Although it may seem intimidating, fulfilling our tax obligations is crucial for individuals and businesses. Tax season can be challenging, but it is a necessary aspect of our financial duties. One of these obligations is filing an Income Tax Return (ITR) annually. However, navigating the different types of ITR forms and determining the right one for your income and business type can be challenging. It is common to have uncertainties about filing Income Tax Returns (ITR), including its importance, which ITR form should file, and the various types of ITR forms available. Don’t worry; we’ve got you covered! Let’s discuss the different types of ITR forms and which one you should file based on your income and nature of business.

What is ITR?

Income Tax Return or ITR is a document filed with the Income Tax Department by taxpayers, stating their income and tax liability for a specific financial year. It is a mandatory requirement under the Income Tax Act of 1961, and non-filing or incorrect filing can attract penalties and legal action.

In addition to stating the income and tax liability, an ITR also provides details of deductions claimed, taxes paid, and any refunds due. There are different types of ITR forms for different categories of taxpayers in accordance with their income sources and nature of income.

ITR forms must be filed annually by individuals, Hindu Undivided Families (HUFs), companies, firms, and other entities that are within the purview of the Income Tax Act. The deadline for filing ITR varies based on the taxpayer’s category and the filing method. E-filing of ITR has become increasingly popular in recent years, as it is faster, more convenient, and lessens the chances of errors in the filing process.

It is important for taxpayers to ensure accurate and timely filing of ITR, as non-compliance can result in penalties, fines, and legal consequences. Moreover, filing ITR enables taxpayers to establish their income, which may be required for obtaining loans, visas, or other financial transactions.

