Organisations nowadays seek professionals who can bring value to their organisation and possess a dynamic approach and specialised skill set. Having just a B.Com degree may not set you apart from the competition. However, by enrolling in supplementary short-term courses, you can impress potential employers and demonstrate your willingness to learn and develop your skill set. To assist you in making an informed decision, here is comprehensive information on various short-term courses you can consider after completing your B.Com degree.

By enrolling in a supplementary course, you can gain comprehensive knowledge and practical training in various professional skills. If you are pursuing a short-term certification course in accounting, you can learn about crucial topics like TDS, GST, Advanced Accounts, Additional Accounts, SAP, Banking, Auditing, and more. With this diverse skill set, you can strengthen your expertise and boost your chances of securing a promising career in accounting.

Why Select Supplementary Courses?

Supplementary courses in accounting can be a game-changer for individuals seeking employment opportunities in the finance and banking industry. These courses can open up many possibilities, including salary increments, promotions, and new job roles. Furthermore, completing short-term accounting courses can equip you with the skills to handle financial statements, banking processes, and other important tasks.

These courses can help you secure roles such as invoicing specialist, ledger manager, or even general ledger creation. You can also better understand business operations and decision-making processes by obtaining certification.

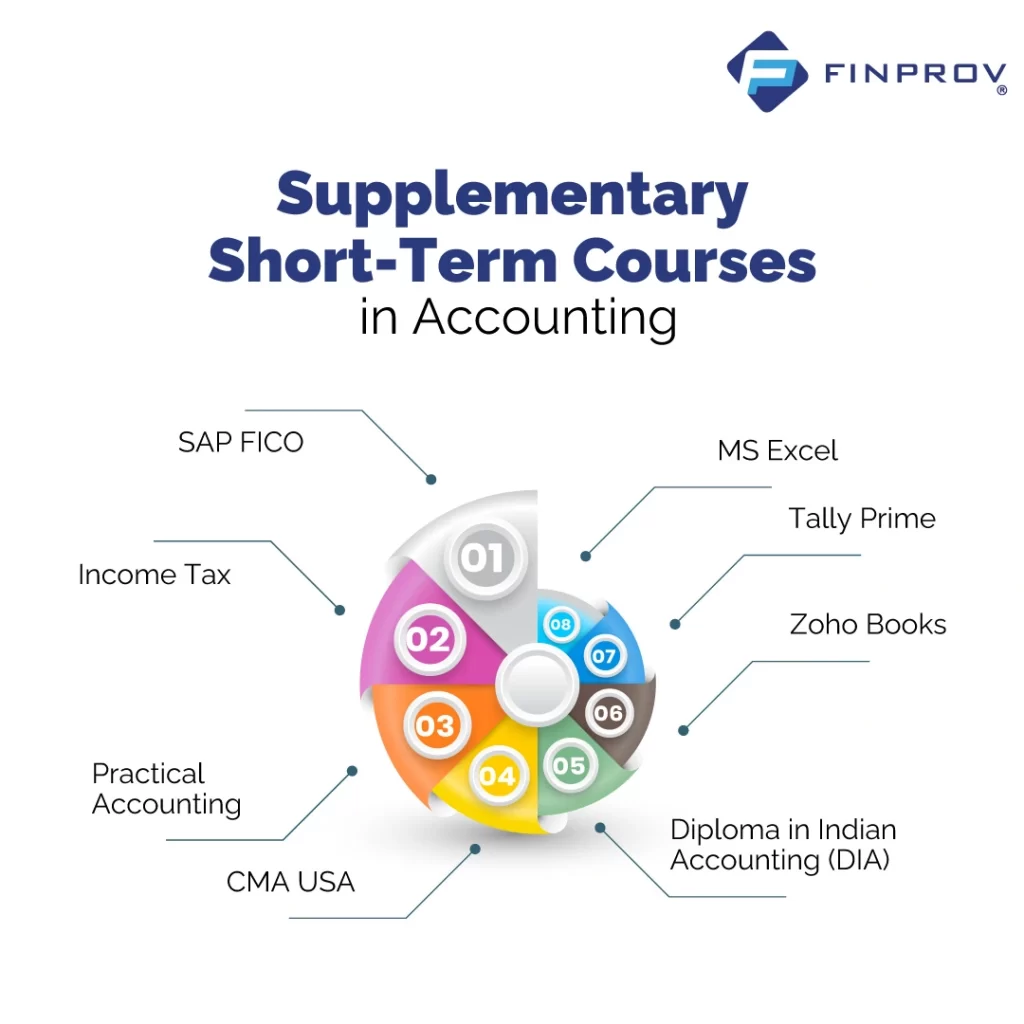

Supplementary Short-Term Courses in Accounting

SAP FICO

The SAP FICO course is a comprehensive short-term certification course in accounting that spans three months, providing theoretical and practical training on software concepts. The course covers many important topics, including the basics of SAP FICO, enterprise structure, general ledger accounting, reference documents, bank accounting, and asset accounting. In addition to these core topics, the course also covers other important areas such as transactional activities, financial status analysis of an organisation, managing multiple SAP sessions, and handling large amounts of data for multiple companies.

Income Tax

The Income Tax course covers a range of important concepts, including the basics and major heads of income, tax frameworks, old and new tax schemes, TDS and TCS basics, due dates, penalties, accounting books, and accounting maintenance. The course also includes hands-on training at the end of each topic, which helps solidify understanding and ensure concepts are clear.

Practical Accounting

