What is eWay Bill?

The e-way bill is an essential electronic waybill used for the transportation of goods and must be generated on the e-way bill Portal. As per GST regulations, a GST-registered individual cannot transport goods valued at more than Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill from ewaybillgst.gov.in. In addition to the website, e-way bills can be created or cancelled through SMS, Android App, or by integrating site-to-site using APIs while ensuring the correct GSTIN of the parties involved.

It is crucial to validate the GSTIN using the GST search tool before utilizing it to generate an e-way bill. Upon successful generation of an e-way bill, a unique E-Way bill Number (EBN) is assigned to the supplier, recipient, and transporter for tracking purposes. This process promotes transparency and compliance in the transportation of goods under GST.

Who should Generate an eWay Bill?

Under GST regulations, a person with GST registration must generate an e-way bill for the following situations:

- Suppose the goods being transported are valued at more than Rs. 50,000, whether to or from a registered person. It’s worth noting that individuals with registration can opt to create an e-way bill for goods that are valued under Rs. 50,000.

- If an unregistered person supplies goods to a registered person, they must also create an e-way bill. In this scenario, the registered receiver must ensure that all compliances are met and generate an e-way bill if necessary.

- If a transporter is moving goods by road, air, rail, or other means of transportation, and the supplier still needs to produce an e-way bill, the transporter is responsible for generating one. These regulations are in place to ensure transparency, accountability, and compliance with GST guidelines for the movement of goods.

By generating an e-way bill in the above scenarios, businesses can avoid penalties and legal complications while facilitating the seamless transportation of goods.

Documents Required to Generate eWay Bills

To facilitate the transportation of goods, certain documents must be relevant to the consignment of goods. These documents include an Invoice, Bill of Supply, or Challan. Additionally, depending on the mode of transportation, the following information is required:

- The Transporter ID or the vehicle number must be provided for road transportation.

- The following details are required for rail, air, or ship transportation: Transporter ID, Transport document number, and date.

By including these details in the relevant documents, businesses can ensure that the transportation of goods is smooth and complies with the necessary regulations. Providing inaccurate information may result in penalties or legal issues. Therefore, verifying and providing correct information related to the consignment of goods before transporting them is essential.

eWay Bill Format

The e-way bill is divided into Part A and Part B. Part A collects consignment details, usually including invoice information. The following details must be submitted:

- GSTIN of the recipient.

- Pin code of the delivery location.

- Please provide the invoice or challan number for the goods that were supplied.

- Please provide the value of the package being shipped.

- HSN code of the goods being transported. If your business has an income of up to INR 5 crores, you only need to specify the first two digits of the HSN code. However, a four-digit HSN code is required if your turnover is more than INR 5 crores.

- Predefined reason for transportation. The most appropriate reason must be selected from the options available.

- Transport document number includes the goods receipt number, railway receipt number, or airway bill number.

By providing accurate information in Part A of the e-way bill, businesses can ensure that the transportation of goods complies with the necessary regulations and avoid any legal complications. It is crucial to verify the details entered before generating the e-way bill.

How to Generate an eWay Bill?

An E-Way Bill (EWB) is a digital document required to move goods worth more than Rs. 50,000 (Single Invoice/bill/delivery challan) in a single vehicle, which can be generated on the e-way bill Portal. The GST e-way bill has been mandatory since 1st April 2018 per the GST Council’s regulations. To obtain a GST e-way bill, both the supplier and the transporter of the goods must register with GST.

Once generated on the portal using the required credentials, the e-way bill Portal generates a unique E-Way Bill Number (EBN) for the registered supplier, recipient, and transporter. To develop an e-way bill on the Government website, the supplier or the transporter can use LEDGERS Software, an e-way bill portal, SMS, Android App, or site-to-site integration through API.