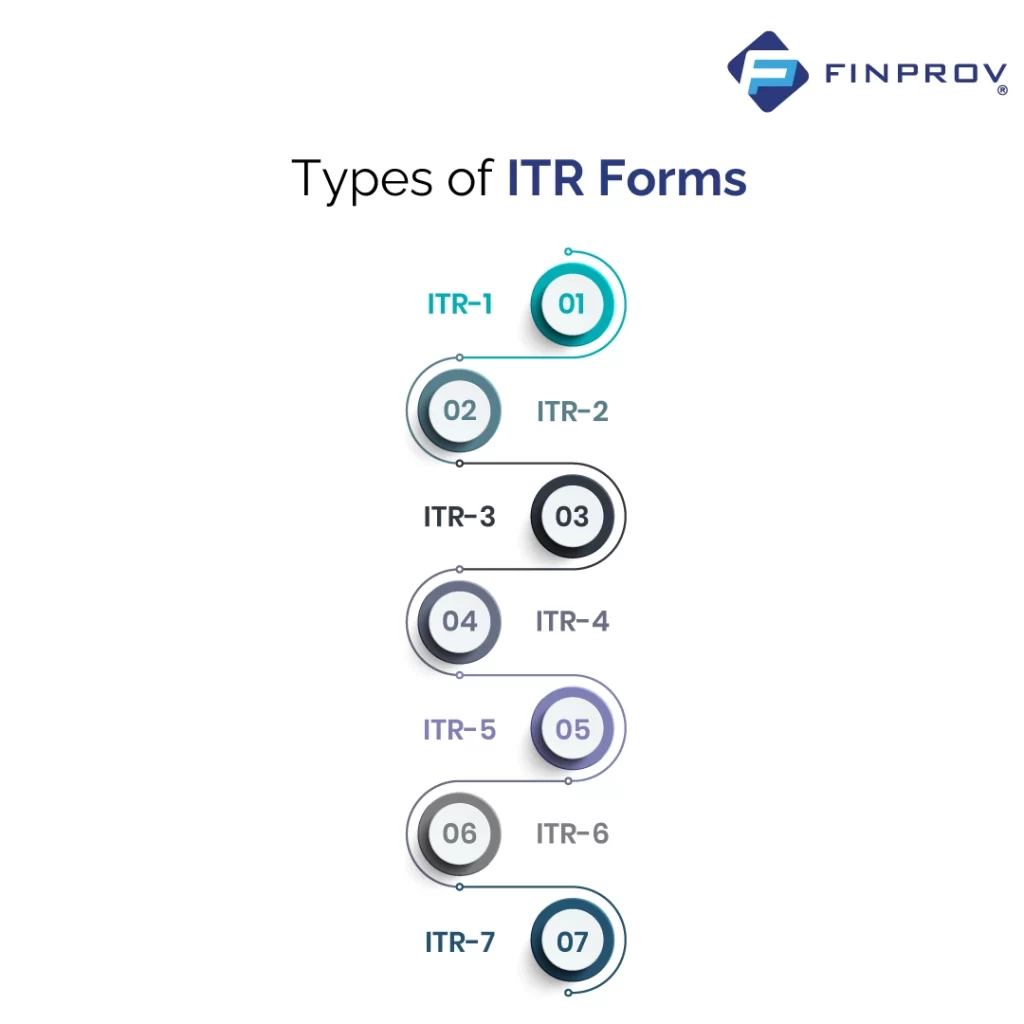

Types of ITR Forms

There are different types of ITR forms based on the nature of income, business or profession, and the total income earned in a financial year. The CBDT or Central Board of Direct Taxes has prescribed seven types of ITR forms for different categories of taxpayers.

ITR-1: For persons having Income from One House Property, Salaries, Other Sources, and having Total Income up to Rs.50 lakhs.

ITR-1, the Sahaj form, is the most straightforward and commonly used form. It applies to individuals with income from salaries, one house property, and other sources, and total income up to Rs.50 lakhs. However, this form cannot be used by individuals who are directors in a company, have invested in unlisted equity shares, or have earned capital gains during the year.

ITR-2: ITR-2 is applicable for individuals and Hindu Undivided Families (HUFs) who are not carrying out any business or profession under any proprietorship. It is also applicable if an individual has more than one house property, earned capital gains during the year, or has foreign assets or income.

ITR-3: This refers to individuals or Hindu Undivided Families who are partners in firms but do not engage in any business or profession as sole proprietors. The form is also applicable for individuals and HUFs earning income from proprietary businesses or professions.

ITR-4: For Individuals and HUFs with Presumptive Income-ITR 4 or Sugam is meant for individuals and HUFs who have income from a presumptive business or profession. If your income is calculated on a presumptive basis according to any of the following sections of the Income Tax Act: Section 44AD, Section 44ADA, or Section 44AE, then this form is applicable to you.

ITR-5: This form suits partnerships, LLPs, and the Association of Persons (AoPs). It can be filed online only.

ITR-6: This form is suitable for companies that do not qualify for exemption under Section 11 of the Income Tax Act and can only be filed electronically.

ITR-7: This form applies to entities that are required to provide returns under any of the designated sections within the Income Tax Act: Section 139(4A), Section 139(4B), Section 139(4C), or Section 139(4D). The form can only be submitted electronically.

Which ITR should you file?

If you are an Indian taxpayer, it is essential to file your Income Tax Returns (ITR) accurately and on time. ITR filing is a crucial responsibility that every individual or entity earning taxable income must fulfil. However, with several types of ITR forms available, it can be confusing to determine which ITR form to file.

Let’s discuss which form you should file based on your financial situation:

Salaried Individuals: If you have a salary income, income from a single property, or income from other sources, you should file ITR-1. However, if you have income from multiple sources, including salary, house property, capital gains, and foreign assets, you should file ITR-2.

- If you have income from salaries, pensions, or interest and no other sources of income, you can file your ITR using Form ITR-1 (SAHAJ).

- If you have income from capital gains, house property, or foreign assets and no other sources of income, you can file your ITR using Form ITR-2.

- If you generate revenue from a sole proprietorship business or profession, you can file your Income Tax Return (ITR) using Form ITR-3.

- If you have presumptive income from a business or profession, you can file your ITR using Form ITR-4 (SUGAM).

- If you are an LLP, AOP, BOI, or partnership firm, you can file your ITR using Form ITR-5.

