Tax is a mandatory payment enforced by the government on goods, services, income, and transactions to finance public services and government spending. There are two main tax categories: direct tax and indirect tax. The taxpayer pays Direct tax directly to the government based on income, wealth, or property. VAT is considered an indirect tax charged on the supply of goods and services and is assessed at every stage of the supply chain. The ultimate burden of VAT falls on the end consumer, while registered taxpayers are liable for collecting and forwarding the tax to the government on behalf of the consumers.

Basics of UAE VAT – VAT Rate in UAE

The Federal Tax Authority (FTA) has introduced a standard VAT rate of 5%. However, the FTA has classified certain goods and services as zero-rated supplies and exempt supplies, which are not subject to any tax.

VAT Registration in UAE

According to the VAT law in the UAE, businesses must obtain VAT registration if the total value of taxable supplies and imports exceeds AED 375,000 within a year. Additionally, companies can voluntarily register if the total value of supplies, substances, or expenditures exceeds AED 187,500 within a year. To initiate the VAT registration process, businesses in the UAE can conveniently access the FTA’s website and complete the necessary registration formalities.

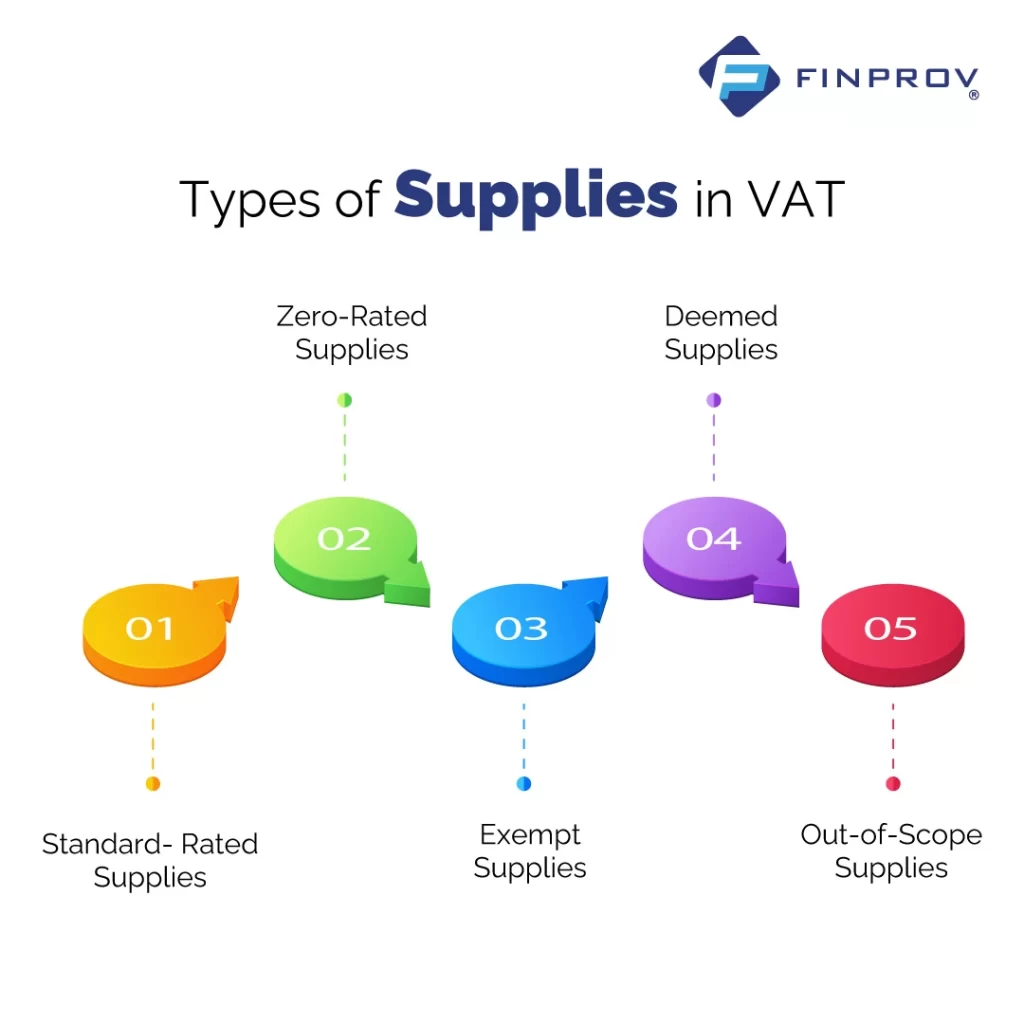

Types of Supplies in VAT

In the UAE, VAT applies to various supplies, and the VAT rates are determined based on the goods or services’ qualities. Here are the different categories of supplies under VAT:

- Standard-Rated Supplies: These supplies are subject to a 5% VAT rate.

