Handling money is a vital task for every business, regardless of size. Businesses frequently face challenging decisions about spending, taking on debt, choosing projects for investment, and finding ways to cut costs. All these choices fall under the umbrella of corporate finance. While it might seem complex with its specialized terms, grasping the basics of corporate finance is more straightforward than it appears at first glance.

What is Corporate Finance?

Corporate finance is how businesses manage their money to grow and run smoothly. It’s about how they decide to spend their money, what’s important when they make these decisions, their plans, and the rules they follow.

While corporate finance usually focuses on how a company keeps track of its money and gets new money, it’s about more in the US. It includes everything from how a business spends money to ensuring enough cash and investing resources.

Scope of Corporate Finance

Knowing how to handle money through corporate finance is crucial for businesses. It helps them meet their financial needs and tackle challenges effectively. Here’s why having a good scope of corporate finance is essential for any business:

Identifying Financial Needs

A key area of corporate finance involves analyzing a business’s financial requirements. Companies need to understand their economic status and explore options for raising capital. Corporate finance guides companies in deciding whether to acquire funds through debt or equity, employing thorough market analysis and in-depth studies to devise effective capital-raising strategies.

Guiding Investment Decisions

A firm’s investment strategy greatly benefits from corporate finance knowledge. Companies need to evaluate their past investments and the returns they’ve brought. This evaluation aids in determining where to invest a significant portion of the company’s capital while minimizing risk. It involves selecting suitable types of assets, developing a viable revenue model, estimating potential profits, determining an asset’s actual value, and considering various other elements.

Making the Best Use of Resources

Using a company’s money wisely is essential. Corporate finance helps businesses decide how much to spend paying employees and buying materials.

Helping with Big Choices

Corporate finance guides essential decisions like starting a new project or making the company bigger. It helps determine how much money is needed and if it’s a good idea for the company to grow or try new things.

Handling Surprises

Sometimes, unexpected things happen, like significant changes in the market. For example, the pandemic made many companies lose money and cut salaries. Corporate finance is like a safety plan, ensuring the company is ready for surprises and can deal with risks.

