AI and ML have transformed the financial services industry, significantly improving businesses in several areas. From enhancing customer service to detecting fraud and automating repetitive tasks, AI has demonstrated its potential to revolutionise the industry.

Integrating AI and ML in finance has led to a shift in how finance professionals work. Financial institutions, including banks and fintech firms, increasingly leverage machine algorithms to automate time-consuming procedures and provide a more personalised and efficient consumer experience.

ChatGPT has enabled financial institutions to provide 24/7 customer service and streamline transaction speed and accuracy. ChatGPT, powered by AI and ML, allows chatbots to assist clients in various financial tasks, such as checking account balances, transferring funds, and managing investments through easy and intuitive dialogues. In addition to automating financial tasks, ChatGPT’s advanced analytics and data processing capabilities enable financial institutions to make data-driven determinations and acquire insights into customer behaviour and preferences.

While ChatGPT has demonstrated significant potential in automating financial tasks, it can only partially replace modern financial experts. Financial experts bring unique perspectives and insights essential for making complex financial decisions.

Define ChatGPT

ChatGPT, an acronym for “Generative Pre-trained Transformer,” is a powerful AI tool launched by OpenAI in November 2022. It is a variant of the famous GPT-3 language model explicitly designed for chatbot applications. ChatGPT’s machine learning capabilities enable it to automate processes, generate Excel macros, answer queries, perform financial modelling, translate languages, and even teach users how to create machine learning algorithms.

Companies have widely utilised ChatGPT’s machine learning capabilities to discover directions and designs that may have yet to be apparent to human analysts by training the model on vast amounts of financial data. This has enabled companies to make data-driven decisions and gain a comprehension of their processes and customers’ preferences.

However, despite its extensive capabilities, ChatGPT is not a replacement for human financial experts. Human experts bring unique perspectives, insights, and experience essential to making complex financial decisions.

How is the Finance sector using ChatGPT?

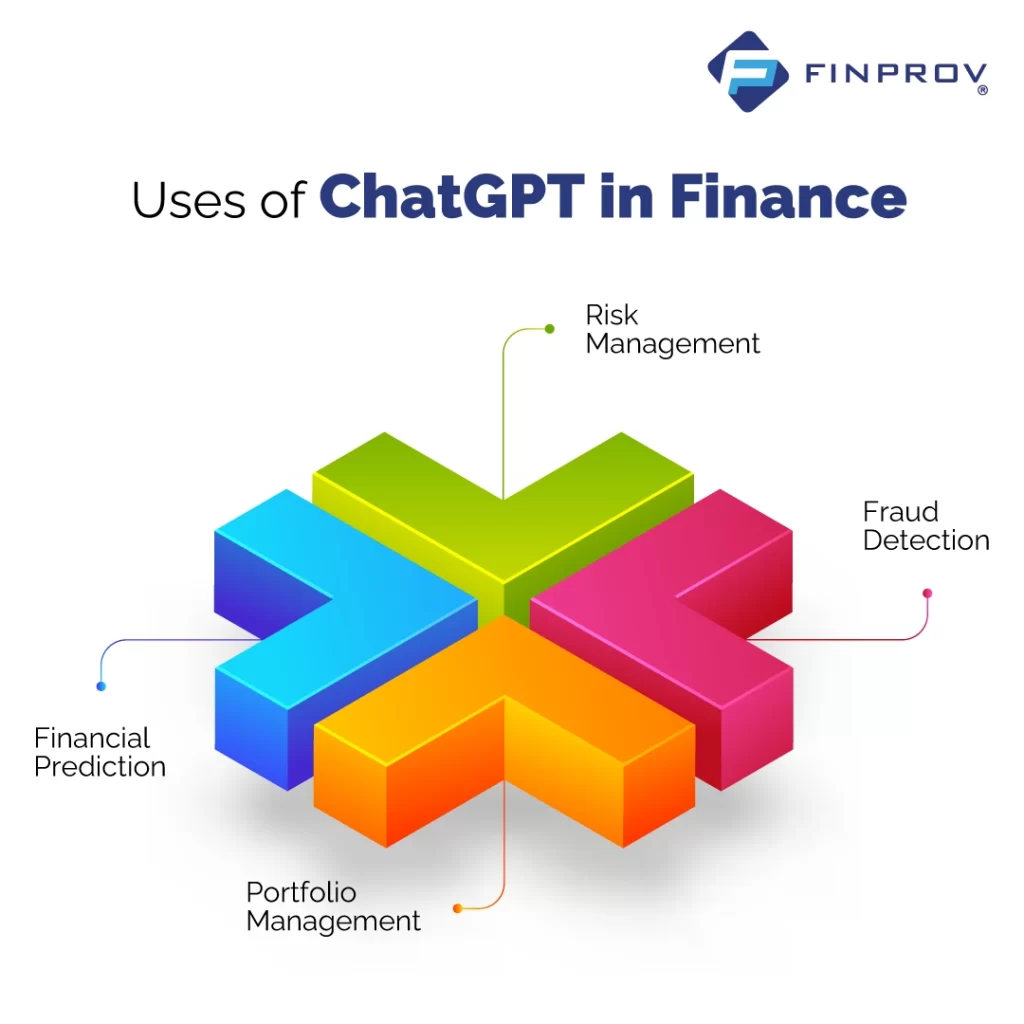

The finance sector has found various ways to use ChatGPT to enhance operations. One of the practical uses of ChatGPT in finance is risk management.

