Accounting is the foundation of all financial transactions. An accounting course will help you master the fundamental accounting principles, increasing efficiency. Before pursuing any system, please familiarise some of its common terminologies. We have listed below some basic terms used in accounting to give you a clear understanding. Understanding them will help you stay ahead of your colleagues in every field.

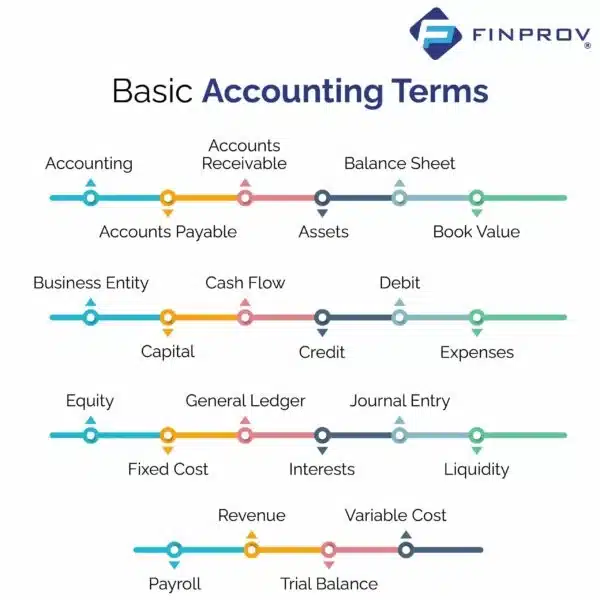

Basic Accounting Terms

Accounting

Accounting is the structured method of reporting and recording the financial transactions of different business organisations.

Accounts payable

It is the amount the company has to pay creditors or suppliers for the goods they have delivered.

Accounts receivable

It is the vice-versa of amounts payable, i.e., the amount of money the customers or consumers must pay the suppliers for the goods and services they receive.

Accounting period

Financial statements like balance sheets, income statements and statements of cash flows mention the accounting period. It is the period recorded in the reports.

Accrued expense

The expense that has already been incurred but hasn’t yet been paid is known as an accumulated expense.

Assets(fixed and current)

Assets can be any business property that provides tangible or non-tangible value, including monetary value. Current assets are the ones that will convert to cash within one year. It could be inventory, cash or accounts receivable. Fixed assets are long-term and will benefit the company for more than a year. It includes land or machinery, real estate, etc.

Asset classes

It is a security group that has similar characteristics in the marketplace. Asset classes classify themselves into fixed income or bonds, equities or stocks, and cash equivalents or money market instruments.

Balance sheet

The balance sheet is the financial report that gives an overview of the company’s assets (what it owns), liabilities(what it owes) and shareholder or owner equity for a particular time. A balance sheet follows the basic accounting equation.

Basic accounting equation

The accounting equation is the base of the double-entry system. The accounting equation on the company’s balance sheet refers to the company’s assets as the total of the company’s liabilities and shareholder’s liabilities.

Assets = liability+ equity

The accounting equation maintains the balance sheet based on this theory and ensures that each entry made on the debit side has corresponding access on the credit side.

Remember this equation in your life if you have plans to enter the accounting world. It will help you in the long run.

Book value

When an asset depreciates, its value is lost. The book value showcases the original value of the investment without its depreciated loss.

Bonds and coupons

A bond is fixed income security in the form of debt investment. An individual, government, company or municipality gives a loan to an entity to get it back with interest. The coupon, also known as the coupon rate, is the annual interest paid on the bond.

Business Entity

A business entity is often called a legal structure or type of business. Some of the famous company formations are a partnership, sole proprietor, limited liability company(LLC), a private limited company(Pvt. Ltd), a public limited company(Ltd), etc. Each entity has its own set of laws, requirements and tax implications.

Capital

Capital is either the financial asset or the value of the financial investment, usually calculated from the current assets from the current liabilities. In other words, it is the money or assets the organisation invests in their work.

Cash flow

Cash flow is the revenue or expense generated over a while by different business activities like sales, manufacturing, etc.

Cost of goods sold

It is the direct expense of the business while selling the goods produced. The formula for calculating the cost of goods sold varies depending upon the goods delivered. For instance, we can figure it by the cost of raw materials used and the amount of labour used during production.

