What is GST Return?

A GST return is a mandatory form that must be filed by any taxpayer registered under the Goods and Services Tax (GST) law for each corresponding GSTIN registration. It is essential to ensure that the GSTIN status remains active to facilitate the regular filing of returns.

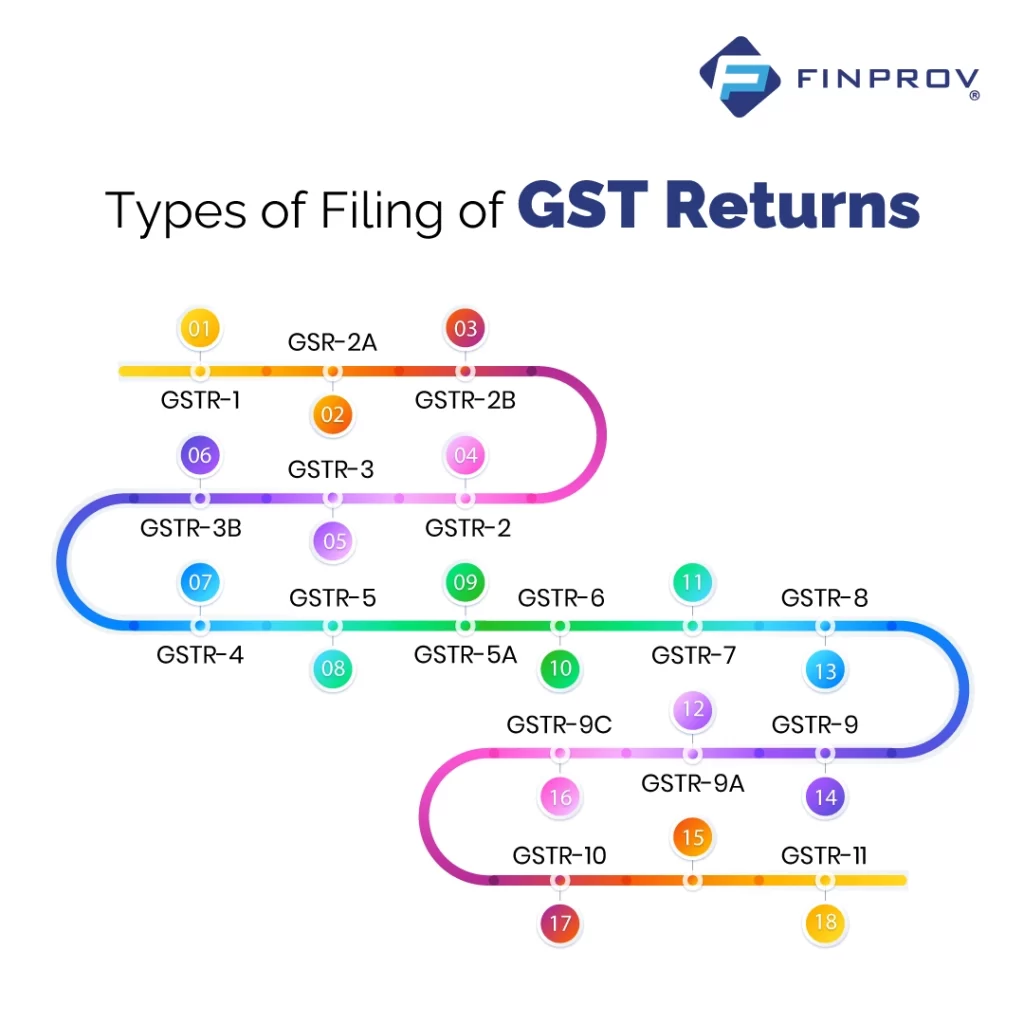

Did you know that 22 types of GST returns are prescribed under the GST Rules? Out of these, 11 GST returns are active, four are suspended, and eight are view-only. The number and specific types of GST returns a business or professional must file depend on their respective taxpayer registration category. These categories encompass regular taxpayers, taxable composition persons, e-commerce operators, TDS deductors, non-resident taxpayers, Input Service Distributors (ISD), and casual taxable persons.

Who should File GST Returns?

GST returns are mandatory for all business entities registered under the GST system. The filing process varies based on the nature of the business and its activities. Registered dealers involved in the following actions are required to file a GST return:

- Sales

- Purchase

- Output Goods and Services Tax

- Input Tax credit with GST paid on the purchase

Types of Filing of GST Returns

Notably, the frequency of filing certain GST returns may vary for GSTR-1 and GSTR-3B filers who choose to participate in the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme. Here are the 11 types of filing GST Returns;

GSTR-1

GSTR-1 is a crucial return that needs to be furnished to report the details of all outward supplies of goods and services. It encompasses the invoices and debit/credit notes generated for sales transactions during a specific tax period. GSTR-1 must be filed by all regular taxpayers, including casual taxable persons registered under the Goods and Services Tax (GST) system. All suppliers or sellers registered under GST must report any amendments to sales invoices, even if they pertain to previous tax periods, in their GSTR-1 return.