- Zero-Rated Supplies: These are charged a 0% VAT rate, but taxpayers can claim relevant input tax. Zero-rated collections include certain education services, healthcare supplies, exports of goods and services above the GCC, precious metals like gold and silver, and international transportation.

- Exempt Supplies: These supplies are unrelated to VAT, and businesses neither charge VAT nor claim input tax on these supplies. Input tax cannot be recovered when selling or providing exempt goods or services. Exempt supplies include residential properties, undeveloped lands, public transport services, life insurance, and certain financial services.

- Deemed Supplies: These supplies do not meet the definition of a regular supply but are still subject to VAT. Examples of considered supplies in the UAE include business assets sold without consideration, transfer of business assets between UAE and other GCC Implementing States, and goods utilized for non-business purposes on which input tax is claimed.

- Out-of-Scope Supplies: These supplies are not covered by the VAT law and are considered outside the scope of VAT.

Businesses need to understand the classification of supplies and the corresponding VAT rates to confirm compliance with the UAE VAT regulations.

Input Tax

Input tax refers to the VAT paid or due on the collection of goods or services or during imports. In the UAE, businesses must maintain invoices and import documents as evidence to claim the input tax paid on their purchases. By keeping proper records, companies can accurately track and account for the VAT they have paid, ensuring they can claim the appropriate input tax credit when filing their VAT returns.

VAT Records in UAE

Regardless of registration status, all businesses must maintain records, including the balance sheet, profit and loss statement, fixed assets records, payroll records, inventory records, and accounting records encompassing sales, purchases, payments, receipts, revenues, and expenses. Additionally, VAT-registered businesses in the UAE must retain these records for five years from the transaction date. This ensures compliance with regulations and facilitates proper financial management and reporting.

VAT Returns in UAE

VAT-registered businesses in the UAE must submit their VAT return and make payment of their VAT liability every quarter to the Federal Tax Authority (FTA). Registered taxpayers must ensure that they file their VAT return and make the payment before the 28th day following the end of the respective quarter. It’s important to note that the FTA may assign a different tax period to specific groups of taxable persons if deemed necessary. Compliance with these filing and payment obligations is crucial to adhere to VAT regulations and maintain good standing with the tax authorities.

Penalties for VAT Offences in UAE

The Federal Tax Authority (FTA) can impose penalties and fines on taxpayers who violate UAE VAT laws and rules—Federal Law No. (7) of 2017 on Tax Procedures specifies the penalties for such offences and tax evasion in the UAE.

- Not displaying the price list in the business place: A fine of AED 15,000 may be imposed.

- Failure to issue a tax invoice, credit note, or an alternative document during a supply: A penalty of AED 5,000 may be levied for each tax invoice, credit note, or alternative document not issued.

- Failure to notify the FTA regarding the charge of tax based on the margin: A penalty of AED 2,500 may be applicable.

- Not keeping goods in a Designated Zone or moving them to another Designated Zone: The penalty ranges from AED 500 up to 300% of the tax involved, depending on the situation.

- Tax evasion: The penalty for tax evasion is set at 300% of the tax amount that was evaded.

These penalties and fines are enforced to ensure compliance with VAT laws and regulations and to discourage any attempts to evade taxes. Businesses must understand these penalties and fulfil their obligations to avoid legal consequences.

Enrolling in a UAE VAT course is an excellent way to enhance your practical knowledge of VAT and open up better job opportunities in GCC countries. Such a course equips you with the necessary skills to secure a rewarding job quickly. Managing VAT processes can be challenging for businesses, and that’s where Finprov comes in. We offer various courses tailored for graduates and professionals, along with valuable placement assistance.

Our UAE VAT course covers essential topics, including the basic concepts of VAT and its functioning, the VAT registration process, VAT implications on import and export businesses, invoicing and documentation requirements, VAT compliance and filing obligations, accounting entries, recordkeeping, and penalties. By acquiring expertise in these areas, you can excel in various career paths such as VAT Executive, VAT Consultant, Finance Manager, Senior Accountant, Tax Executive, VAT Expert, Billing Clerk, Sales Accounting Manager, or office work.

Enroll in our UAE VAT course at Finprov and embark on a transformative journey to acquire comprehensive knowledge that will significantly enhance your business growth or open doors to exceptional job prospects in the accounting industry.