double-Entry Accounting

The application of double-entry accounting in businesses is guided by two essential golden rules: ensuring the equilibrium of the accounting equation and minimising the likelihood of errors.

1. Dual Recording Requirement

Each transaction necessitates a minimum of two accounts for recording. This principle ensures that the financial impact of any transaction is accurately reflected in at least two corresponding accounts, maintaining the integrity and completeness of financial records.

2. Balance in Debits and Credits

The total amount debited for every transaction must precisely match the total amount credited. This foundational rule guarantees that the accounting equation remains balanced, providing a systematic and error-resistant framework for financial transactions.

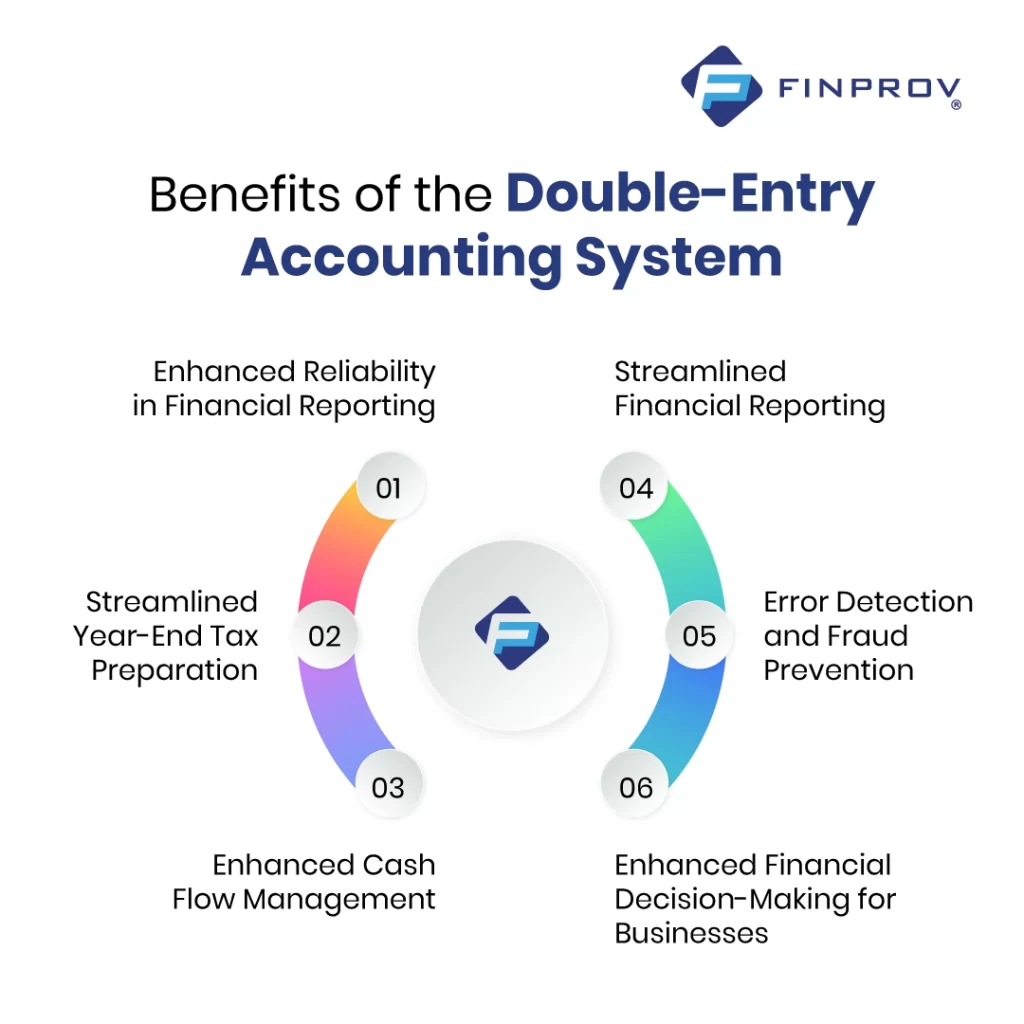

Benefits of Double-Entry Accounting System

The advantages of double-entry accounting system are explored in greater detail, emphasising key benefits:

1. Enhanced Reliability in Financial Reporting

The benefits of double-entry accounting system accurately depicts the financial landscape by recording each transaction in at least two accounts. This method provides a clearer understanding of income source expenditures and a comprehensive snapshot of a company’s assets, encompassing cash, stock, and equipment.

2. Streamlined Year-End Tax Preparation

Year-end tax preparation involves meticulously reviewing financial transactions and determining taxable entries for the company’s tax return. The double-entry process facilitates this by:

- Maintaining a clear and transparent record of every financial transaction.

- Ensuring each entry is balanced minimises the risk of errors and saves time and cost during tax filing.

- Enhancing cash flow management, ultimately contributing to the accuracy and completeness of financial records for smoother tax return preparation.

3. Enhanced Cash Flow Management

The searching and recording of all financial transactions using the double-entry method contribute to improved cash flow management. This approach offers a comprehensive and accurate record of economic activities by recording each transaction on both the credit and debit sides. This clarity enables businesses to identify areas where cash may be tied up unnecessarily, allowing for developing strategies to optimise cash flow. Moreover, double-entry accounting aids in identifying and correcting errors or inconsistencies in financial records, thereby enhancing financial information’s overall accuracy and reliability.

4. Streamlined Financial Reporting

The double-entry system proves invaluable in obtaining a more precise financial overview. Every transaction recorded in at least two accounts provides a clearer image of cash entries, elucidating the sources and destinations of funds.

5. Error Detection and Fraud Prevention

Through the meticulous recording inherent in the double-entry method, companies can enhance operational control by maintaining detailed account records. This facilitates thorough comparisons and acts as a robust mechanism for error detection and fraud prevention. One can learn these benefits of double-entry accounting system by joining accounting courses online.

6. Enhanced Financial Decision-Making for Businesses

Double-entry accounting empowers businesses to make well-informed financial decisions by furnishing a comprehensive and accurate record of the company’s financial transactions. This clear and detailed financial picture enables firms to assess their financial health, pinpoint areas for improvement, and make proper decisions regarding resource allocation and financial management. Furthermore, the method aids in identifying and rectifying errors or inconsistencies in financial records, thereby elevating the accuracy and reliability of financial information crucial for effective decision-making.

All the benefits of the double-entry accounting system stand as a robust and time-tested framework that ensures accurate financial representation and contributes significantly to the efficiency and transparency of financial management within organisations.

To learn more about the double-entry accounting systems, joining a job-oriented course in Kochi helps to get better opportunities in the industry. Finprov is a leading ed-tech institute committed to empowering graduates and professionals through diverse cutting-edge accounting courses. Our curriculum boasts top-tier programs such as CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel. Our courses are designed to cater to the unique needs of graduates and seasoned professionals, our modules provide hands-on practical training essential for real-world application.

Beyond education, Finprov is dedicated to ensuring your success by offering online job-oriented courses and placement assistance. Choose Finprov today to unlock access to some of the highest-paying jobs in India and elevate your skills for a brighter and more promising future. Your journey to success starts with Finprov – where education meets opportunity.