The regularity and financial benefits of banking careers make them particularly appealing. The ideal way is to prepare well for and take the government bank examinations if you are a strong candidate with a strong desire to start a career in the banking industry. Aspirants for banking jobs might find solid employment prospects by taking tests administered by government organizations. Examples of bank exams are SBI PO, IBPS PO, NABARD Assistant, LIC, etc.

Each bank exam has a distinctive set of exams, a slightly different syllabus, a different exam format, a different cutoff score, a different vacancy, and other distinct characteristics. Even though you may be studying more efficiently, you must acknowledge that each exam is different in some way. You must begin your preparation more seriously if you are a serious candidate with greater passion. Let’s discuss the importance of SBI PO and IBPS PO, compare the two, and determine which is better.

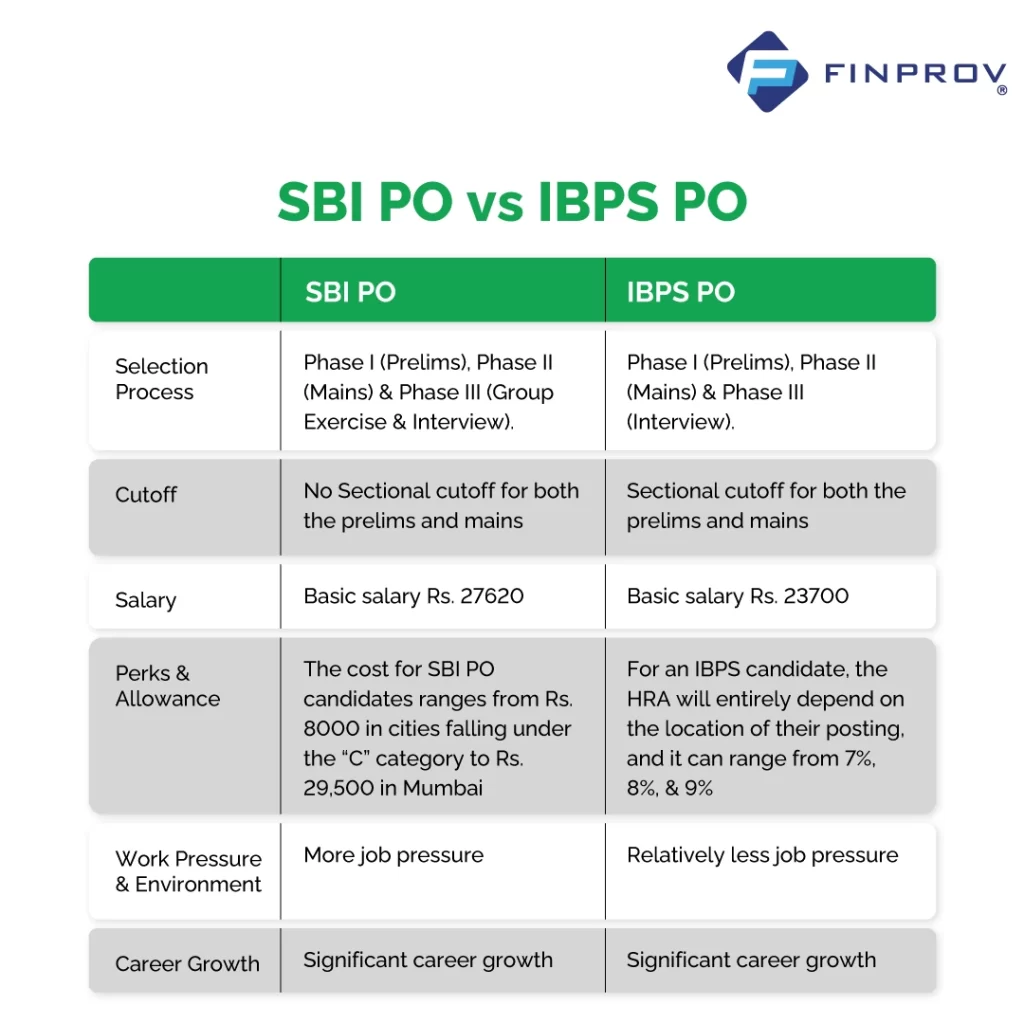

SBI PO vs IBPS PO

Both the SBI PO and IBPS PO bank designations are prestigious and secure in the professional lives of job candidates. For a successful career progression, both tests are the greatest choices. The IBPS PO 2023 test will be held on September 23, September 30, and October 1, 2023, while SBI PO 2023 exam dates have not yet been made public.

The vacancy rate is one of the considerable differences regarding these examinations. The SBI PO position has a lower vacancy than the IBPS PO position. As a result, there are more employment prospects in IBPS PO. Another notable distinction is SBI PO carried out by SBI for itself. In contrast, the IBPS conducts the PO test for the 11 nationalized banks. Besides that, there may be a difference in the working atmosphere, pay, career opportunities, etc. Let’s learn more about how SBI PO and IBPS PO differ.

Selection Process: SBI PO vs IBPS PO

IBPS and SBI PO selection procedures differ slightly from one another.

IBPS PO: The IBPS PO exam consists of three main stages. Phase I is the preliminary exam, and Phase II is the main descriptive exam. The interview is the third phase.

