When it comes to minimizing income taxes, small businesses have various strategies at their disposal. These include making estimated tax payments, claiming deductions, and deducting mileage expenses. Explore our tailored tax saving tips for small business owners to reduce your tax liability.

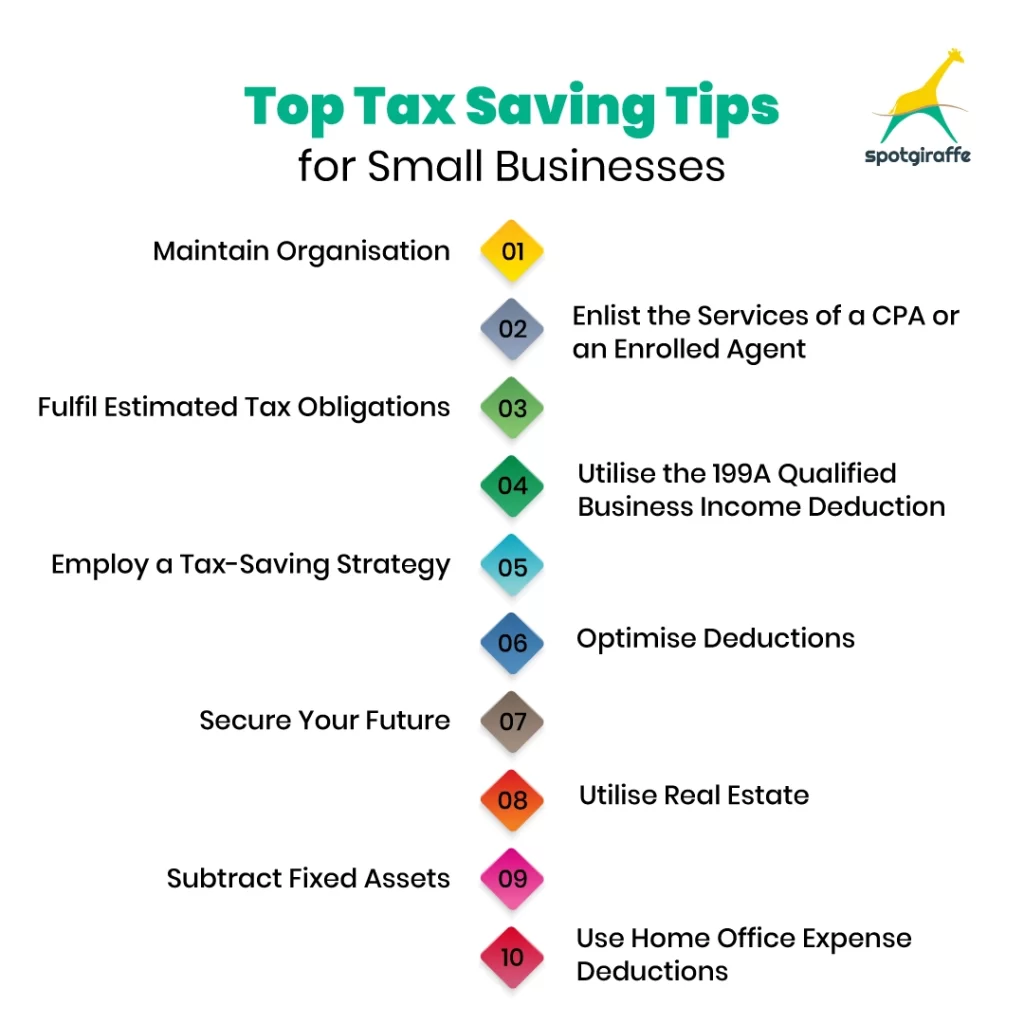

Top Tax Saving Tips for Small Businesses

Let’s read the top 10 tax saving tips for small businesses;

Maintain Organisation

Efficiently minimizing your small business taxes starts with deducting every eligible dollar spent on business expenses, which requires a high level of organization. Avoid compiling tax returns based on a chaotic assortment of receipts, as this increases the risk of overlooking deductions. Stay organized with the following tax saving tips:

- Establish a dedicated bank account solely for business transactions.

- Utilise bookkeeping software to monitor and tie your expenses to banking activity, ensuring comprehensive expense capture.

- Base your tax return on financial statements generated by your bookkeeping software.

- Safeguard receipts by filing them in an organised system or attaching electronic copies to corresponding transactions in your bookkeeping software.

Enlist the Services of a CPA or an Enrolled Agent

While anyone can sign a tax return as a paid preparer without specific licensing requirements, it’s crucial to exercise caution when entrusting your taxes to individuals who need the appropriate credentials. Bookkeepers, for instance, may handle income and expense numbers but need more comprehensive expertise for tax preparation.

