Maximizing tax savings is about examining a company’s financial situation throughout the year and finding legal ways to pay less. This means making smart choices, using options like moving income around, and claiming the tax deductions, credits, exemptions, and incentives the law allows. The main goal is to ensure the company pays as little in taxes as possible while still following all the tax rules. This is more than just something to consider during tax season; watching it all year is essential.

What is Tax Planning

Tax planning is essential for running your business smoothly. The more you understand how maximizing tax savings works for your business, the better you can plan. Every business has its money situation, such as income, expenses, and where it comes from. As these numbers change, so does your tax bill. To pay less in taxes, you need to pay attention to these details and how they affect your overall taxes.

So, how do you do that? You need a clever tax plan that fits your business perfectly. This plan helps you figure out how to pay less tax and save more money faster. The better your tax plan, the better your overall financial situation.

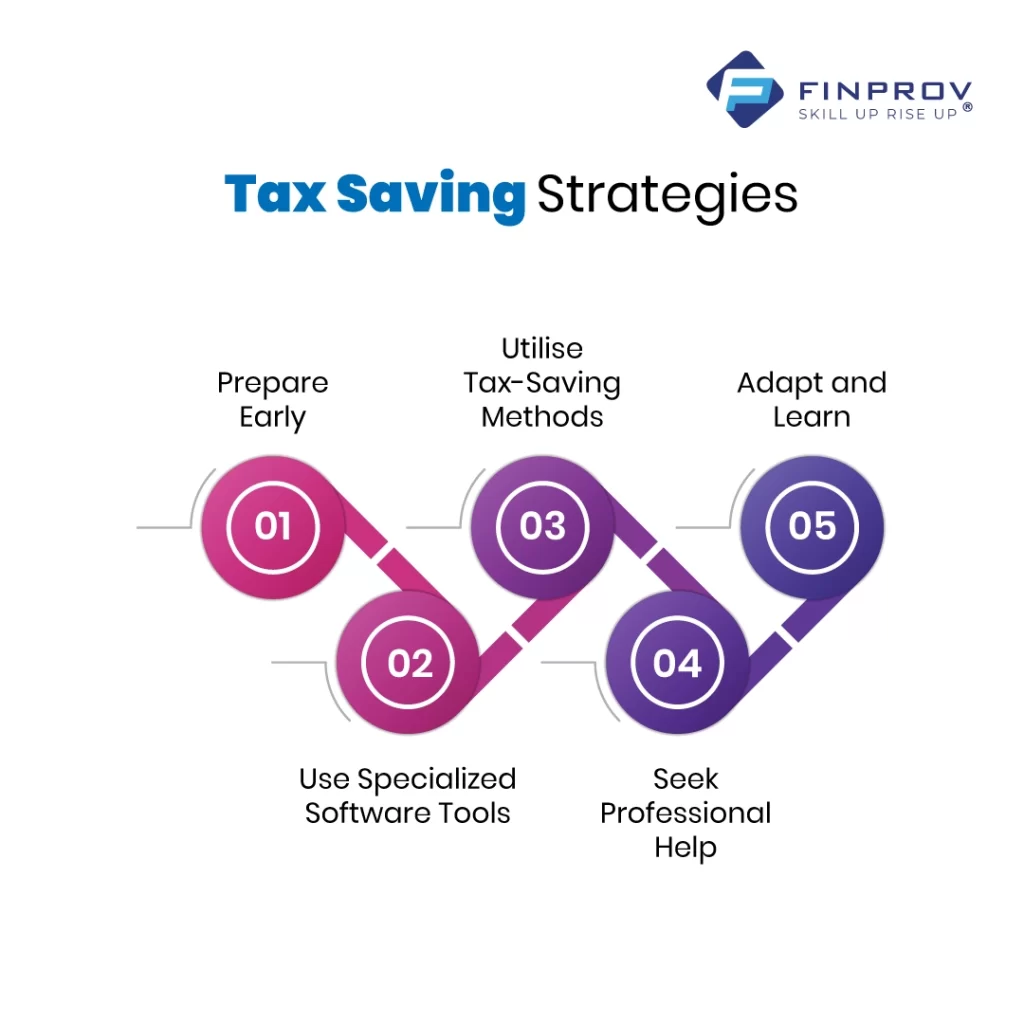

Best Methods for Tax Savings

There are so many methods you can use to save money from filing taxes. Let’s see about some maximizing tax savings through some accounting practices;

Prepare Early

Preparing a tax list before is the best way to avoid last-minute preparation. Prepare all the documents first. The papers must include a list of income statements, expense receipts, and investment records. If you are doing business, you also need to submit the tax. Stay up to date with the government’s regular rules and tax regulations. The most recent information can be seen on the IRS website.

Use Specialized Software Tools

Accounting professionals and business owners can make tax season easier using specialized software tools. Software like TaxDome, Karbon, or Canopy helps manage tasks, save time, store documents securely, and communicate with clients.

You can use software like QuickBooks and Xero for specific tasks like payroll or bookkeeping. There are also tools for managing documents, getting signatures, and automating emails. However, many accountants prefer software that combines all these features in one place.

Utilise Tax-Saving Methods

One can also save tax by using some other methods. Here are some methods of maximizing tax savings;

- If one’s medical costs exceed 7.5%, tax can be deducted. This is helpful for people who have to pay medical expenses.

- Students who are studying in college are also free from tax-paying.

- There is no need to pay tax for charity donations.

Seek Professional Help

No one knows everything entirely about maximizing tax savings. If you are still looking for information, ask someone who knows more about taxes. You can also ask a certified, qualified tax professional. Here are some ways to find a good tax expert:

- Ask your friends to give any references

- You can also check in online

- You can find out some of the firms online. Call them and have a word with them. If you find comfort, follow them.

A trustworthy tax expert can help you avoid mistakes and save money during tax time.

Adapt and Learn

Tax rules change frequently, so try to learn everything. Focus on new laws daily that teach you how to save taxes easily. Use online resources, webinars, and seminars to understand more about taxes.

For more tax-saving study tips, check out the business accounting and taxation course at Finprov Learning. We offer a range of courses designed for accounting professionals, covering topics like CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, MS Excel, and more. Whether you’re new to the field or have been around a while, their courses in Kochi are designed to give you a solid learning experience.

At Finprov, we focus on both theory and hands-on training to give you practical skills. Plus, they help you find a job once you finish your course. If you’re interested in accounting tax courses, contact Finprov today and set yourself up for a bright future.