An expense is a money used to buy something. This includes daily costs like paying a phone bill and more significant purchases like a company buying new equipment. While people might track their spending for budgeting, businesses and accountants have clear rules about what counts as an expense.

Expenses in Accounting

An expense in accounting refers to money spent and costs incurred by a company in generating revenue. These costs are important to track and are listed in financial statements to show the business’s profit.

Here are a few examples of expenses in accounting:

- Office Supplies: When a business buys office supplies, it uses cash, an asset.

- Depreciation: This is a cost that reduces the value of equipment, such as a machine or building, over time as it is used.

- Prepaid Expenses: For example, if a business pays rent in advance, it’s considered an asset. As each month passes, that prepaid rent becomes a regular expense.

Cost and Expenses in Accounting

In accounting, costs refer to the money spent to acquire business assets with a useful lifespan, such as machines. Such costs pertain to all expenses from the time the asset was brought up to the time it was placed in the location it is to serve, including the expense incurred in putting it there and the amount spent to educate the personnel on how to use it.

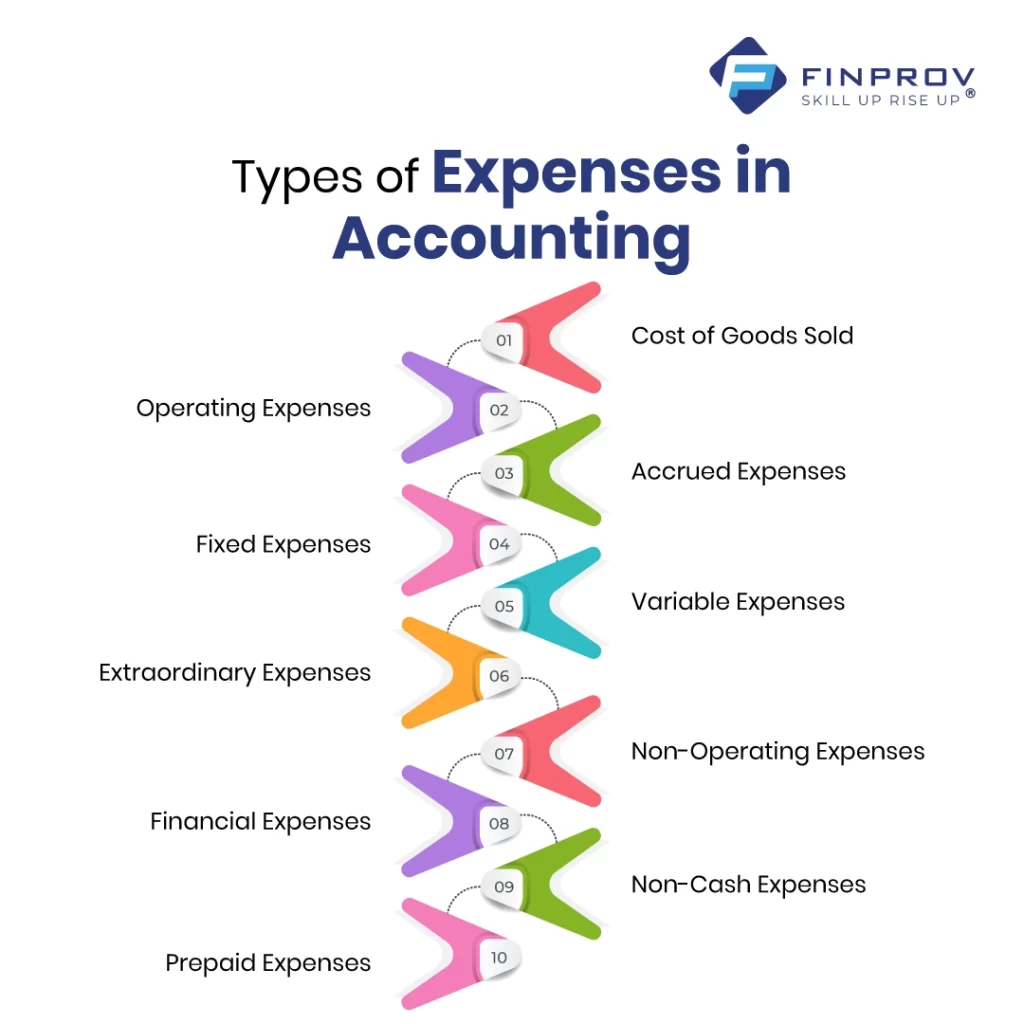

Types of Expenses in Accounting

Expenses affect your financial statements, especially the income statement. Here are the main types:

Cost of Goods Sold

This is the cost of purchasing or producing the products you sell. For manufacturers, it includes materials, labor, and overhead. For service companies, it’s called the cost of services. For businesses selling goods and services, it’s called the cost of sales. This type does not cover selling, administrative costs, interest, or extraordinary losses.

Operating Expenses

Operating expenses are costs for selling your products or services. They cover things like advertising, rent for your store, and wages for your sales staff. Additionally ,general and administrative costs include expenses for running your business’s main activities. This covers research, executive salaries, travel, training, and IT. Joining job oriented short term courses also allows you to acquire more knowledge regarding operating expenses.

Accrued Expenses

Accrued expenses in accounting are costs your business has already used but has yet to pay hasn’t for. You record these costs as a liability to match the expense with the correct period. For example, you may use office space in December but only pay for it in January. In this case, you should record the rent as a December expense. This will ensure that your rent expenses for December and January are accurate.

Fixed Expenses

Fixed expenses are costs that remain constant over time. They remain the same based on how much you produce or sell. Examples are rent, salaries, and regular wages.

Variable Expenses

Variable expenses in accounting change depending on how much you produce or sell. These costs can vary from month to month. Examples include pay for freelancers, overtime wages, and sales commissions.

Extraordinary Expenses

Extraordinary expenses are unusual, occasionally occurring, and are not part of your regular business activities. Examples include selling a large piece of property, replacing expensive equipment unexpectedly, or expenses from layoffs.

Non-Operating Expenses

These are costs that are separate from your main business activities. For example, paying interest on loans is a non-operating expense because it comes from borrowing money rather than from what your business typically does.

Financial Expenses

Financial expenses are costs from borrowing money. They are not part of your primary business operations. Examples include interest on loans and fees for getting those loans.

Non-Cash Expenses

Non-cash expenses in accounting end up on the balance sheet and do not include direct cash payments. For instance, depreciation lowers your income; however, no actual cash has been spent. Non-cash expenses work with depreciation and balance sheet impact. Thus, such costs impact the profit margin but do not imply a strict monetary outlay.

Prepaid Expenses

A “prepaid expense” is a payment made before using a service or product, recorded as an asset. Over time, as you use it, the prepaid amount is gradually moved to the expense account.

For example, paying a year’s rent upfront is first recorded as prepaid rent. Part of it is moved to the rent expense account each month to reflect usage.

To learn more about accounting, check out Finprov Learning. We offer a variety of online courses in accounting, including CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, MS Excel, and more.

Our courses are designed for both graduates and professionals, providing practical, hands-on training to help you gain real-world skills. We also offer placement assistance to help you start your career after you finish your course. Contact Finprov today to learn more and boost your accounting knowledge for a better future.