On July 1, 2017, the Indian Government implemented the Goods and Services Tax Act (GST), a significant legislative change. This legislation received formal approval in the Parliament on March 29 of the same year. The GST Act is an indirect tax designed to streamline and replace various other indirect taxes in India, establishing a unified taxation system to simplify collection and enhance operational efficiency. Today, obtaining a new GST registration is obligatory for businesses with an annual turnover of Rs. 40 lakh and above. In the Northeast and Hill states, registration is mandated for companies with annual revenue exceeding Rs. 10 lakh. The process of GSTIN registration is relatively straightforward and typically takes 2 to 6 working days to complete.

Who Needs to Register for GST?

Businesses interested in the supply of goods with an annual turnover exceeding INR 40 lakh must register as regular taxable entities. However, if your business operates in the northeastern states, J&K, Himachal Pradesh, or Uttarakhand, the threshold limit is INR 10 lakh. For service providers, the turnover limit is INR 20 lakh, except for particular category states, where it’s INR 10 lakh. In addition, the following businesses are obligated to register for GST, regardless of their turnover:

- Casual taxable persons or Input Service Distributors (ISD)

- Non-resident taxable persons

- Inter-state suppliers of goods and services

- Suppliers of goods through an e-commerce platform

- All service providers

- Those liable to pay tax under the reverse charge mechanism

- TDS/TCS deductors

- Online data access or retrieval service providers

What Documents Are Necessary for GST Registration?

You must furnish essential documents to ensure a smooth and efficient GST registration. These documents include your Permanent Account Number (PAN), a duplicate of your Aadhaar card, proof of business registration or incorporation certificate, identity and address proof of the promoters or directors with a photograph, a bank account statement or a cancelled cheque, an authorisation letter or board resolution designating an authorised signatory, and a digital signature. These documents are vital for completing your GST registration and complying with the requirements set forth by the Goods and Services Tax authorities.

