Do you know that Accounting is essential for recording, classifying, and summarising financial transactions to provide information that leads to making business decisions? It manages the use of financial statements, such as the balance sheet, income statement, and cash flow statement, to track and report on a company’s financial performance. The double-entry accounting system is a fundamental principle of accounting and is used to ensure the accuracy and completeness of financial records. It requires that every financial transaction be recorded in at least two accounts, with a debit entry in one account and a corresponding credit entry in another account.

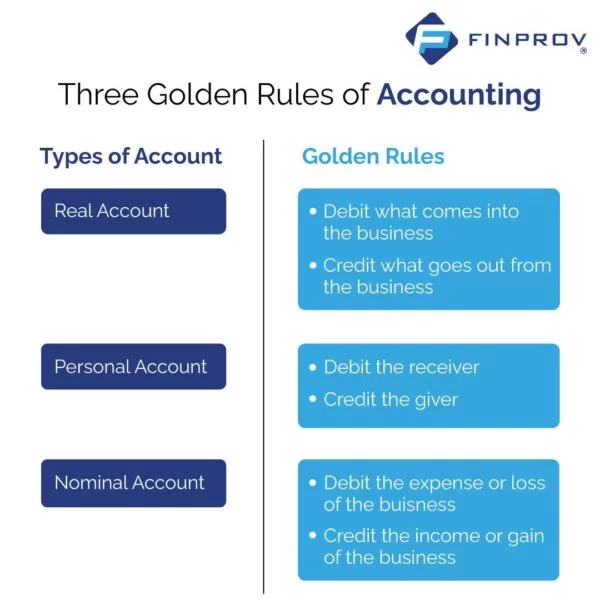

The three golden rules of accounting provide a framework for recording financial transactions consistently and accurately. They ensure that the accounting records are complete and accurate and that the financial statements accurately reflect the financial position and performance of the business. These rules are the foundation of accounting and bookkeeping and are used by accountants to maintain accurate financial records and to generate financial statements that provide useful information for decision-making.

Types of Accounts

Nominal Accounts

Nominal accounts are used to record transactions that relate to a specific fiscal year. These accounts are also referred to as temporary or income statement accounts because they are used to record transactions that are related to revenue, expenses, gains, and losses for the period.

Examples of nominal accounts include accounts for salary, rent, interest, cost of goods sold, loss on asset sale, and sale of services. These accounts are closed at the end of the fiscal year by transferring the balance to a permanent account, such as the income summary or retained earnings account, so that they can accept new transactions for the new fiscal year. The outcome of a nominal account is profit or loss, which gets transferred to the capital account or retained earnings account.

Real Accounts

A real account, also known as a permanent account, is a type of account that appears on the balance sheet of a company and contains transactions associated with the assets and liabilities of the company. These accounts do not close on the completion of a financial year and are carried forward to the next fiscal year. The balance in the real accounts is rolled over to the next period as the opening balance.

Examples of real accounts include cash, fixed assets, accounts payable and receivable, and retained earnings. Real accounts can be further classified into tangible and intangible real accounts. Tangible real accounts record assets that have a physical presence, such as cash, inventory, and stationery. Intangible real accounts record assets that do not have any physical existence but can be measured monetarily, such as trademarks, copyrights, goodwill, and patents.

It’s also worth noting that while retained earnings is a real account, it is also considered a stockholders’ equity account, which summarises the company’s net profit or loss over time and the total equity at a given point in time.

Personal accounts

Personal accounts are a subcategory of the general ledger that is used by individuals, associations, firms, and companies. They are further divided into three subcategories: natural personal accounts, artificial personal accounts, and representative personal accounts.

Natural personal accounts refer to human beings, and any account belonging to them falls under this category. These accounts can include creditor, debtor, capital, or drawings accounts. Artificial personal accounts refer to entities that act as separate legal bodies as per the law, such as government bodies, cooperatives, partnerships, and companies. These accounts can enter into legal agreements.

Representative personal accounts represent both actual and artificial persons. These accounts are used to record expenses that are pre-paid or outstanding or when income becomes accrued. Examples of representative personal accounts include prepaid rent accounts or unearned brokerage accounts.

It’s worth noting that these three types of personal accounts are used to record transactions that are related to the people or entities with whom the business has financial transactions.

Three Golden Rules of Accounting

Rule 1- Debit what comes in, Credit what goes out

The phrase “debit what comes in – credit what goes out” is a basic principle in bookkeeping and accounting. It means that when money or assets come into a business, they are recorded as a debit on the balance sheet, and when money or assets go out of a business, they are recorded as a credit. The goal is to maintain a balance between the debits and credits in each account and to have the balance sheet show a positive overall balance. This is important for tracking the financial health of a business and for preparing financial statements. This rule applies to existing accounts such as furniture, land, buildings, etc.

Rule 2- Credit the giver and Debit the Receiver

This statement is not entirely accurate for all accounting transactions. It applies to personal accounting. In accounting, “credit the giver and debit the receiver” is a common expression to describe the double-entry accounting system, where every transaction affects at least two accounts, and the sum of debit entries must equal the sum of credit entries. However, whether a specific account is credited or debited depends on the type of account and the nature of the transaction. For example, in a gift shop transaction, the account for cash would be debited, and the account for sales would be credited.

Rule 3- Credit all income and debit all expenses

This rule applies to nominal accounts. Income and expenses are temporary accounts used to measure a company’s financial performance over a specific period, such as a month or a year. When a company earns income, it increases its assets, so the income is recorded as a credit. When a company incurs an expense, it decreases its assets, so the expense is recorded as a debit. However, it’s important to note that this rule does not apply to all accounts, only to temporary accounts like income and expense accounts. For example, some accounts, like asset and liability accounts, may have a normal debit balance, while others, like owner’s equity accounts, may have a normal credit balance.

Finprov is an accounting course institute that offers a variety of accounting courses, including CBAT, PGBAT, Income tax, Practical accounting, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel. The courses are designed for both graduates and professionals and offer both theoretical and practical training. We also provide placement assistance to all the learners that can be utilized for several job opportunities in the accounting and finance sector.