Are you looking to take your career in management accounting to the next level? Look no further than the US CMA certification offered by the Institute of Management Accountants (IMA) in the United States. This globally recognized professional certification showcases your expertise in the field and can give you a competitive edge in the job market. Whether you’re looking to work abroad or secure a higher salary, the CMA designation can help you achieve your career goals.

However, it’s important to remember that becoming a CMA is just one piece of the puzzle. Other factors such as work experience, language proficiency, and market demand can also play a significant role in determining your career prospects and earnings. If you’re serious about advancing your career in the world of management accounting, consider taking the leap and becoming a CMA. With this certification, you’ll demonstrate to employers your dedication to the field and commitment to staying ahead of the curve.

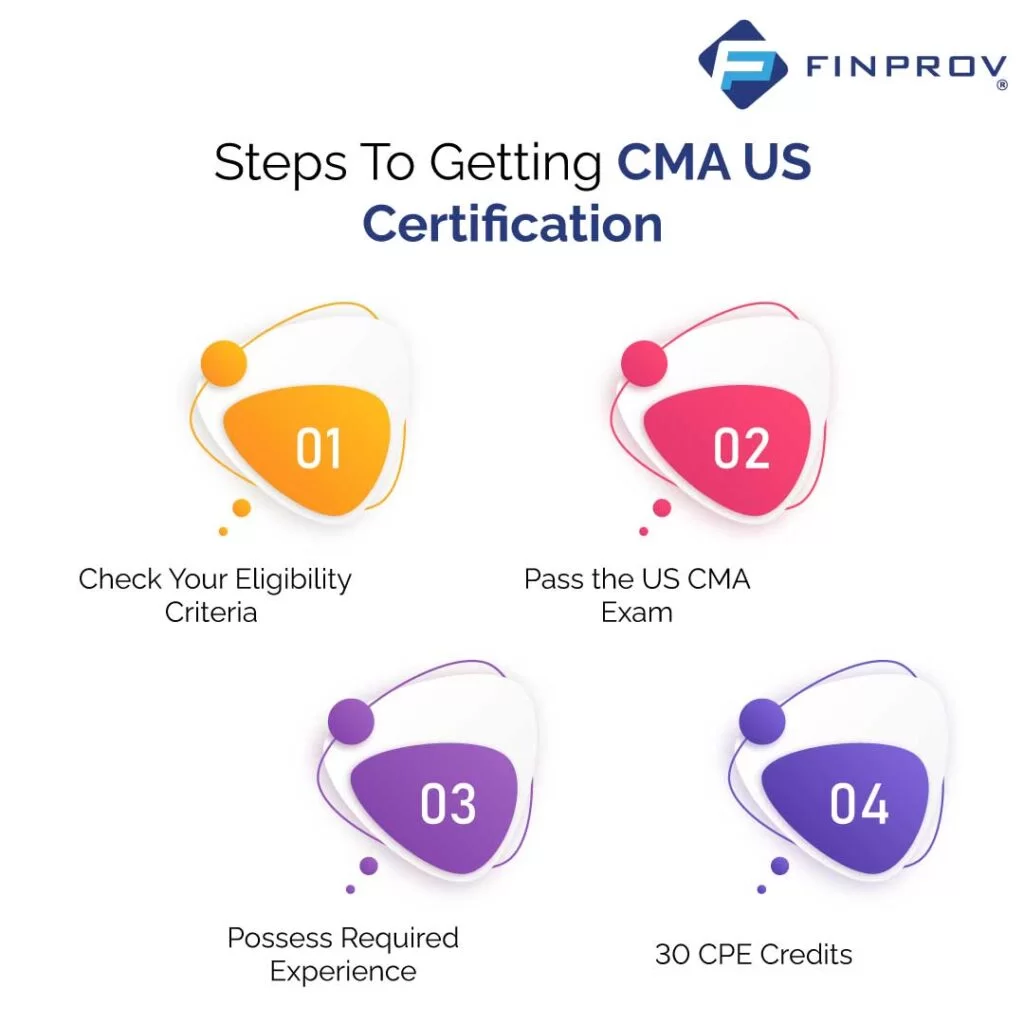

Steps To Getting US CMA Certification

Step 1: Eligibility Criteria

To be eligible to take the CMA US exams, you must have a bachelor’s degree from an accredited university or college or an equivalent level of education. Additionally, having completed 12th grade in India would meet the minimum educational requirements for taking the exams. However, it is important to check the specific eligibility criteria set by the Institute of Management Accountants (IMA) to ensure that you meet all the requirements for the certification.

Step 2: Pass the CMA US Exam

To obtain the CMA US certification, you must pass the US CMA examination, which is held three times a year in the months of January-February, May-June, and September-October.

Step 3: Required Experience

In addition to passing the US CMA examination, you must also have relevant work experience of at least 2 continuous years to obtain the CMA US certification. Failing to meet this requirement will prevent you from getting the certification, even if you clear the examination.

Step 4: Continuous Professional Education Credits

To maintain the CMA US certification, you must complete 30 hours of continuing professional education (CPE) credits within approved topics. 2 of the hours must be in ethics.

Syllabus of CMA US Exam

The US CMA examination consists of two parts:

Part 1: Financial Planning, Performance, and Analytics

The topics covered in this part include Planning, Budgeting, Forecasting, Cost Management, External Financial Reporting Decisions, Internal Controls, Performance Management, and Technology and Analytics.

Part 2: Strategic Financial Management

The topics covered in this part include Corporate Finance, Risk Management, Professional Ethics, Financial Statement Analysis, Decision Analysis, and Investment Decisions.

Pattern of US CMA Certification Exam