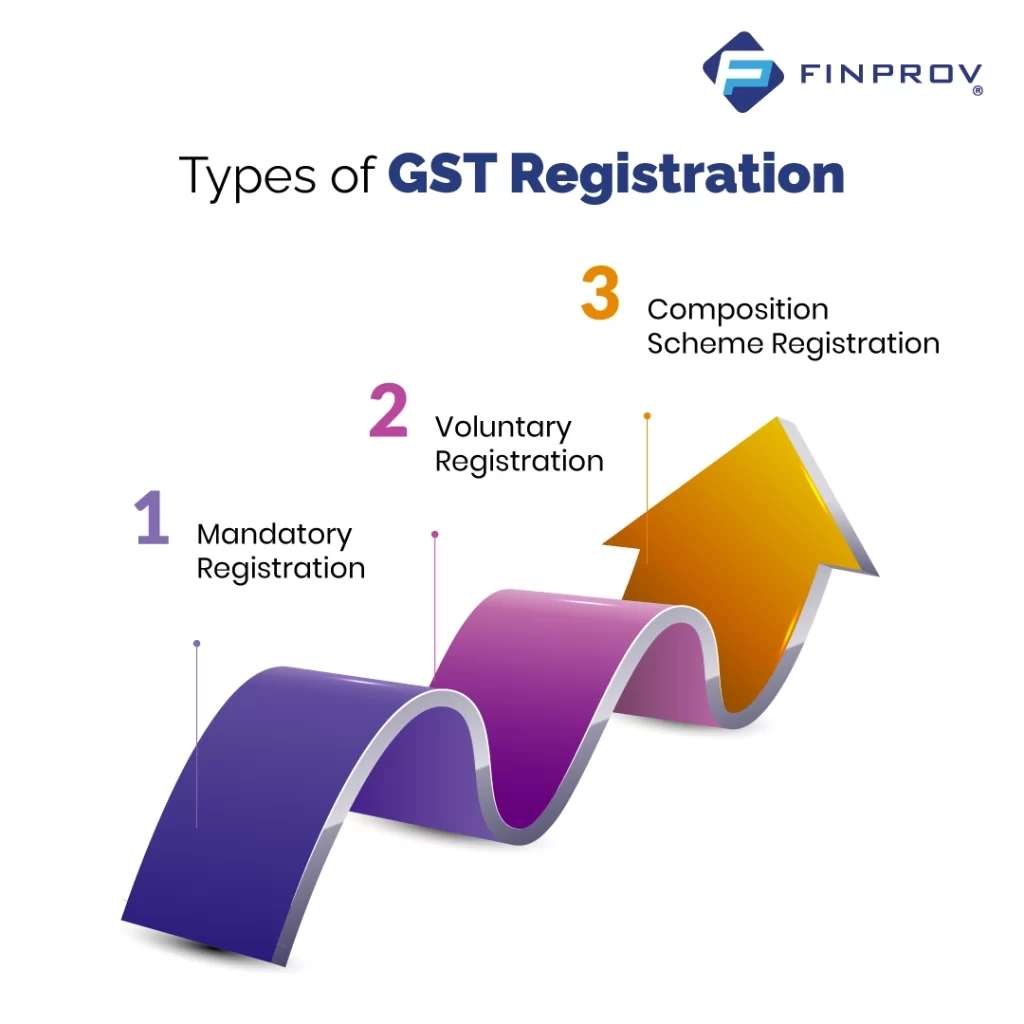

Types of GST Registration

Mandatory Registration

Under certain circumstances, businesses must obtain Mandatory Registration under GST, irrespective of their turnover. For example, inter-state sales of taxable goods, e-commerce operators, and e-commerce sellers fall into this category.

Voluntary Registration

Businesses not compelled to apply for mandatory registration can apply voluntarily, known as Voluntary Registration under GST.

Composition Scheme Registration

When the aggregate turnover exceeds the specified threshold limit of Rs.40 lakhs (Rs.20 lakhs for particular category states) for goods, or Rs.20 lakhs (Rs.10 lakhs for separate category states) but remains below Rs.1.5 crore (Rs.75 lakhs for unique category states), dealers can choose to register under the Composition Scheme. In the case of services, if the aggregate turnover exceeds Rs.20 lakhs (Rs.10 lakhs for particular category states) but is less than Rs.50 lakhs, dealers can opt for registration under the Composition Scheme. This scheme entails taxpayers paying GST at a fixed rate based on turnover, with reduced compliance requirements compared to regular registration.

Exemption from GST Registration

Specific categories of individuals or businesses are exempt from GST Registration:

- Businesses with an aggregate turnover during the financial year not exceeding Rs. 40 lakhs for goods (Rs. 20 lakhs for particular category states) or Rs. 20 lakhs for services (Rs. 10 lakhs for certain category states).

- Businesses that are not mandated to register compulsorily under GST.

- Individuals or entities selling goods or services are either exempt from GST or not covered by GST.

- Agriculturists engaged in the supply of crops produced from land cultivation.

Key Points to Note About GST Registration

- GST Registration Threshold: Any business with a turnover exceeding 20 lakh INR must register for GST. However, if your business operates in the northeastern states, J&K, Himachal Pradesh, or Uttarakhand, the threshold limit is 10 lakh INR.

- Inter-State Suppliers: If your business supplies goods to multiple states, you must register for GST in all the states where you deliver goods.

- No Registration Fee: Registering for GST is free, and there is no registration fee.

- Consequences of Non-Registration: Failing to register for GST can result in a penalty of 10,000 INR or 10% of the due amount, whichever is higher. Ensuring timely registration is crucial to avoid penalties, and compliance with tax regulations is vital.

Penalty for Non-Registration under GST

Businesses that are obligated to register under GST but fail to do so will incur a penalty. The penalty amounts to 10% of the tax amount payable, with a maximum limit of INR 10,000. This penalty incentivizes timely and proper registration, emphasising the importance of compliance with GST regulations.

Enrolling in a GST certification course can significantly enhance one’s proficiency in effectively managing GST accounting software for businesses. Finprov, a reputable institute, offers a comprehensive GST certification course to equip learners with in-depth knowledge of GST principles and practices supported by real-world examples. This course is ideal for graduates, Chartered Accountants, company secretaries, finance and tax professionals, and individuals seeking career opportunities.

The GST certification course provided by Finprov covers various essential topics, including the fundamentals of GST, Input Tax Credit, Composition Scheme, GST return filing, E-way bill, Time of Supply, Place of Supply, Reverse Charge Mechanism, and more. It caters to the learning needs of graduates and professionals aiming to expand their expertise in accounting and finance. By choosing Finprov for your GST certification course, you gain access to quality education and valuable insights that hold high relevance in these domains.