Currently, the filing frequency for GSTR-1 is as follows: (a) Monthly filing: The return must be filed by the 11th* of each month if the business has an annual aggregate turnover exceeding Rs. 5 crores or has not opted for the Quarterly Return filing and Monthly Payment of taxes (QRMP) scheme. (b) Quarterly filing: The return must be filed by the 13th** of the month following the respective quarter if the business has opted for the QRMP scheme.

The due date for the monthly filing of GSTR-1 was previously the 10th of every month until September 2018. And the due date for quarterly filing of GSTR-1 was previously the end of the month succeeding the respective quarter until December 2020.

GSR-2A

GSTR-2A is a read-only dynamic GST return that provides recipients or buyers with information about their inward supplies of goods and services. It includes details of purchases made from GST-registered suppliers during a specific tax period. The data in GSTR-2A is auto-populated based on the information filed by suppliers in their GSTR-1 returns. Data filed in the Invoice Furnishing Facility (IFF) by the Quarterly Return Monthly Payment (QRMP) taxpayers are also included.

As a view-only return, no action can be taken within GSTR-2A. However, buyers frequently refer to it to claim accurate Input Tax Credit (ITC) for each financial year across multiple tax periods. If any invoices still need to be included, buyers can communicate with the sellers and request they upload them in their GSTR-1 on time.

Until August 2020, GSTR-2A was commonly used for claiming ITC for each tax period. Afterwards, buyers must refer to GSTR-2B, a static return, to claim the input tax credit. Nevertheless, some taxpayers still find referring to GSTR-2A beneficial when filing their annual GST returns.

GSTR-2B

GSTR-2B is a view-only static GST return designed for recipients or buyers of goods and services. It is generated monthly, starting August 2020, and provides consistent ITC data for a specific period when reviewed. The ITC details are captured from the filing of GSTR-1 for the previous month (M-1) up to the filing of GSTR-1 for the current month (M). The return is made available on the 12th of each month, allowing sufficient time before filing GSTR-3B, where the ITC is declared.

GSTR-2B provides information on the actions for each reported invoice, such as reversal, ineligibility, and reverse charge. It also offers references to the table numbers in GSTR-3B.

GSTR-2

GSTR-2 is a currently suspended GST return that buyers could use to report their inward supplies of goods and services, i.e., their purchases during a tax period. The details in the GSTR-2 return were intended to be auto-populated from GSTR-2A. Unlike GSTR-2A, GSTR-2 allowed editing of the information. GSTR-2 applied to all average taxpayers registered under GST, but its filing has been suspended since September 2017.

GSTR-3

GSTR-3 is also currently a suspended GST return. It served as a monthly summary return for providing summarized details of outward supplies, inward supplies, input tax credit claimed, tax liability, and taxes paid. The recovery was auto-generated based on the information from GSTR-1 and GSTR-2 returns. GSTR-3 was required to be filed by all regular taxpayers registered under GST, but its filing has been suspended since September 2017.

GSTR-3B

GSTR-3B is a monthly self-declaration return that needs to be filed to provide a summary of outward supplies, input tax credit claimed, tax liability, and taxes paid. It applies to all average taxpayers registered under GST.

Before filing GSTR-3B, taxpayers must reconcile the sales and input tax credit details with GSTR-1 and GSTR-2B for each tax period. This reconciliation process is essential to identify any discrepancies in the data, as it could lead to GST notices in the future or even the suspension of GST registration.

The current frequency for filing GSTR-3B is as follows: (a) taxpayers with an aggregate turnover of more than Rs. 5 crores in the previous financial year, or those who were eligible but chose not to participate in the Quarterly Return Monthly Payment (QRMP) scheme, are required to file it on a monthly basis by the 20th of the following month.

(b) Quarterly, on the 22nd of the month following the quarter for the ‘X’ category of States and on the 24th of the month following the quarter for the ‘Y’ category of States – This applies to taxpayers with an aggregate turnover equal to or below Rs. 5 crores, who are eligible and remain opted into the QRMP scheme.

GSTR-4

GSTR-4 is the annual return previously filed by composition-taxable persons under GST. It had to be submitted by 30th April following the relevant financial year. GSTR-4 replaced the earlier GSTR-9A (annual return) starting from the financial year 2019-20.

Before FY 2019-20, taxable composition persons must file GSTR-4 every quarter. However, from that financial year onwards, a simplified challan in the form of CMP-08, filed by the 18th of the month following each quarter, replaced the quarterly filing requirement.

The composition scheme allows taxpayers to deal with goods and has a turnover of up to Rs. 1.5 crores to opt for a simplified taxation system and pay taxes at a fixed rate based on the turnover declared. Service providers can also avail of a similar scheme if their turnover is up to Rs. 50 lakh, as per CGST (Rate) Notification 2/2019 dated 7th March 2019.

