In this article, we shall look into the most popular bank exams in India that candidates should look up for.

The banking industry in India is one of the country’s largest and most competitive sectors, with thousands of candidates vying for a limited number of job openings each year. As a result, bank exams in India have become some of the most sought-after and competitive exams, attracting candidates from all over the country.

Every year, a number of banks post job openings for positions such as Bank PO, Bank Clerk, Bank SO, Assistant, and so on. Lakhs of candidates take various bank exams based on the availability of bank vacancies.

Because the number of bank vacancies is hundreds or thousands, competition among banking aspirants to make the final list of shortlisted candidates is fierce.

Read in detail about the most popular bank exams in India:

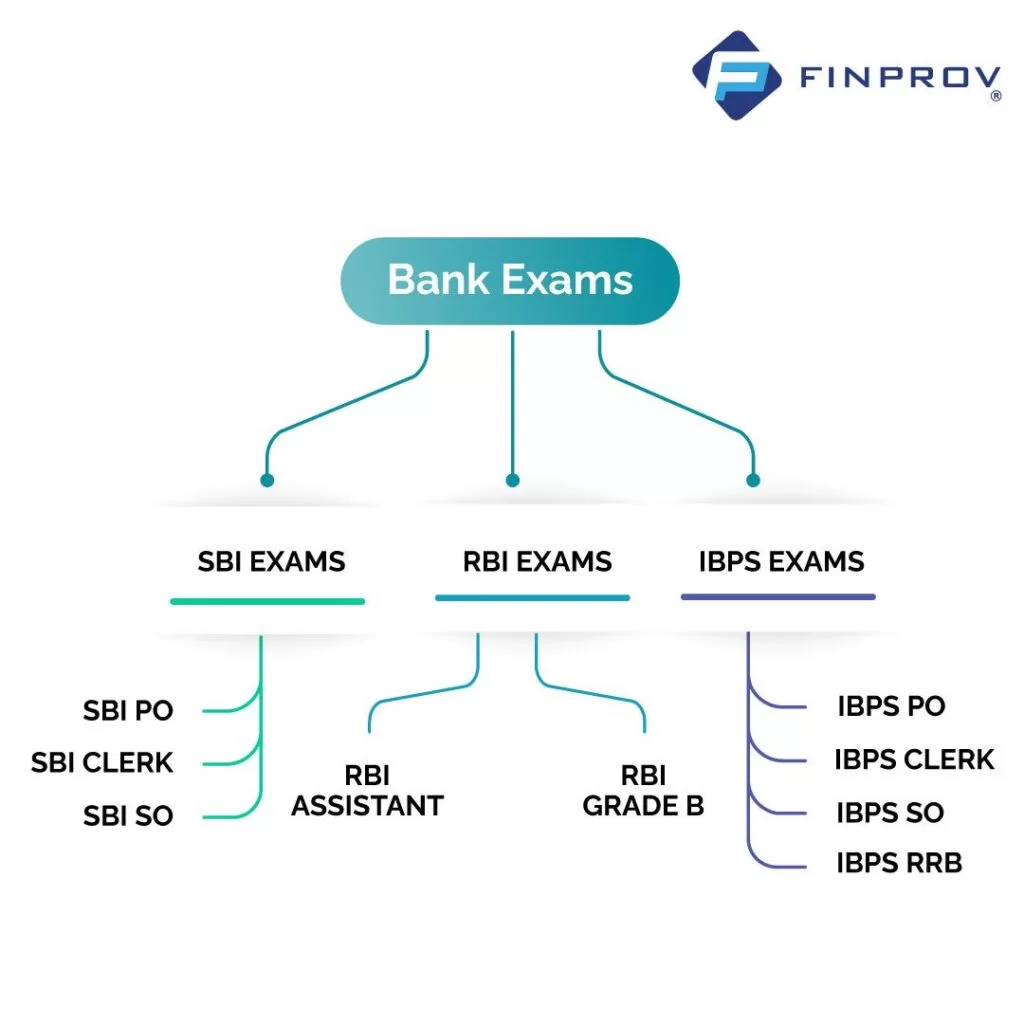

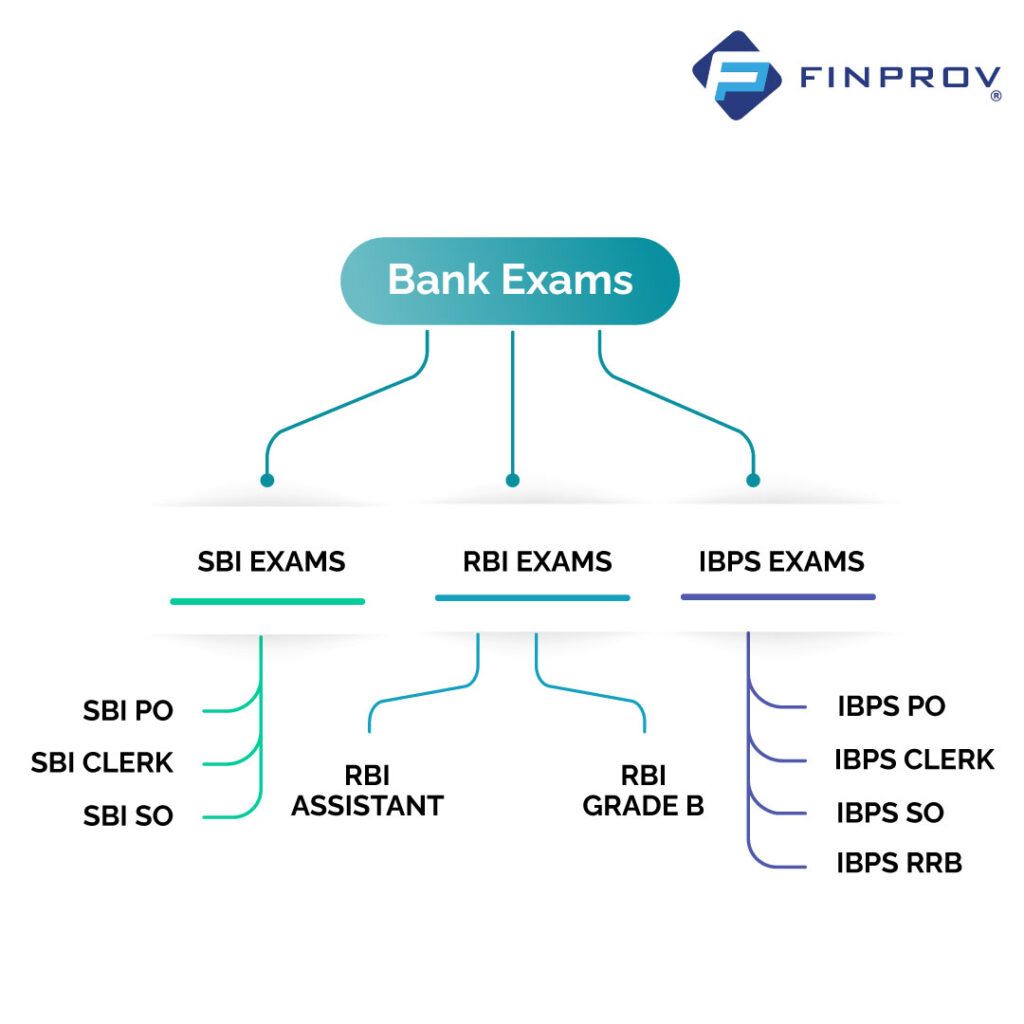

Top Bank Exams in India

Several bank exams are conducted in India to recruit candidates for positions in public sector banks and other financial institutions. Some of the most popular bank exams in India are:

- SBI PO Exam

- SBI SO Exam

- SBI Clerk Exam

- IBPS PO Exam

- IBPS SO Exam

- IBPS Clerk Exam

- IBPS RRB Exam

- RBI Officer Grade B

- RBI Officer Grade C

- RBI Office Assistant

- NABARD

Bank Exams in India – Best 10 Bank Exams in 2023

The best 10 banking exams in India that candidates should consider if they aspire to build a career in the banking sector:

1. SBI PO

The State Bank of India (SBI) Probationary Officer (PO) Exam is one of India’s most popular and competitive bank exams, attracting many candidates each year who aspire to build a career in the banking sector. The SBI PO Exam is conducted annually to recruit talented and skilled individuals for the position of Probationary Officer in various branches of SBI across the country.

