Taxes play a significant role in generating revenue for the government and financing public services. Understanding the intricacies of taxation is crucial for individuals and businesses in India. When it comes to understanding the taxation system in India, it is crucial to comprehend the difference between direct and indirect taxes. Let’s explore the types of taxes in India, focusing on the disparities between direct and indirect taxes.

Importance of Direct and Indirect Taxes in India

Direct and indirect taxes play crucial roles in the Indian economy, contributing to revenue generation, economic growth, and the redistribution of wealth. Direct taxes imposed on individuals and businesses, such as income and corporate taxes, form a significant portion of the government’s revenue. They give the government the necessary funds to invest in infrastructure development, social welfare programs, and public services.

Direct taxes also reduce income inequality by implementing a progressive tax structure. Individuals with higher incomes must pay higher tax rates, ensuring a fairer distribution of the tax burden. This helps in bridging the wealth gap and promoting social welfare.

Indirect taxes, on the other hand, contribute to the government’s revenue through the consumption of goods and services. The implementation of GST has streamlined the indirect tax system in India, eliminating multiple taxes and reducing tax cascading. GST has increased transparency, simplified compliance procedures, and improved tax collections.

Indirect taxes also significantly impact the economy by influencing consumer behaviour and promoting domestic industries. They can be used as tools to incentivize certain sectors or discourage the consumption of harmful or luxury goods. Additionally, customs duties on imported goods protect domestic industries and promote self-sufficiency.

Overall, the proper implementation and balance of direct and indirect taxes are essential for the sustainable growth of the Indian economy, ensuring adequate revenue collection, reducing income inequality, and encouraging economic activities.

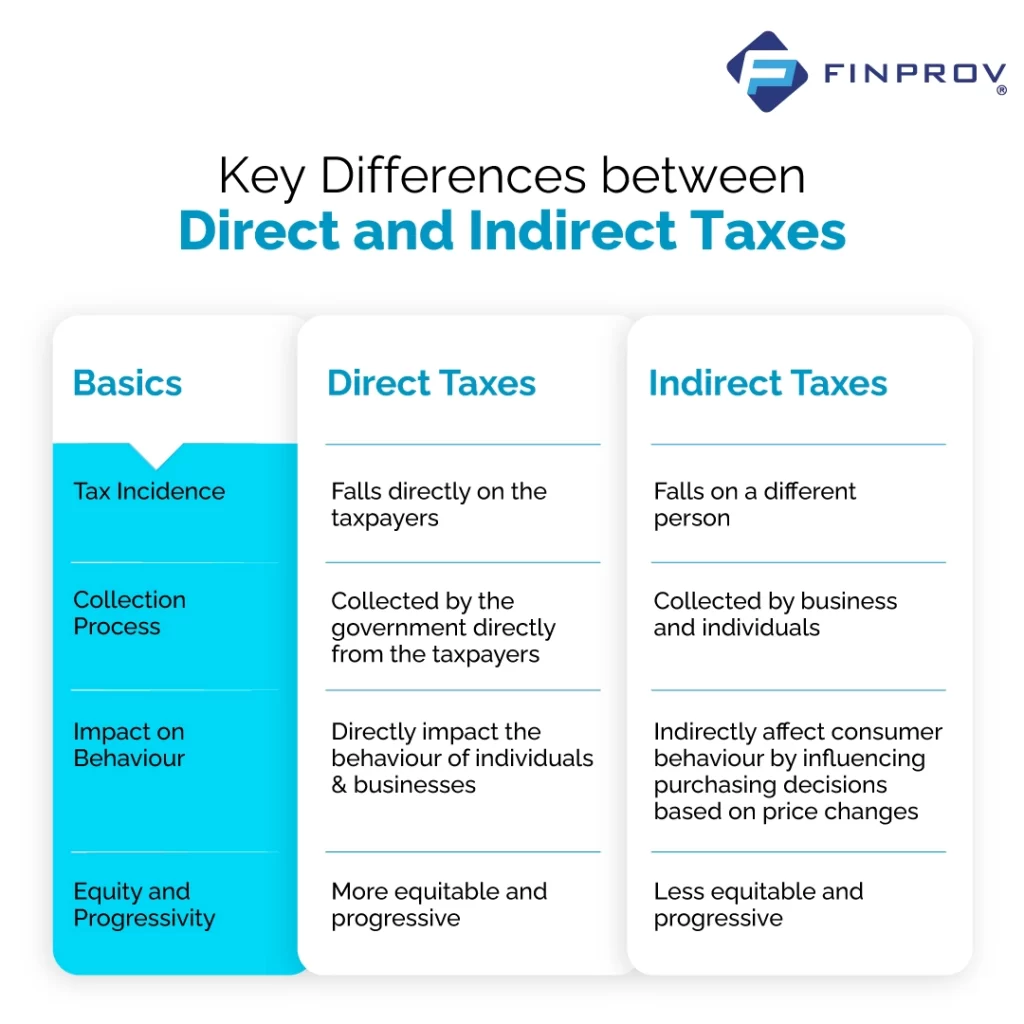

Key Differences between Direct and Indirect Taxes

1. Tax Incidence

One of the primary differences between direct and indirect taxes lies in how the tax burden is distributed among individuals and businesses. In the case of direct taxes, such as income tax or corporate tax, the burden falls directly on the taxpayers. They are responsible for paying the taxes from their income or profits. On the other hand, indirect taxes are passed on to the end consumers through the pricing of goods and services. The burden of indirect taxes is not immediately apparent as it is embedded in the final price of the products or services.