GSTR-5

GSTR-5 is the return that needs to be filed by non-resident foreign taxpayers who are registered under GST and engage in business transactions in India. This return includes details of outward supplies, inward supplies, credit/debit notes, tax liability, and taxes paid. The filing deadline for GSTR-5 is the 20th of each month, and it is filed under the GSTIN (GST Identification Number) that the taxpayer has obtained in India.

GSTR-5A

GSTR-5A is a summary return that is submitted by providers of Online Information and Database Access or Retrieval (OIDAR) services. It is used to report their outward taxable supplies and the amount of tax payable under the Goods and Services Tax (GST) system. The due date for filing GSTR-5A is the 20th of every month.

GSTR-6

GSTR-6 is a monthly return that must be filed by an Input Service Distributor (ISD). This return includes details of the input tax credit received and distributed by the ISD. It also contains information about the documents allocated for the distribution of input credit and the distribution method. The due date for filing GSTR-6 is the 13th of every month.

GSTR-7

GSTR-7 is a monthly return filed by individuals or entities who must deduct Tax Deducted at Source (TDS) under GST. This return includes details of the TDS removed, the TDS liability payable and paid, and any TDS refund claimed. The due date for filing GSTR-7 is the 10th of every month.

GSTR-8

GSTR-8 is a monthly return that e-commerce operators must file registered under GST and collect Tax Collected at Source (TCS). This return contains details of all collections made through the e-commerce platform and the TCS assembled on those supplies. The due date for filing GSTR-8 is the 10th of every month.

GSTR-9

GSTR-9 is the annual return that needs to be filed by taxpayers registered under GST. It must be submitted by 31st December following the relevant financial year. This return consolidates the details of all outward supplies made, inward supplies received, and taxes paid under different tax heads (CGST, SGST, and IGST). It also includes a summary of supplies reported under each HSN code and the details of taxes payable and paid.

GSTR-9 consolidates the monthly or quarterly returns (such as GSTR-1, GSTR-2A, and GSTR-3B) filed during the financial year. It applies to all taxpayers registered under GST except those who have opted for the composition scheme, casual taxable persons, input service distributors, non-resident taxable persons, and persons paying TDS under Section 51 of the CGST Act.

Please note that as per CGST notification no. 47/2019 (later amended), the annual return under GST has been made optional for taxpayers with an aggregate turnover not exceeding Rs. 2 crores for FY 2017-18, FY 2018-19, and FY 2019-20.

GSTR-9A

GSTR-9A is an annual return previously required to be filed by composition taxpayers. However, it is currently suspended. GSTR-4 (yearly return) introduced from FY 2019-20 replaced GSTR-9A. Before that, GSTR-9A filing for composition taxpayers was waived off for FY 2017-18 and FY 2018-19.

GSTR-9C

GSTR-9C is a self-certified reconciliation statement that must be filed by every registered person under GST whose turnover during a financial year surpasses the prescribed limit of Rs. 5 crores. The deadline for filing GSTR-9C is aligned with the due date for GSTR-9, which is on the 31st of December of the year following the relevant financial year. GSTR-9C serves as a reconciliation between the books of accounts and the GSTR-9. It is filed for each GSTIN, meaning one PAN can have multiple GSTR-9C forms filed.

GSTR-10

GSTR-10 is a return that must be filed by a taxable person whose GST registration has been cancelled or surrendered. It is the final return and must be filed within three months from the date of cancellation or the date of the cancellation order, whichever is earlier.

GSTR-11

GSTR-11 is the return that needs to be pointed out by persons who have been issued a Unique Identity Number (UIN). UIN is assigned to foreign diplomatic missions, and embassies cannot pay taxes in India. These entities can claim a refund for the GST on goods and services purchased within India. GSTR-11 includes details of inward supplies received and the refund claimed by them.

Filing of GST returns is a mandatory requirement under the GST regime, even if no transactions are reported. It is essential to file a Nil return in such cases. However, it is important to note that you can only file a return for a particular period if the previous month or quarter return has been filed.

Late filing of GST returns can have significant consequences, including imposing heavy fines and penalties. For example, the late filing fee for GSTR-1 is reflected in the liability ledger of the subsequent GSTR-3B filed immediately after the delay. Therefore, adhering to the prescribed timelines for filing GST returns is crucial to avoid cascading effects and financial implications.

Enrolling in a GST certification course is a valuable step towards gaining comprehensive knowledge of effectively managing GST accounting software for businesses. Finprov, a reputable institute, offers a range of accounting courses, including their GST certification course, designed to provide learners with a deeper understanding of GST principles and practices through real-world examples. This course suits graduates, Chartered Accountants, company secretaries, finance and tax professionals, and individuals seeking career opportunities in these fields.

The GST certification course offered by Finprov covers various topics, including the fundamentals of GST, Input Tax Credit, Composition Scheme, GST return filing, E-way bill, Time of Supply, Place of Supply, Reverse Charge Mechanism, and more. It caters to both graduates and professionals looking to enhance their knowledge in the accounting and finance sectors. Choosing Finprov for your GST certification course ensures access to quality education and valuable insights in these domains.