Risk Management

Certified Management Accountants (CMA) use their financial expertise to advise companies on risk management by analysing the company’s financial health based on current and historical data. ChatGPT can be a valuable tool that helps CMAs detect and analyse potential threats to a company’s financial health more quickly and efficiently.

Moreover, ChatGPT can be used to create frameworks that help the company manage those risks better. For instance, ChatGPT can provide personalised recommendations on risk mitigation strategies, identify areas of improvement, and provide insights that can help companies optimise their risk management strategies.

Fraud Detection

Fraud detection involves the detection and prevention of criminals from obtaining money or sensitive data by deception. ChatGPT can be a valuable tool in increasing safety by detecting fraud. It can seem odd or suspicious financial activity patterns and signal potential fraud for further investigation, helping finance professionals see and prevent fraudulent activities more quickly and efficiently.

Portfolio Management

Finance experts must advise their clients on portfolio management. They must implement investment strategies to achieve client objectives and help them develop and manage portfolios. Companies often hire qualified Chartered Financial Analysts (CFA) to perform this task. CFAs can use ChatGPT to optimize an asset portfolio and evaluate the performance of various assets of an individual, enabling them to make more informed decisions and provide more nuanced guidance to their clients. ChatGPT’s machine learning capabilities can help CFAs identify trends and patterns in financial data, leading to better economic predictions.

Financial Prediction

Analysing vast amounts of data can be overwhelming and time-consuming. For example, finance job roles that require courses like ACCA demand professionals to prepare corporate reports, financial accounts, and projections. With ChatGPT, ACCAs can analyse massive volumes of economic data to uncover patterns that can be used to produce more accurate financial forecasts. ChatGPT can assist ACCAs in creating financial models, generating forecasts and projections, and improving their overall financial analysis.

Will ChatGPT Replace Financial Experts?

While AI tools like ChatGPT can automate specific financial tasks, they will only partially replace human, financial experts. Instead, these tools will assist financial experts by handling large amounts of data, making suggestions, and allowing human programmers to write the final output.

ChatGPT serves as an assistant to overcome blockades and help programmers get into a productive flow. It provides an initial result that human experts can refine and improve upon. Financial experts can use ChatGPT to increase productivity, efficiency, and accuracy, but ultimately, the human touch and judgement are still crucial in making important financial decisions.

Limitations of ChatGPT

ChatGPT is an impressive AI bot that engages in human-like conversation to assist customers. It has many potential applications, but there are limits to what it can do. Despite its intuitive responses, ChatGPT cannot match the sophisticated solutions that qualified financial experts can provide. Some services require human finesse, and no amount of technological progress can replace this.

There are several reasons why ChatGPT can only partially replace financial experts. For example, its solutions may only sometimes be valid. Although its responses may seem reliable and convincing, financial experts can uncover errors or weaknesses that ChatGPT cannot detect. ChatGPT’s solutions can also be highly mechanical, making them challenging for clients to understand. In such cases, only experienced financial experts can clarify the answers and provide additional guidance. These limitations of ChatGPT highlight the importance of financial experts in finance.

While AI bots like ChatGPT can add versatility and improve responses, concerns around the accuracy and validity of answers still need to be addressed. Although tools like ChatGPT are revolutionary in assisting financial advisors in tackling complex queries, human expertise is irreplaceable. The financial services industry will always require professionals who can provide more personal and empathetic interactions with clients.

Finprov is a one-stop destination for training aspirants for the best jobs in the financial sector with the help of job-oriented accounting courses. Finprov Learning is an ed-tech institute offering a wide range of courses in accounting. As a leading provider of accounting courses, we offer comprehensive programs such as CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel, among others. Our course modules are tailored to meet the needs of both graduates and professionals, providing them with practical and theoretical training that helps them achieve their career goals in the accounting sector.

Additionally, we provide placement assistance to our learners, helping graduates land their dream jobs and professionals upgrade their knowledge and skills. Our tech-enabled learning methodology ensures that accounting concepts are easy to understand, making Finprov an excellent choice for anyone looking to enhance their accounting skills.