SBI PO Selection Process: The selection process for the SBI PO Exam consists of three phases-

Phase 1: Preliminary Examination (Prelims)

The preliminary exam tests candidates on subjects such as reasoning, quantitative aptitude, and the English language.

Phase 2: Mains Examination

The main exam tests candidates on subjects such as data analysis, reasoning, general awareness, and the English language.

Phase 3: Personal Interview

Candidates who clear the main exam are then called for a personal interview, where they are assessed based on their communication skills, leadership qualities, and overall personality.

To prepare for the SBI PO Exam, candidates should familiarize themselves with the latest pattern and syllabus of the exam and work on improving their weaker areas. They should also practice regularly and take mock tests to get a feel of the actual exam. It is also important to stay updated on current affairs and develop a strong understanding of banking and financial concepts.

By following a well-structured study plan, staying motivated, and being consistent in their efforts, candidates can crack the SBI PO Exam and take their first step towards a rewarding career in the banking sector.

2. SBI Clerk

The SBI (State Bank of India) Clerk Exam is a competitive examination held annually to recruit individuals for the position of Clerk in various branches of SBI across the country. The SBI Clerk Exam is a great opportunity for candidates seeking a career in the banking sector and wanting to work with one of the largest public sector banks in India.

SBI Clerk Selection Process: The selection process for the SBI Clerk Exam consists of two phases-

Phase 1: Preliminary Examination (Prelims)

The preliminary exam tests the candidate’s knowledge of reasoning, quantitative aptitude, and the English language.

Phase 2: Mains Examination

The main exam tests the candidate’s knowledge in general awareness, financial awareness, general English, quantitative aptitude, and reasoning.

3. IBPS PO

The Institute of Banking Personnel Selection (IBPS) PO, also known as IBPS Probationary Officer, is a national-level examination conducted annually by the IBPS to recruit individuals for the post of Probationary Officer (PO) in various public sector banks in India.

IBPS PO Selection Process: The selection process for the IBPS PO Exam consists of two phases-

Phase 1: Preliminary examination

Phase 2: Mains examination

Both the IBPS PO Prelims and Mains exams have objective-type online mode examinations.

Phase 3: Personal interview

Successful candidates who clear all the rounds are eligible for appointment as Probationary Officers in participating banks. The exact eligibility criteria, exam pattern, syllabus, etc., are usually released in the official notification released by the IBPS.

4. IBPS Clerk

IBPS Clerk Examination is conducted annually by the IBPS to recruit individuals for the post of Clerk in various public sector banks in India.

IBPS Clerk Selection Process: The selection process for the IBPS Clerk Exam consists of two phases-

Phase 1: Preliminary examination

Phase 2: Mains examination

The minimum eligibility criteria for appearing in the IBPS Clerk examination include having a graduation degree in any discipline from a recognized university, being between 20 and 28 years of age, and meeting other requirements as specified by the IBPS.

5. IBPS RRB Officer Scale I

IBPS RRB Officer Scale I refers to the IBPS (Institute of Banking Personnel Selection) Common Recruitment Process for the selection of Officer Scale I in Regional Rural Banks (RRBs) in India. The IBPS RRB Officer Scale I examination is conducted annually for the recruitment of eligible candidates to the officer cadre posts in various participating RRBs.

IBPS RRB Officer Scale I Selection Process: The selection process for the IBPS RRB Officer Scale I consists of two phases-

Phase 1: Preliminary examination

This objective-type test consists of multiple-choice questions from various sections, such as Reasoning, Numerical Ability and Computer Awareness.

Phase 2: Mains examination

This objective-type test consists of multiple-choice questions from various sections such as Reasoning, Financial Awareness, Computer Awareness, English Language and Quantitative Aptitude.

Phase 3: Personal interview

Candidates who clear the main examination are called for an interview, which is the final stage of the selection process. The interview is conducted to analyse the candidate’s communication skills, personality, and overall suitability for an Officer Scale I position in RRBs.

