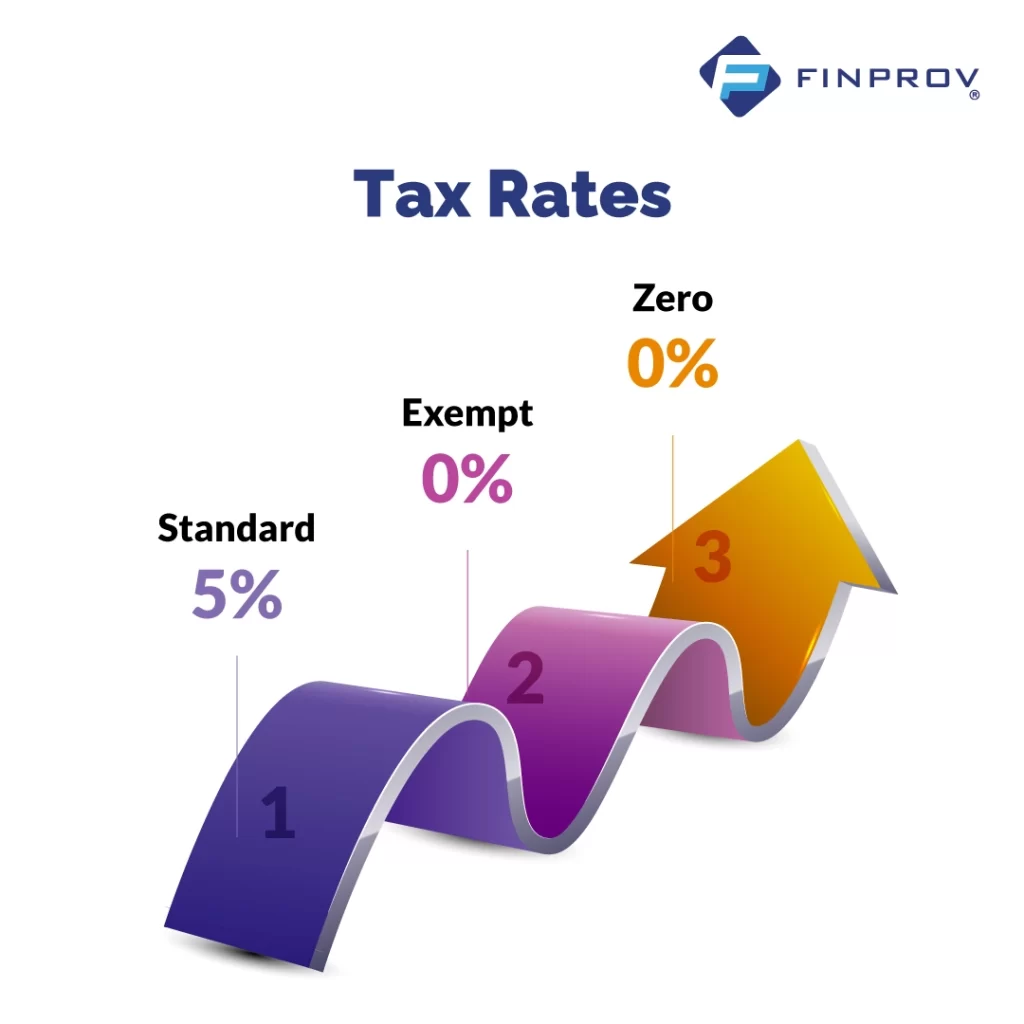

The GCC framework has established three VAT rates that member states can apply with varying degrees of discretion. The first two rates apply to taxable supplies, while the third rate applies to tax-exempt supplies. They are Standard rate, Zero rates and Tax exempt.

VAT Rate in UAE Explained

Standard Rate

The standard rate, fixed at 5%, is applicable across various sectors. Invoices must display the tax value individually; the final bill value is the sum of the total amount plus the Tax.

For businesses that provide VAT-inclusive prices, showing the VAT charged separately on their invoices is mandatory, rounded to the second decimal place. The VAT registration number must also be included on the invoice to facilitate the buyer’s VAT credit claim.

Zero Rate

When a zero rate is applied, the Tax is calculated at a rate of 0%. Invoices for zero-rated transactions should include a tax column, but with the rate and value indicated as zero. It is crucial to accurately reflect the zero value, as subsequent transactions cannot offset the Tax charged for items in this category. However, if a purchase has been made where Tax was paid, and later the item is sold with no tax charged, the business can declare a tax credit for the VAT paid. For instance, if raw materials for producing bread were purchased with Tax paid, and no tax was charged while selling the bread, the business can reclaim the initially paid VAT.

The government has recently issued clarifications regarding applying zero rates for certain goods. Under the value-added tax (VAT) system, zero rating applies when goods and services are exported to countries outside the VAT-implementing GCC state. It also applies to international transportation of passengers or goods, including transfers that start or end in the UAE or pass through its territory. Zero-rating also extends to the supply of air, sea, and land transport used for transporting passengers and goods. It also encompasses goods and services related to the supply of these means of transport, such as operating, repairing, maintaining, or converting them.

Furthermore, zero-rating applies to the supply of aircraft or vessels specifically designated for use in air or sea assistance or rescue operations. It also covers goods and services related to transferring goods or passengers aboard land, air, or sea means of transport intended for consumption on board. It includes anything consumed during transportation, including installations, additions, or any other uses.

Moreover, the supply or import of investment-precious metals and the first supply of residential buildings within three years of their completion, either through sale or lease in whole or in part, are also subject to zero rates of VAT.

The GCC has established a list of goods subject to zero value-added Tax (VAT) rates. This includes:

- Exports outside GCC.

- Food items as specified in the GCC list.

- Pharmaceuticals and medical equipment listed by GCC

- Provision of sea, land, and air transportation

- International and intra-GCC transportation and services

- Non-profit organizations providing charitable services

- Gold, silver, and platinum with a purity level of 99% or higher

- Initial distribution following extraction of gold, silver, and platinum

Furthermore, the zero rates are applicable to the provision of educational services and associated goods and services offered by nurseries, preschools, primary schools, and higher educational institutions that are either government-owned or funded by the Federal or local government, in accordance with the specifications mentioned in the Executive Regulation. Additionally, it includes the supply of preventive and primary healthcare services and related goods and services, as defined in the Executive Regulation.

Tax Exempt

Tax exemption refers to a specific category of goods, services, or transactions that are completely exempt from the imposition of taxes. In the context of the GCC framework, tax exemption applies to certain supplies not subject to value-added Tax (VAT). Tax-exempt supplies are not subject to VAT, meaning that no tax is levied on these goods or services at any stage of the supply chain. This exemption is typically granted for specific reasons, such as promoting social welfare, supporting certain industries, or facilitating essential services.

The list of tax-exempt supplies may vary depending on each GCC member state’s specific regulations and policies. It commonly includes essential items such as basic food, healthcare, education, and certain financial services.

Enrolling in a UAE VAT course enhances your practical knowledge of VAT, creating better job opportunities in GCC countries. Finprov offers tailored courses with placement assistance. Our UAE VAT course covers essential topics: VAT concepts, registration, import/export implications, invoicing, compliance, accounting, and more. Excel as a VAT Executive, Consultant, Finance Manager, Senior Accountant, Tax Executive, VAT Expert, Billing Clerk, Sales Accounting Manager, or in office roles.

Our UAE VAT course at Finprov will provide extensive knowledge that significantly contributes to your business growth or enhances your job prospects in the accounting industry. If you have career goals in the accounting sector, Finprov is the ideal choice to help you achieve them.