How about being a valuable and most acceptable accounting professional in global prospects? The Certification course in Indian and Foreign accounting drives your finance job prospects towards a higher altitude. The course provides an opportunity to explore your career life globally. Earn your Certification in Indian and Foreign accounting and craft your career in the accounting industry. Learn the key aspects pertaining to finance, accounting, taxation and accounting softwares. Enrol in this course to get hands-on experience and acquire practical knowledge by handling real case studies.

Certification course in Indian and Foreign Accounting

5.0

5/5

About the course

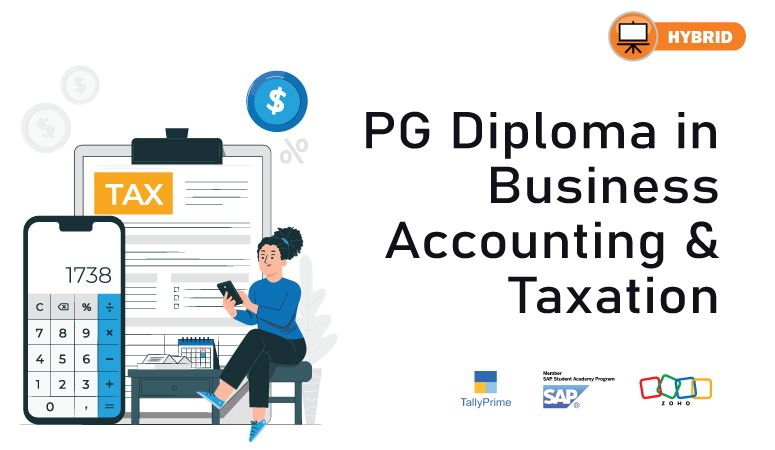

Finprov offers the best Certification course in Indian and Foreign accounting that elevates your chances of getting hired in the accounting field. This course is the ticket to fly over to your dream career and offers a chance to build your career both in India and abroad. The courses covers the aspects of Practical accounting, Tally Prime, GST, Income Tax, Zoho Books, UAE VAT and SAP FICO. The course helps to attain practical knowledge in accounting and hence, significantly contributes to the learners’ excelling performance. The successful completion of the certification course nurtures you into a perfect professional.

What you'll learn

- Expertise in Practical Accounting

- Learn Income Tax and GST

- Familiarising softwares including Zoho Books, Tally prime, SAP FICO

- Hands-on training with case studies

₹40,000

₹48,000

- Course Mode

- Duration

- Lectures

- Quizzes

- Language

- Students enrolled

- Assessments

- Online

- 6 Months

- 111

- -

- Malayalam

- 123

- -

Share Now

Skills you will gain

- Practical Accounting

- Tally Prime

- Income Tax

- GST

- Zoho Books

- Gulf Vat

- SAP FICO

Key Highlights of Our Program

We create engaging learning experiences through expert training. Building the finance professional force of tomorrow

Tech-enabled learning

An advanced and innovative learning platform providing global access

360 Degree Exposure

Specializes in all-round subject exposure with intense subject coverage

Designed by the best

Curated by experts from the industry, the curriculum is made with real work experience insights.

Personalised Student Support

We are 100% committed to present an empowering learning experience for our learners

Request more information

Upcoming Batches

| November 2024 | Registration open |

Instructors

Get Ahead with Course Certification

On successful completion of the course participants will be awarded a certificate of course completion issued by FINPROV. This certificate is

a golden ticket to the job of your dreams at leading finance firms and beyond.

-

Earn your

Certificate

-

Share your

achievement

Frequently Bought Together

₹40,000

₹48,000

Certification course in Indian and Foreign Accounting

Commonly Asked Questions

The program is intended for freshers, junior accountants, entry-level finance & accounting professionals, Bcom/MCom/MBA or any Commerce Students, Entrepreneurs and Business owners to gain Gulf VAT knowledge in Malayalam.

You can directly enroll on the course through the course page on our website.

Yes, you need stable internet for the course since they are in video format.

You can contact us on WhatsApp as well as through email for academic and non-academic queries.

Once you are enrolled on the course, you can select the login option from the course page and give your login credentials to sign in.