- If you are a company other than companies claiming exemption under section 11, you can file your ITR using Form ITR-6.

- If you are required to furnish a return under section 139(4A), 139(4B), 139(4C), or 139(4D), you can file your ITR using Form ITR-7.

Let’s take a quick overview with the given table:

| ITR Form | Eligible Taxpayers | Non-Eligible Taxpayers |

| ITR-1 | Individuals who are Resident and Ordinarily Resident (ROR) with income up to Rs. 50 lakh, having income from salary, one house property, and other sources (up to Rs. 5,000); including income of the spouse or minor child | Individuals who earn over Rs. 50 lakh, receive income from multiple house properties, or generate income from business or profession. |

| ITR-2 | Individuals and Hindu Undivided Families (HUFs) who cannot file ITR-1 and have income from various sources, such as salary, house property, capital gains, and foreign assets. | Individuals and HUFs with income from business or profession, or with presumptive income under sections 44AD, 44ADA or 44AE |

| ITR-3 | Individuals and HUFs having revenue from business or profession, including partners in a firm | Individuals and HUFs not having revenue from business or profession. |

| ITR-4 | Individuals, HUFs, and firms (other than LLPs) with presumptive income from business or profession | Companies, LLPs, trusts, and other entities not eligible to file ITR-4S |

| ITR-5 | Persons other than individuals, HUFs, and companies filing ITR-7 (e.g., LLPs) | Individuals, HUFs, and companies eligible to file ITR-1, ITR-2, ITR-3, and ITR-4 |

| ITR-6 | Companies not claiming exemption under section 11 of the Income Tax Act | Companies claiming exemption under section 11 of the Income Tax Act |

| ITR-7 | Persons including companies, charitable and religious trusts, political parties, universities, colleges, and other specified entities | Individuals, HUFs, and companies eligible to file ITR-1, ITR-2, ITR-3, and ITR-4 |

It is essential to note that the eligibility criteria for each ITR form may undergo changes on a yearly basis, and taxpayers should verify the most recent updates prior to filing their returns. Having knowledge of ITR is relevant for both accounting professionals and common individuals. However, To become an expert in income tax, GST, and government-related rules and regulations, staying updated with the most recent changes and developments is crucial. Reading relevant books, articles, and newsletters, attending seminars and webinars, and following the official websites of the tax authorities can help individuals stay informed.

Moreover, gaining practical-oriented training is equally crucial to improve one’s skills and to stay competitive in the job market. Enrolling in a reputed training program can provide hands-on experience in handling real-world scenarios and challenges.

Finprov is an excellent option for individuals seeking to update and upgrade their skills in GST filing, income tax, Gulf VAT, and accounting software. Our training modules are designed based on real case studies, providing participants with a practical understanding of the concepts.

Additionally, accounting professionals can also benefit from gaining expertise in popular accounting software such as SAP FICO, Tally Prime, MS Excel, and more. These software programs can help individuals streamline their accounting processes and increase their efficiency at work.

FAQs:

What is ITR-1 Sahaj?

A: ITR-1 Sahaj is the simplest ITR form applicable to salaried individuals with an income of up to Rs. 50 lakhs and income from other sources.

Who can file ITR-2?

A: ITR-2 is applicable to individuals and HUFs with income from sources other than business or profession, and those having income from more than one house property, capital gains, foreign

How can I claim a tax refund and a TDS refund under Section 87A of the Income Tax Act?

If your net income after deductions and allowances is below Rs. 5 lakhs, you are eligible for a tax refund on the amount you owe. The maximum refund amount is Rs. 12,500. Additionally, if you have paid TDS (Tax Deducted at Source) on your income, you may also be eligible for a refund.

Is it possible to file an Income Tax Return (ITR) if I have incurred losses from a job, home, or sale of stocks?

Yes, you can file an ITR even if you have incurred losses from a job, the sale of stocks, or interest on a home loan. Filing an ITR enables you to carry forward the losses to subsequent years for set off against future income. However, it is important to file your ITR within the deadline specified by the Income Tax Department.