Coupon bond formula

The coupon bond formula applies to bonds that pay coupons as the principal amount of the bond or the nominal percentage of the par value. Its formula calculates the present value of the possible future cash flows, ideally in the form of coupon payments and principal amounts, i.e. the amount received at the time of maturity.

Credit

Credit is the accounting entry subjected to the decrease or increase in the assets or liabilities equity on the company’s balance sheet, depending on the transactions. The double-entry accounting method has two recorded entries for each transaction- a credit and a debit.

Debit

Debit is the accounting entry made whenever there is a decrease in liabilities or increase in assets on the company’s balance sheet.

Diversification

Diversification is distributing or spreading capital investments into different assets to avoid risk due to over-exposure.

Expenses

Expenses can be the accrued, variable, fixed or day-to-day costs a business may encounter during its functioning. Fixed expenses include rent in regular periods; variable expenses may change within a given time limit. Accrued expenses are expenses that have not been paid yet. Operation expenses include business expenditures not directly associated with producing goods and services like advertising costs, insurance expenditures, property taxes, etc.

Equity and owner’s equity

Owner’s equity is the stock percentage of a person’s ownership interest in the company. Stock owners are also known as shareholders. You can determine equity by subtracting liabilities from assets.

Fixed Cost

Fixed costs do not change with the volume of sales. For instance, salaries and rent won’t vary if a company has more sales.

Generally accepted accounting principles(GAAP)

GAAP is all companies’ rules and regulations while reporting financial data. All public trading companies have to follow these rules strictly. The accounting industry develops these rules.

General ledger

The general ledger is the complete record of the company’s financial transactions.

Insolvency

Insolvency is when an organisation or individual can no longer meet financial obligations with their creditors when their debts are due.

Interests

Interest is the amount paid on the line of credit or loan that exceeds the repayment of the principal balance.

Inventory

Under inventory comes the assets the company purchased to sell to its customers but hasn’t done yet. After selling the items to its customers, the inventory account will decrease its value.

Journal entry

Journal entries are the updates and changes made in the company’s books. Every journal entry comprises a date, a unique identifier, an amount, a debit/credit and an account code.

Liabilities(long-term and current)

Liabilities are the debts or financial obligations of the company during its operations. Long-term liabilities can be paid over some time, mainly more than a year. Current liabilities are debts that you have to pay within a year. For example, debts to suppliers are a liability.

Limited liability company(LLC)

In a limited liability company(LLC), the members are not responsible for the company’s debts or liabilities. Such a corporate structure helps business owners from losing their life savings if someone sues their company.

Liquidity

Liquidity defines the state in which you can quickly convert something to cash. For example, stocks have more value than a house in terms of liquidity, as you can convert stocks into cash more quickly than in real estate.

Material

When information influences decisions, the term material is used. According to GAAP, you should disclose all material considerations.

Net income

Net income or net profit is the company’s total savings. You can calculate net income by subtracting total expenses from total revenue.

On credit/on account

This term helps the customer make future payments but allows him to enjoy all the benefits immediately after the purchase.

Overhead

Expenses related to running businesses are often defined as overhead. These expenses do not include the production cost and delivery charge.

Payroll

The payroll account consists of payments including employee wages, salaries, deductions and bonuses. It is often mentioned in the balance sheet as a liability for unpaid wages or vacation pay.

Present value

The present value is the current value of the sum of money that you have to return in the future.

Profit and loss statement

The financial statement defines the company’s financial status and performance after reviewing costs, revenues and expenses within a specific time, like quarterly or annually.

Return on investment

Return on investment or ROI measures your company’s financial performance for the amount of money invested. You calculate it by dividing the net profit by the cost of investment. The result is often explained in percentages.

Revenue

Revenue is the money earned by the company.

Trial balance

Trial balance lists all the general ledger accounts with their balance amount; it can be either debit or credit. The total credit must balance the total debt.

Variable Cost

Variable cost is the opposite of fixed cost—these cost changes with sales volume. As the sales increase, variable costs also increase simultaneously, as they are the expenses met during product delivery. For example, if more students join the accounting courses in an accounting training institute, the institute will have to hire more faculties to meet the increasing demand.

Accounting is indeed a vast ocean. What you have learned above is only the tip of the iceberg. There is much beyond that in accountancy. An accounting course will help you to understand accountancy more. Joining a reliable accounting course is your first step toward entering the accounting world. For more accounting-related queries, visit the official website of Finprov Learning, India’s official accounts learning partner.