2. Collection Process

Direct taxes are typically collected by the government directly from the taxpayers. Various mechanisms are in place to ensure compliance, such as tax return filings and audits. Taxpayers must calculate their taxable income, determine the applicable tax rate, and make the necessary payments to the government. In contrast, indirect taxes are collected by businesses and individuals during the sale or purchase of goods and services. The responsibility of collecting these taxes falls on the shoulders of the business entities, and they are required to remit the collected taxes to the government.

3. Impact on Behavior

Direct taxes can directly impact the behavior of individuals and businesses. Higher tax rates on income or profits may discourage individuals from seeking additional income or investing. For businesses, higher corporate tax rates can reduce their profitability and hinder expansion plans. On the other hand, indirect taxes may not directly impact behavior, as they are the price of goods and services. However, they can indirectly affect consumer behavior by influencing purchasing decisions based on price changes.

4. Equity and Progressivity

Direct taxes are often considered more equitable and progressive compared to indirect taxes. Direct taxes are designed to be progressive, meaning that the tax rates increase as the income or profits increase. This progressive nature ensures that higher-income individuals contribute more of their earnings as taxes. Indirect taxes, on the other hand, tend to be regressive, as they have a more significant impact on individuals with lower incomes. Since indirect taxes are generally the same for everyone, regardless of income level, they can place a relatively higher burden on individuals with lower purchasing power.

Direct Taxes: An Overview

Direct taxes are levied directly on persons or organizations, and the burden of these taxes cannot be shifted to another entity. These taxes are progressive and intend that the tax rate elevates as the taxable income or profits rise.

In India, direct taxes primarily consist of several areas: income tax, corporate tax, wealth tax, and capital gains tax. Income tax is the most prevalent form of direct tax and is imposed on the income earned by individuals, Hindu Undivided Families (HUFs), and certain categories of firms and companies. In contrast, the corporate tax is levied on the profits earned by corporations and companies. Although abolished in 2015, wealth tax was previously applicable to individuals and HUFs with significant wealth. Capital gains tax is implemented on the gains arising from the sale of assets( stocks, real estate, or mutual funds).

Income Tax:

Income tax is imposed on an individual’s or a company’s earnings from various sources such as salaries, investments, or business activities. The tax rates for income tax are progressive, meaning they increase as the income brackets rise.

Corporate Tax:

The corporate tax applies to companies and organizations based on their net profits. The corporate tax rate depends on the company’s turnover and legal structure, such as whether it is a domestic or foreign corporation.

Wealth Tax:

Although abolished in recent years, wealth tax was imposed on individuals possessing substantial wealth. It was calculated based on the market value of specified assets, including real estate, jewellery, and investments.

Indirect Taxes: An Overview

Indirect taxes are imposed on producing, selling, or consuming goods and services. The end consumer ultimately bears these taxes. Some common examples of indirect taxes in India are Goods and Services Tax (GST), excise duty, and customs duty. Unlike direct taxes, indirect taxes are not directly levied on individuals or businesses but are imposed on manufacturing, selling, or consuming goods and services. The burden of these taxes can be shifted to the end consumer by pricing products and services.

In India, some common forms of indirect taxes consist of goods and services tax (GST), excise duty, customs duty, and service tax. GST, introduced in 2017, replaced multiple indirect taxes (central excise duty, service tax, and value-added tax (VAT)). It is a comprehensive tax imposed on goods and services nationwide.

Goods and Services Tax (GST):

GST is a comprehensive indirect tax system introduced in India to replace multiple state and central taxes. This tax is applied to the value-added at the supply chain at each stage, starting from the manufacturer and ending with the consumer. GST has simplified the taxation process, promoting ease of doing business in the country.

Excise Duty:

Excise duty is imposed on producing and selling certain goods within the country. It is typically included in the product’s final price, making it an indirect tax. Excise duty rates may vary depending on the type of goods.

Customs Duty:

Customs duty aims to regulate trade and protect domestic industries. Customs duty is applicable to goods imported into or exported out of the country. It is collected by the customs authorities and is based on the value, quantity, and nature of the goods.

Implications and Impact on Individuals and Businesses:

Direct taxes play a crucial role in redistributing wealth and reducing income inequality in the country. Direct taxes are considered progressive as they are based on an individual’s or a company’s income or profits. This means that higher-income earners or profitable businesses pay a higher percentage of their income or profits as taxes.

Indirect taxes, on the other hand, affect individuals and businesses uniformly, irrespective of their income or profits. These taxes are embedded in the price of goods and services, so they impact all consumers. However, it is significant that these taxes may have a greater impact on individuals with lower incomes, as they tend to allocate a larger portion of their earnings towards essential items.

Besides all that, understanding tax updation beneficially impacts one’s job prospects in the accounting field. If you have expertise in GST, Income Tax, Vat system, and tax filing, then your requirement in an organization is essential. Updating and developing knowledge in this area will help you to grab your job in the desired field.

At Finprov, you can earn the best practical, oriented, real case study-based learning facilities regarding accounting courses. The expert faculties of Finprov help to upgrade your skill with various accounting softwares, concepts etc. our team offer you effective training on Income Tax, GST, Gulf VAT, SAP FICO, Tally Prime, MS Excel, Zoho Books and more. We aim to equip candidates with the necessary skills to excel in the challenging accounting sector.