The double-entry system has been a fundamental principle in finance and accounting for years. Luca Pacioli invented this system in the 15th century, and it is still used in modern financial management. This system is still used for its many benefits, which help improve the accuracy, transparency, and reliability of financial information. In this blog, we will dive into the benefits of the double-entry accounting system for businesses and how it helps finance professionals to effectively manage accounts using this method.

What is Double-Entry Accounting System?

The double-entry accounting system is one of the most widely used accounting methods. As the term “double entry” suggests, each of the financial transactions is recorded twice. It is based on the principle that each transaction has two aspects that should be recorded in the book of accounts. In short, this concept means that for every value received, an equal value is given. The transactions are recorded in at least two of the accounts as a credit or debit.

This principle can help to maintain a balance in the accounting records and provide a complete picture of the financial activities of a business. By recording both transactions, this system can improve the accuracy, reduce errors, and ensure reliability.

Two Fundamental Principles of Double-Entry Accounting

There are two golden rules for double-entry accounting used by businesses. These two rules are to make sure the accounting equation remains balanced and reduce the occurrence of errors.

1. Dual Recording Requirement

Each transaction should be recorded at least twice. This principle makes sure that the financial impact of the transaction is reflected in a minimum of two accounts to maintain the integrity and completeness of the financial records.

2. Balance in Debits and Credits

The total amount debited for every transaction should match the total credited amount. This basic rule makes sure that the accounting equation remains balanced in providing a systematic and error-resistant framework that can be used for financial transactions.

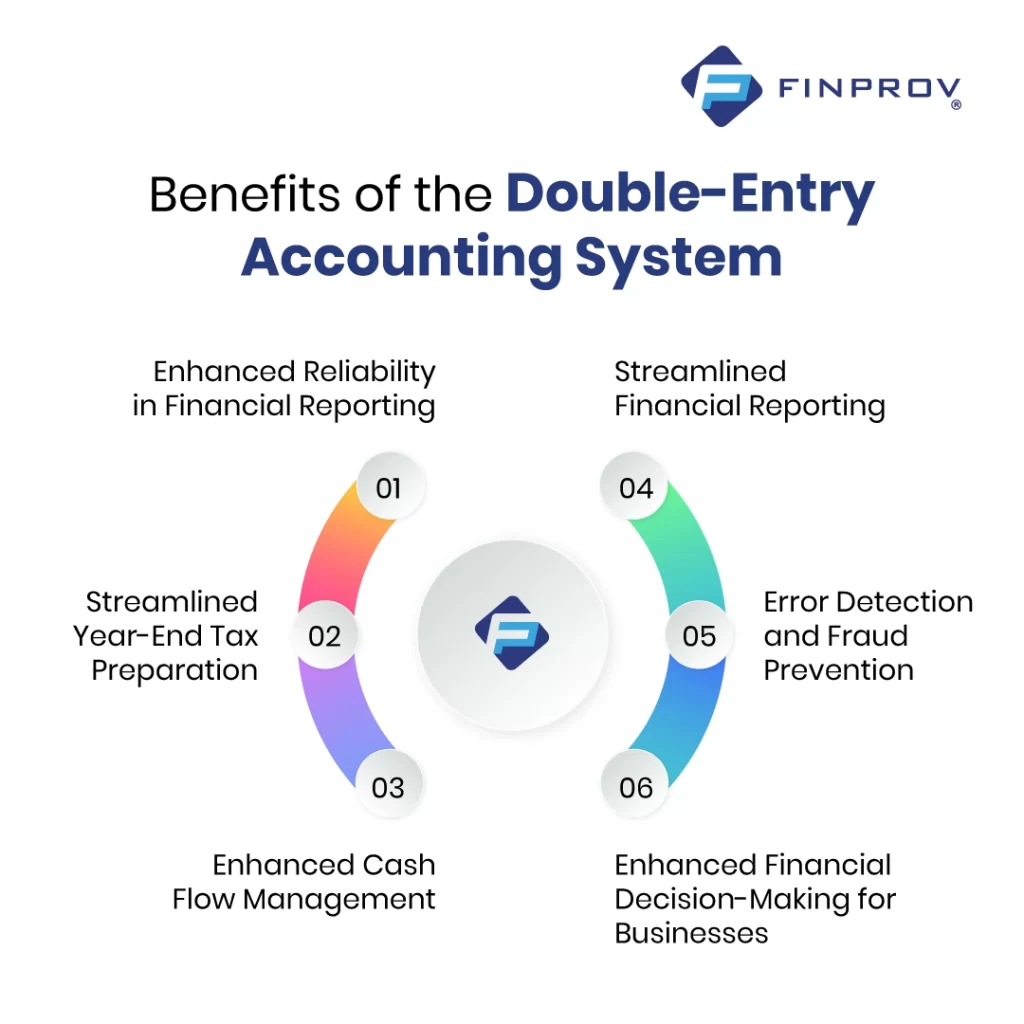

Benefits of Double-Entry Accounting System

Some of the advantages of the double-entry accounting system include:

1. Enhanced Reliability in Financial Reporting

One of the benefits of the double-entry accounting system is that every financial transaction is recorded twice. This helps to ensure accuracy and maintain a balance. This method provides a clear image of the income and expenses. It can also help to get a complete picture of the financial position of a company to track and manage its finances.

2. Streamlined Year-End Tax Preparation

The Year-end tax preparation includes reviewing the financial transactions and identifying the tax entries for the company’s returns. It is done by:

- Maintaining a clear and transparent record of every transaction.

- It ensures that each of the entries is balanced, which can reduce the risk of errors and save time.

- Recording accurately can improve cash flow management and ensure the records are reliable and complete, making the tax return smoother and more efficient.

3. Enhanced Cash Flow Management

Recording every transaction that uses the double-entry method can improve cash flow management. This method can provide a complete and accurate record of all the transactions on the credit and debit sides. This helps businesses track and identify unnecessary areas and develop strategies to optimize the cash flow. It can help to detect and correct errors and inconsistencies in the financial records, thereby improving the accuracy and reliability.

4. Streamlined Financial Reporting

The double-entry system provides a more precise financial overview. Recording all the transactions in two accounts can provide a clear view of cash flow and help to identify the sources and destinations of the funds.

5. Error Detection and Fraud Prevention

With the double-entry accounting method, companies can improve their strength by maintaining detailed accounting records. This method can be used to get a comparison, and it acts like a robust mechanism for detecting errors and preventing fraud. By joining and taking an accounting course, you can learn about the double-entry accounting system online.

6. Enhanced Financial Decision-Making for Businesses

The double-entry system is used by businesses to make decisions by providing a complete and accurate record of all financial transactions. This provides a clear and detailed image that the organization can use to calculate its overall financial health, areas to improve, and make informed decisions to allocate resources and manage finances. This method can also help to identify and correct the errors or inconsistencies in the financial records to improve the accuracy and reliability of the information for making effective decisions.

Overall, the double-entry accounting system offers a reliable and tested time framework that ensures accurate financial reporting and improves the efficiency and transparency of the financial management in an organization.

Conclusion

The double-entry accounting system provides accuracy, transparency, and reliability in financial management. By recording each of the transactions with equal credits and debits, businesses can get a complete view of their financial health. This can help to strengthen the cash flow management, detect errors, and prevent fraud. It can also help make informed decisions by providing dependable financial insights. In the era where financial clarity is important for the growth of business and compliance, the double-entry accounting system stands as an important tool for organizations.

For learning more about the double-entry accounting system, enrolling in a job-oriented course in Kochi can help provide better career opportunities. Finprov is one of the leading ed-institutes that help graduates and professionals through diverse and cutting-edge accounting courses. Our curriculum includes top-tier programs such as CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel. Our courses are designed to provide a unique experience for students and working professionals with practical training for real-life applications.

Beyond education, Finprov Learning ensures your success by providing job-oriented courses and placement support. Choose Finprov and get the highest-paying jobs in India, and improve your skillsets to unlock a better future.

FAQs

Q1. What is a double-entry system in accounting?

The double-entry system in accounting is designed for recording each of the financial transactions twice, once as a debit and once as a credit.

Q2. What are the advantages of the double-entry Accounting System?

It helps to improve the reliability of the financial reporting, streamline the tax preparation at the end of the year, and detect errors.

Q3. What is the main objective of double-entry accounting?

The main goal of double-entry accounting is to maintain an accurate and balanced record of financial transactions by recording both credit and debit.

Q4. Is double-entry accounting important for every business?

The double-entry accounting system is used by businesses that have to generate GAAP-compliant financial statements for the owners or lenders, including public companies.

Q5. Which one is better, single-entry or double-entry accounting?

In single-entry bookkeeping, the transaction is recorded once. If you have a small business without any assets or loans, then choosing single-entry bookkeeping can be helpful. If you have assets or loans, using the double-entry accounting system will provide an accurate record of your financial health.