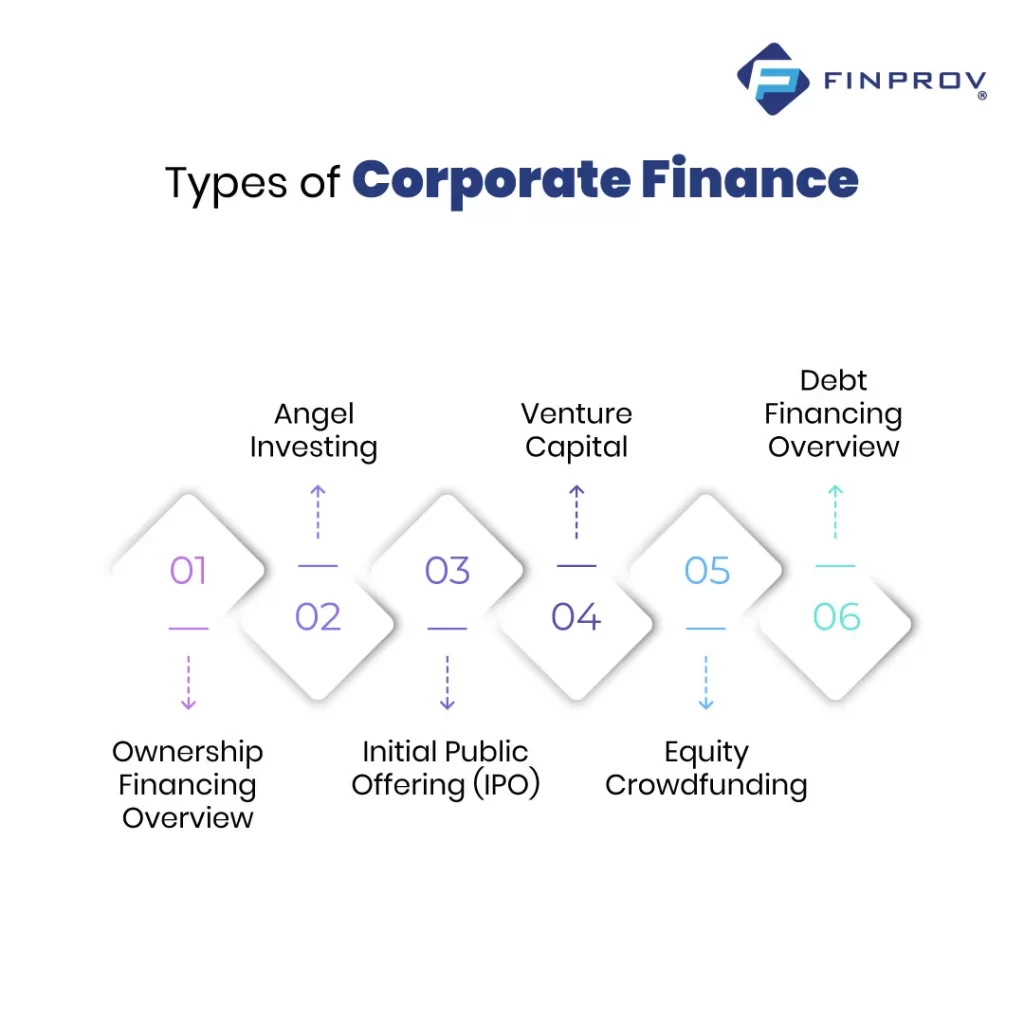

Types of Corporate Finance

Corporate financing primarily occurs through two channels – the company’s partners/owners/promoters invest their funds or borrow money from external sources. Let’s explore the various forms of equity and debt corporate financing.

Ownership Financing Overview

Ownership financing, or equity financing, happens when investors put their money into a company and, in return, receive a portion of its ownership.

Angel Investing

Angel investors are wealthy people who give money to new businesses when they’re just starting. In return, they might get a piece of the company or some of the business’s money. They’re like the first supporters and usually don’t tell the industry what to do every day.

Initial Public Offering (IPO)

An IPO is when a company sells its shares to regular people for the first time. The price of the shares is decided in a way called book-building. This lets the company collect money from regular folks who want to own a part of the company by getting some shares.

Venture Capital

Venture capitalists (VCs) manage funds that invest in companies with significant growth potential. Venture capital is beyond angel investing, focusing on startups ready for more substantial, subsequent funding rounds. VCs invest in exchange for equity and a stake in future profits, leveraging their expertise in managing diverse asset portfolios.

Equity Crowdfunding

Capital is sourced from various investors or online investment platforms in this equity financing route. These investors gain a proportional stake in the company, reflecting the size of their investment.

Debt Financing Overview

This method involves a company taking loans from external parties, which it must repay along with interest. The most common forms include:

- Bank Loans: Firms secure bank loans for fixed terms, typically five to ten years. Short-term financial needs might be met through bank overdraft facilities.

- Debentures: A company can raise funds directly from the public by issuing debenture bonds, a form of long-term borrowing.

- Commercial Loans: Beyond banks, companies can access funds through loans from non-banking financial institutions, providing an alternative borrowing channel.

To enhance your grasp of accounting, enrolling in accounting courses online can significantly improve your career prospects. At Finprov, a leading educational technology institute, we are dedicated to empowering graduates and professionals with cutting-edge accounting programs. Our accounting training institute includes high-quality courses such as CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel, designed to cater to the unique needs of learners at different career stages. Our accounting training strongly emphasizes hands-on practical experience, providing you with skills crucial for real-world application.

In addition to educational offerings, Finprov ensures your success by offering job-oriented courses and placement assistance. Choosing Finprov opens doors to some of the most lucrative job opportunities, allowing you to enhance your skills for a more promising and prosperous future. Start your journey to success with Finprov, where education seamlessly aligns with opportunities.