6. IBPS RRB Office Assistant

The IBPS RRB Office Assistant examination is conducted annually to recruit eligible candidates to the office assistant cadre posts in various participating RRBs.

IBPS RRB Office Assistant Selection Process: The selection process for the IBPS RRB Office Assistant consists of two phases-

Phase 1: Preliminary Examination

Phase 2: Mains Examination

The minimum eligibility criteria for appearing in the IBPS RRB Office Assistant examination is having a graduate in any discipline from a recognized university, being between 18 and 28 years of age, and meeting other requirements as specified by the IBPS. Additionally, candidates should have knowledge of the local language of the state where the RRB is located, as specified by the IBPS.

7. RBI Grade B Officer

RBI Grade B Officer refers to the Reserve Bank of India (RBI) Grade B Officer recruitment examination. The RBI Grade B Officer examination is conducted annually to recruit eligible candidates to the officer cadre posts in the Reserve Bank of India.

RBI Grade B Officer Selection Process: The selection process for the RBI Grade B Officer consists of two phases-

Phase 1: Prelims Examination

This is an objective type test consisting of multiple-choice questions from various sections such as General Awareness, English Language, Quantitative Aptitude and Reasoning.

Phase 2: Mains Examination

This is an objective type test consisting of multiple-choice questions from various sections such as Economic and Social Issues, English (Writing Skills), Finance and Management.

Phase 3: Personal Interview

Candidates who clear the Phase II examination are called for an interview, which is the final stage of the selection process. The interview is conducted to analyse the candidate’s communication, personality, skills, , and overall suitability for the post of a Grade B Officer in RBI.

8. RBI Office Assistant

The Reserve Bank of India (RBI) Office Assistant is a position in the administrative support staff of the RBI. The role of an RBI Office Assistant is to assist with the day-to-day administrative tasks in the office, including data entry, file management, correspondence, and general office support. The responsibilities of an RBI Office Assistant may vary depending on the specific requirements of the department they are assigned to.

RBI Office Assistant Selection Process: The selection process for RBI Office Assistant selection process consists of two phases-

Phase 1: Preliminary Examination

Phase 2: Mains Examination

9. NABARD Exam

NABARD (National Bank for Agriculture and Rural Development) conducts an examination for the recruitment of candidates to various posts in the bank. The NABARD Exam is conducted in two stages – the preliminary exam and the main exam.

The preliminary exam tests the candidate’s knowledge of the English Language, Reasoning, Computer Knowledge, General Awareness, and Quantitative Aptitude. The main exam tests the candidate’s knowledge of the relevant subjects for the post they have applied for, such as Agricultural and Rural Development, Economic and Social Issues, and Environmental and Ecological Issues, among others.

10. NABARD Development Assistant Exam

The National Bank conducts the NABARD Development Assistant Exam for Agriculture and Rural Development (NABARD) for the recruitment of Development Assistants. This exam is an entry-level position in NABARD and is suitable for candidates who are looking to start their careers in the banking sector with a focus on agriculture and rural development.

NABARD Development Assistant Selection Process: The selection process for RBI Office Assistant selection process consists of two phases-

Phase 1: Preliminary Exam

The preliminary exam tests the candidate’s knowledge of the English Language, Reasoning, Computer Knowledge, General Awareness, and Quantitative Aptitude.

Phase 2: Mains Exam

The main exam tests the candidate’s knowledge of the relevant subjects for the post they have applied for, such as Agricultural and Rural Development, Economic and Social Issues, and Environmental and Ecological Issues, among others.

Working in the banking sector offers a number of benefits such as allowances, medical benefits, lease facilities, concessional rates of interest for loans, two-year sabbaticals for female employees, and many more. Apart from monetary benefits and perquisites, public sector banks have the best promotion policies and offer learning opportunities for personal and professional growth.

So you now have some knowledge of the top bank exams in India. Preparation and practice are key to success in any exam, including bank exams. By staying focused and disciplined in their approach to preparation, candidates can increase their chances of success.

Finprov is one of the best institutes that offer various accounting and banking courses to graduates and professionals. Our main goal is to make the learners understand better in the banking, accounting and finance industry.