Consider hiring a CPA (Certified Public Accountant), licensed by individual states, or an enrolled agent directly licensed by the IRS. Both professionals must meet education requirements, pass exams, and undergo continuous education.

Given tax laws’ intricate nature, managing your business and staying updated on tax regulations is unrealistic. A tax professional is like a CPA or enrolled agent, can provide valuable expertise, potentially offsetting their cost with tax savings over the lifespan of your business.

Fulfil Estimated Tax Obligations

Small business owners, particularly S corporation (S-corp) owners, must make estimated tax payments on their business income. These payments are divided into four quarterly instalments, with S-corp owners estimating income tax and sole proprietors and partners estimating self-employment tax and income tax on their business income.

Considering the 15.3% self-employment tax and potential income tax reaching up to 37% in 2023, sole proprietors need to stay diligent in making timely estimated payments. These payments are typically necessary when income is not subject to withholding, such as business income. Calculating estimated payments involves estimating the total tax on your tax return and deducting any projected withholding. The IRS website provides comprehensive information on paying estimated taxes.

Utilise the 199A Qualified Business Income Deduction

From 2018 to 2025, taxpayers can claim the 199A Qualified Business Income (QBI) deduction of 20% for income flowing through to personal returns from a sole proprietorship, partnership, or S-corp. Certain limitations apply to the income deduction, but joint taxpayers with total taxable income under $340,100 and single taxpayers with total taxable income under $170,050 for 2022 enjoy fewer restrictions. Even if your taxable income crosses these values, you may still qualify for some deduction with more intricate calculations. This is one of the best tax saving tips.

Employ a Tax-Saving Strategy

Utilize the benefits of your children’s lower marginal tax rates by shifting business income to them, resulting in tax savings. Assign them relevant chores and responsibilities within your business and compensate them appropriately.

Wages paid to your children contribute to tax savings on your return, benefiting from your higher marginal tax rate, while your children are taxed at their lower (often zero) marginal tax rate. This strategy applies to individuals with low tax rates, such as retired parents. Instead of gifting money, involve them in business activities and process the payments through payroll.

Sole proprietors and partnerships, specifically those where parents are the sole partners of the child, are from paying Soc Security and Medicare taxes on wages paid to their child who is 18 years old. However, federal and state income tax withholding is required, similar to other employees.

Children’s wages are subject to the same payroll tax obligations for S-corporations as any other employee. While paying children under 18 is generally advantageous for sole proprietors and partnerships, S-corps must weigh the income tax savings against the additional payroll tax liability.

Optimise Deductions

Explore the potential deduction of 100% of premiums paid throughout the year for qualifying health insurance covering yourself, your spouse, and any dependent child under age 27 at the year’s end. Qualifying health insurance includes medical insurance, qualifying long-term care coverage, and all Medicare premiums.

Secure Your Future

Seize the opportunity as a self-employed individual to contribute to a pension plan. Your allowable contribution depends on your plan type, with an annual salary limit influencing the amount eligible for retirement plan contributions. This limit undergoes yearly adjustments.

Utilise Real Estate

If renting your business property from an external party, contemplate purchasing a building for your business. Business buildings are adequate tax shelters, enabling you to deduct the building’s expenses while its value appreciates. Termed a “phantom expense,” you deduct depreciation related to the building, which doesn’t decrease your taxable income. Simultaneously, the building’s value is likely on the rise.

Subtract Fixed Assets

Maximize your tax benefits by utilizing bonus depreciation and Section 179 expense, enabling you to deduct the total cost of acquiring fixed assets in the current tax year rather than spreading it over several years. While historically, bonus depreciation covered 100% of qualifying purchase costs, it is now capped at 80% as of 2023. To optimize your deduction, priorities Section 179 by claiming the maximum allowance and then applying bonus depreciation to the remaining costs. This strategic approach ensures you maximize available tax advantages in a changing regulatory landscape.

Use Home Office Expense Deductions

Numerous small business owners can benefit from deductions on home office expenses, allowing them to offset some of the costs associated with operating a qualified home office. This deduction covers a range of expenses, including real estate taxes, mortgage interest, rent, casualty losses, utilities, insurance, depreciation, maintenance, and repairs linked to the business part of your home. Optimize this deduction by selecting either the simple or regular method based on your specific circumstances.

These are some of the tax saving tips for small businesses.

Enrolling in an Income tax course in Kochi gives learners valuable insights into tax-saving tips. Finprov’s Income tax course online presents an excellent opportunity for comprehensive learning. The course is designed to equip learners with the necessary knowledge and skills to prepare and file income tax returns accurately and efficiently. Covering fundamental concepts such as significant heads of income, tax frameworks, old and new tax schemes, basics of TDS & TCS, due dates, penalties, accounting books, and maintenance, the Online Income tax course at Finprov also includes practical training at the end of each topic. This hands-on experience enables learners to gain practical insights and better understand the concepts.