How are financial institutions leveraging the ever-accelerating pace of technological progress to enhance their services? What impact has the integration of artificial intelligence (AI) had on the financial industry? One of the most prominent and profound breakthroughs witnessed in recent years is integrating artificial intelligence (AI) into the financial sector. Before exploring its applications in finance, it is crucial to recognize AI’s transformative effect on the sector. By harnessing the power of AI, the financial industry has undergone a significant enhancement in efficiency, enabling companies to provide superior services to their customers. Moreover, this integration has given rise to innovative products and services like robo-advisors and chatbots, fundamentally revolutionizing the delivery of financial services.

How has AI impacted the financial sector, and what benefits has it brought? AI has undeniably left a profound imprint on the financial industry, resulting in heightened efficiency and enhanced customer experiences. With the assistance of AI, financial institutions can swiftly and accurately process vast volumes of data, yielding valuable insights that facilitate well-informed decision-making. This, in turn, has created the way for creating previously unattainable products and services, including personalized investment advice and automated financial planning, which cater to individual needs and preferences.

Role of AI in Finance

Artificial Intelligence (AI) has revolutionized the financial sector, benefiting financial institutions and customers. By leveraging the power of AI, financial services have undergone a transformative shift, revolutionizing the delivery and management of various services such as fraud detection and personalized financial planning.

Fraud Detection and Prevention

Fraud detection and prevention have been significantly revolutionized by the implementation of AI in the financial sector. Financial institutions rely on AI algorithms to analyze transactions and identify anomalies that may indicate fraudulent activity. This has resulted in a notable reduction in fraud cases and improved customer protection. By leveraging real-time data analysis, AI-powered fraud detection systems enable financial institutions to detect and prevent fraudulent activities before they cause substantial harm. Machine learning algorithms recreate an essential role in these systems by identifying patterns and anomalies in transaction data, allowing for accurate and efficient fraud detection.

Risk Management and Assessment

AI analyses data and evaluates the risks of different investments and transactions. This aids in making well-informed decisions and effectively managing risk. AI-powered risk management systems excel at analyzing complex financial data and identifying potential risks and opportunities. These systems leverage machine learning algorithms to learn from historical data and predict future market trends and risks. As a result, financial institutions can make informed investment decisions and exhibit enhanced risk management capabilities.

Algorithmic Trading and Investment

AI-powered algorithms are utilized for analyzing and executing trades, leading to more accurate and profitable investments. This has significantly increased efficiency and profitability in the financial sector. AI-powered trading systems excel at analyzing large volumes of data and finding patterns and trends within financial markets. By leveraging machine learning algorithms, these systems learn from historical data and predict future market trends. Consequently, financial institutions can make well-informed investment decisions and execute trades more efficiently.

Personalized Financial Planning Services for Customers

Financial institutions utilize AI-powered robo-advisors to analyze customer data and provide personalized investment recommendations. This has made financial planning more accessible and cost-effective for customers. AI-powered robo-advisors analyze customer data, including income, expenses, and investment goals, to offer tailored investment advice. Machine learning algorithms enable these systems to learn from customer data and predict future investment opportunities. As a result, customers receive personalized investment recommendations aligned with their specific needs and goals.

Customer Service and Chatbots

AI has witnessed a substantial transformation in the financial sector. AI-powered chatbots are now extensively utilized to deliver exceptional customer service. These chatbots offer round-the-clock assistance, promptly responding to customer queries, reducing response times, and enhancing overall customer satisfaction. Consequently, customer engagement and retention rates have witnessed an upswing.