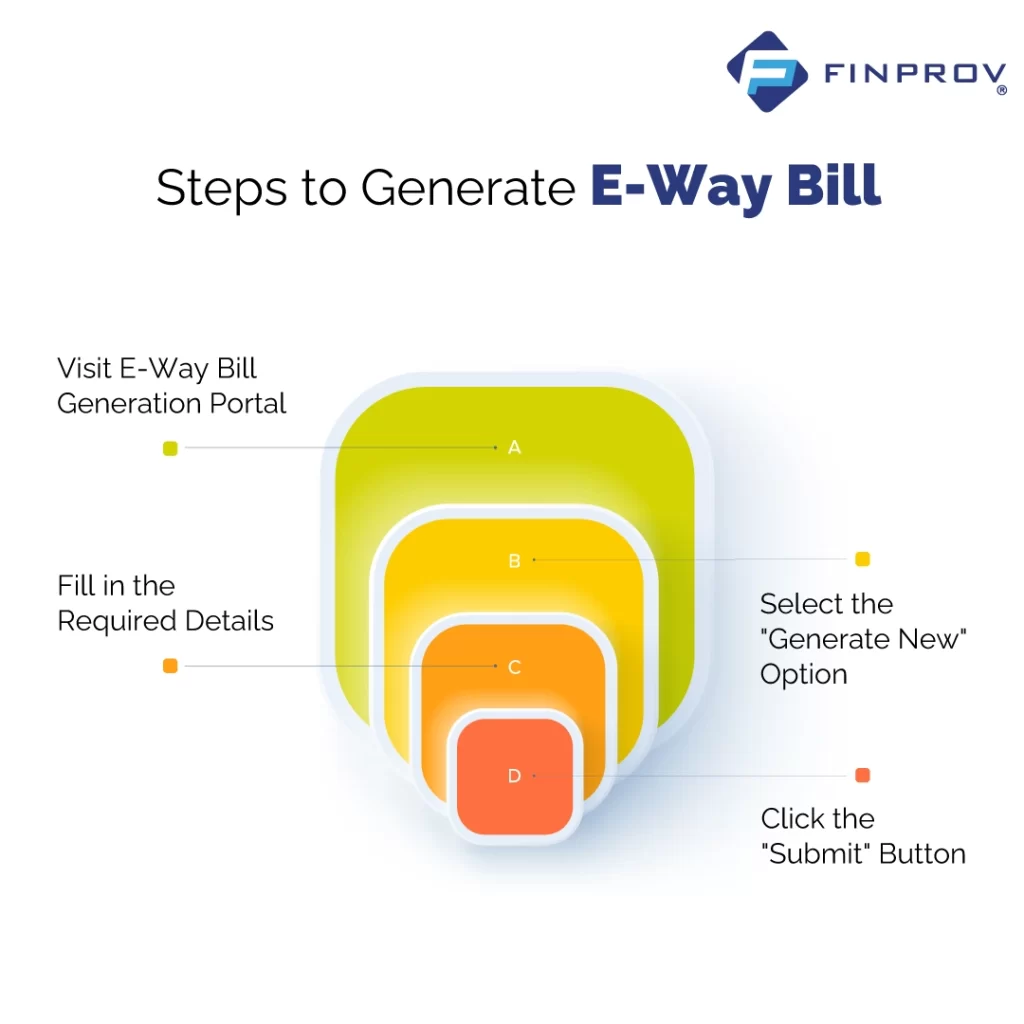

Steps to Generate eWay Bill

The e-way bill is a crucial document that is necessary for the transportation of goods. You can generate an e-way bill on the GST E-Way Portal with a GST and transporter registration.

Here are the steps to generate an e-way bill:

- Step 1: Visit the e-way bill generation portal at https://ewaybill.nic.in/ and log in to the platform using your credentials.

- Step 2: To create a new e-way bill, go to the main menu page and select the “Generate New” option.

- Step 3: Fill in the required details on the EWB generation form. Please enter details of the supplier and recipient along with their GSTIN. Product name, description, HSN code, quantity, unit of goods, value of products, and applicable tax rates must be entered. The transporter name, ID, and approximate transport distance will also be filled.

- Step 4: Once all the necessary details are entered, click the “SUBMIT” button to create the e-way bill. Once generated, the e-way bill will be shown on the portal, including the e-way bill number and a digitally encoded QR code with all the details in digital form. Providing the transporter with a printed copy of the bill is essential.

- Step 5: A consolidated e-way bill can be created by providing the e-way bill number in the required field. Click on “SUBMIT” to generate the consolidated e-way bill.

- Step 6: An existing e-way bill can be updated to update the details on the transporter, consignment, consignor, and GSTIN of both parties, provided that the bill is not due on its validity.

Validity of eWay Bill

When transporting goods, the validity of the e-way bill depends on the distance travelled. When the distance is under 100 kilometers, the e-way bill remains valid for one day from the relevant date. For every additional 100 kilometers, one more day is added to the validity period from the appropriate date. The applicable date refers to the day the e-way bill was prepared, and each day counts as 24 hours.

In general, the validity period of an e-way bill cannot be extended. However, the Commissioner may sometimes extend the validity period by issuing a notification. Additionally, suppose it is impossible to transport the goods during the validity period due to exceptional circumstances. In that case, the transporter can prepare a new e-way bill after updating the details in Part B of FORM GST EWB-01.

If you want to enhance your understanding of the e-way bill and its diverse aspects, we recommend enrolling in our comprehensive e-way bill course. Finprov, an ed-tech institute, offers a comprehensive course on e-way bill and other accounting courses. The e-way bill course covers various topics such as the e-way bill format, how to generate e-way bill on the e-way bill portal, who should generate e-way bill, e-way bill rules, validity and much more. Enrolling in this course, you can better understand the e-way bill and its business implications.

At Finprov, a hands-on approach is key to effective learning. Our courses are created to provide students with real-world scenarios and projects, giving them the practical knowledge needed to succeed in the workforce. Our experienced instructors guide students through a solid theoretical foundation while emphasizing practical applications so that students can apply their newly acquired skills to work.