SBI PO: There are three parts to the exam selection procedure for SBI PO. After the preliminary and main exams, a group exercise and an interview.

The SBI PO exam is more challenging than the IBPS PO exam when compared to the two exams. The SBI PO preliminary exam is an objective test, but the mains descriptive exam will follow. While the main exam requires you to pass the cutoff scores, the preliminary exam has a qualifying nature for both exams. The final step for the applicants selected from the main exam is to appear for the interview segment.

Cutoff: SBI PO vs IBPS PO

IBPS PO: There is a sectional cutoff for both the preliminary and main examinations of the IBPS PO test, as is typical. Additionally, the assessment takes into account overall cutoffs.

SBI PO: There is no sectional cutoff for the SBI PO test’s preliminary and main examinations. However, there are overall cutoffs, and the results will be released in compliance with them.

Salary : SBI PO vs IBPS PO

IBPS PO: IBPS PO candidates would receive a basic salary of Rs. 23700 and a gross salary of Rs. 38730 for this position. Additionally, the posting for the House Rent Allowance (HRA) may vary based on the PO posting.

SBI PO: Candidates for SBI PO will receive a basic salary of Rs. 27 620 per month. The aspirants would receive four increments when they joined.

By comparing the remuneration packages for the two examinations, it is clear that the SBI PO salary is 6,000 more than the PO salary at other nationalized banks.

Perks and Allowance: SBI PO vs IBPS PO

Even though there is only a slight contrast between the benefits and compensation for the SBI and IBPS Probationary Officer positions, it needs to be addressed.

IBPS PO Exam: For an IBPS candidate, the HRA will entirely depend on the location of their posting, and it can range from 7%, 8%, and 9%. According to the most recent evidence, most nationalized banks in IBPS have declared a predetermined amount for medical assistance, which is RS. 9000.

SBI PO Exam: Considering accommodation, the cost for SBI PO candidates ranges from Rs. 8000 in cities falling under the “C” category to Rs. 29,500 in Mumbai. Similar to medical aid, the candidate may be entitled to 100% compensation and family members to 75%.

Work Pressure and Environment: SBI PO vs IBPS PO

IBPS PO: An IBPS PO candidate faces relatively less job pressure. Due to the lack of accessibility in remote locations, these banks have fewer customers.

SBI PO: With over 24000 branches, SBI is already acknowledged as one of India’s largest and oldest banks. Since the bank provides around 50% of the banking services, there is greater job pressure.

Career Growth: SBI PO vs IBPS PO

Both the IBPS PO and the SBI PO show practically identical career progression. A probationary officer has a very long career growth potential. After joining an Indian public sector bank, your career will grow significantly.

Below is the position for the PO.

Deputy Manager

Manager

Chief Manager

Assistant General Manager

Chief General Manager

Additionally, the SBI provides a lot of opportunities to get hired for overseas assignments. SBI offers a number of benefits and allowances if a candidate can deal with the workload and finish the assigned responsibilities.

Pros and Cons : IBPS PO vs SBI PO

| Pros | Cons | |

| IBPS PO | Job security Low Work Pressure Attractive salary along with entitlements | Rural postings Promotion is not frequent while comparing the case of SBI |

| SBI PO | Frequent promotions Offering foreign posting Additional perks High salary than other public sector banks | High work pressure Frequent transfer |

Job Profile: IBPS PO vs SBI PO

The Probationary Officer job profile is the same for both IBPS and SBI, and the institutions’ respective probationary officers must perform the following duties:

Multitasking Job

Candidates will be given a range of banking jobs, and these assignments will familiarize them with the diverse working methods used in the banking sector.

Practical Knowledge

Accounting, marketing, loans & advances, and financing professionals must understand the POs. The chosen individuals will be receiving training for this position.

Customer Service

A PO’s other assigned responsibility is to handle clients. They receive guidance from the PO regarding financial services, products, and facilities, such as issuing demand drafts, ATM cards, and chequebooks. You must address client complaints, such as account inconsistencies and eliminate erroneous charges.

Supervision of Clerical Work

A PO must oversee all clerical tasks such as cash management, account opening, customer service, and all other office duties. The PO’s responsibilities are determining whether the clerk typed everything accurately or not, as well as transaction approval.

Loan Processing

Processing of loans One of the main duties of banks is to make loans. As a PO, you must therefore take care of the necessary. Before approving a loan for a customer, the PO is in charge of overseeing all the paperwork.

A probationary officer also works in several divisions of the relevant banking institution. For instance, fixed deposits, ATM and internet banking, report generation, credit card, loans & advances, clearing, pensions, payment, and check clearances.

The banking industry offers opportunities like IBPS PO, SBI PO, RBI grade B exams, NABARD Assistant, and LIC. The sole requirement is that you must effectively plan. Although there will undoubtedly be variations in exam formats, vacancy rates, and compensation packages, the syllabus for all bank exams is essentially the same.

Suppose you have finished your commitment and organized preparation while being properly guided. You can effortlessly crack the exam with tailored mentoring and quality instruction. You may receive the greatest bank coaching from knowledgeable instructors at Finprov, one of the leading bank coaching companies.

You can rank among the top candidates for the banking examinations by taking our daily and consolidated test series. Finprov’s vast study resources will prepare you for taking the SBI, IBPS, RBI, NABARD, LIC, and cooperative bank exams.