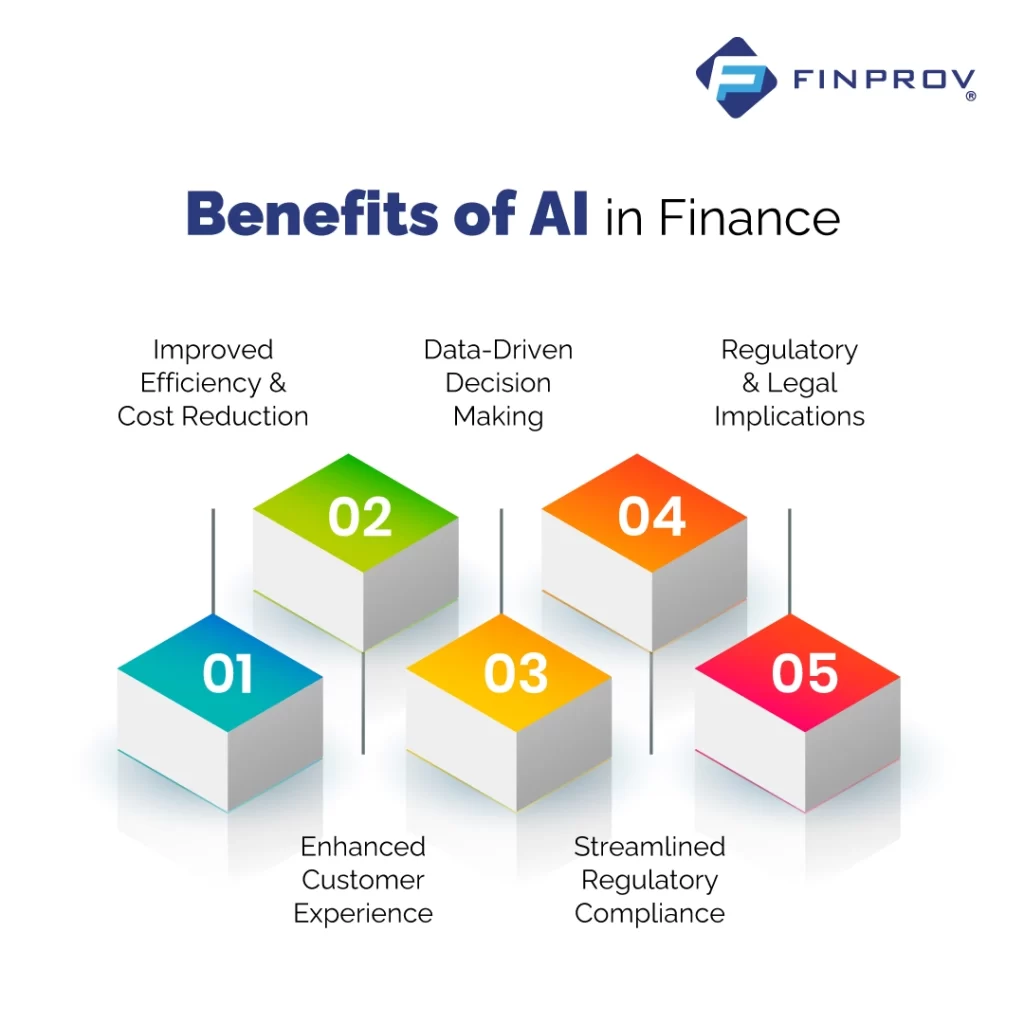

Benefits of AI in Finance

Improved Efficiency and Cost Reduction

The integration of AI has resulted in a notable improvement in efficiency and cost reduction within the financial sector. AI automates numerous tasks that were previously performed manually, leading to cost savings and increased operational efficiency. Financial institutions can now offer enhanced services to their customers while reducing operating costs.

Enhanced Customer Experience

AI has significantly enhanced the customer experience in the financial sector. Using robo-advisors and chatbots has made financial services more accessible and affordable for customers. AI-powered analytics provide valuable insights that can be leveraged to enhance customer experience and satisfaction.

Data-Driven Decision Making

AI empowers data-driven decision-making in the financial sector. Financial institutions can analyze vast data and derive valuable insights that inform informed decision-making. This has improved risk management practices and investment decisions, enhancing the industry’s profitability.

Streamlined Regulatory Compliance

AI is also instrumental in streamlining regulatory compliance within the financial sector. Financial institutions leverage AI algorithms to monitor and ensure adherence to regulatory requirements. This has increased compliance levels and decreased regulatory violations, contributing to a more secure and regulated financial environment.

Regulatory and Legal Implications

Implementing AI in the financial sector brings forth regulatory and legal considerations. Financial institutions must adhere to regulations that govern the use of AI and ensure transparency in their decision-making processes when utilizing AI algorithms. Compliance with existing laws and developing new rules specific to AI implementation are crucial to ensure AI’s ethical and responsible use in finance.

Integrating AI in the financial sector is reshaping the industry, revolutionising its efficiency, cost-effectiveness, and customer-centric approach. AI-powered solutions bring many advantages, including enhanced efficiency, elevated customer experience, data-driven decision-making, and streamlined regulatory compliance. However, it is crucial to acknowledge and address the challenges and concerns associated with AI. Key areas of concern include data security and privacy, ethical considerations, regulatory and legal implications, and workforce adaptation.

By proactively tackling these issues, financial institutions can ensure a successful and beneficial integration of AI that positively impacts all stakeholders involved, including those pursuing finance and accounting courses, to acquire more knowledge in the industry. Finprov is a reputable ed-tech institute offering a wide range of accounting courses to help individuals excel in accounting. With courses such as CBAT, PGBAT, PGDIFA, Income tax, Practical accounting training, DIA, GST, SAP FICO, SAP MM, Zoho Books, Tally Prime, MS Excel, and more, Finprov ensures comprehensive training in various aspects of accounting. By providing practical training, we prepare individuals for future-ready job opportunities.