The US CMA examination consists of two parts. Each consists of 100 MCQs and 2 essay questions. The total duration for each part is 4 hours, 3 hours for MCQs and 1 hour for essay questions. Candidates must have a minimum score of 360 out of 500 in each part of the examination to clear the exam.

US CMA Certification Job Opportunities

Passing the CMA US exam can lead to career growth and advancement in the field of management accounting and financial management. The career growth of US CMAs is high, and they are in demand for various roles in various industries. Some common roles for US CMAs include financial analyst, financial risk manager, financial controller, chief financial officer, cost accountant, and others. The industries that require US CMAs are management accounting, NPOs, e-commerce, financial statement analysis, ITES and IT, business valuation, and consulting services. By obtaining the US CMA certification, individuals can increase their career opportunities and expand their skill set in the field of management accounting and financial management.

Benefits of Becoming a CMA US

Here are a few benefits of becoming a US CMA:

Increased earning potential – US CMAs have higher median salaries compared to non-certified individuals in the same field.

Recognition of expertise – US CMA certification is recognized globally and demonstrates a high level of competence and knowledge in the field.

Access to professional network – US CMAs have access to a network of professionals and resources through the Institute of Management Accountants (IMA).

Career advancement – US CMAs have a competitive edge in the job market and are considered for higher-level positions in the field.

Continued education and professional development – To maintain the CMA US certification, individuals must complete continuing professional education (CPE) credits, which helps them stay up-to-date with the latest trends and developments in their field.

CMA US certification is generally considered certified in the management accounting sector. Having CMA US certification or other accounting certification helps to develop knowledge or get more job opportunities. Finprov is one of the leading institutes that offer various accounting courses like CBAT, PGBAT, Income tax, Practical accounting training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, MS Excel, etc., along with practical examples and placement assistance.

Our course modules are specially created by well-experienced faculties and industry experts that can be utilized by professionals to upskill their knowledge, and graduates can get several job opportunities in the accounting and finance industry. Finprov offers you an opportunity to earn your CMA US certification with the help and support of expert faculties. Our teams ensure your best coaching and training with the opportunity to engage with real case studies. The hybrid course will aid aspirants in securing a stable career.