Practical Accounting course offers comprehensive coverage of vital accounting concepts such as Accounting, Profit and Loss, Debit and Credit, Income Tax, GST, Bank Reconciliation, Business Processes, Balance sheets, Ledger, and Journal Entries. This course is perfect for candidates looking for a career in the accounting sector, as it offers practical knowledge that can be immediately applied professionally.

Diploma in Indian Accounting(DIA)

The Diploma in Indian Accounting (DIA) course is a highly beneficial program for individuals seeking employment in the accounting sector. Experienced professionals and chartered accountants specifically designed the DIA course to comprehensively cover all relevant topics. The course covers crucial topics, including GST filing, accounting, MS Excel, income tax, Tally Prime, practical accounting, cash budgeting, ESI, and PF. By completing this course, learners will have a solid understanding of the key concepts and skills required for a successful career in accounting.

CMA USA

The CMA USA course provided is designed to equip individuals with the knowledge and expertise necessary to excel in their careers. The comprehensive six-month program covers a broad range of critical concepts in finance and accounting, including CMA principles, strategic financial management, cost management, financial planning, performance and analytics, management accounting, business economics, and essential concepts for business professionals.

Zoho Books

The Zoho Books course equates learners with the skills and knowledge necessary to master the Zoho accounting software. The course modules cover a broad range of concepts, including how to handle Zoho applications, the latest accounting technology, file GST returns, manage finances, Eway billing, banking modules, project tracking, and timesheet tracking to maximise the Zoho Books experience.

Tally Prime

Tally Prime is one of the most widely used software in the accounting industry, making it an essential skill set for aspiring accounting professionals. By taking the Tally Prime course, learners can acquire comprehensive knowledge of this software, providing an edge in the job market. This course equips learners with practical training on Tally Prime, enabling them to easily handle accounting processes. The Tally Prime course module cover topics, including an overview of the Tally Prime interface, inventory management, payroll and GST in Tally, TDS & TCS training, MIS Reports, features and benefits of Tally Prime, cost centre and its methods, banking utilities, vouchers, and major tools, among others.

MS Excel

Microsoft Excel is an essential tool in the accounting industry, and proficiency in this software can enhance the career prospects of accounting professionals. MS Excel online accounting course is an excellent opportunity for learners to acquire in-depth knowledge of Excel’s advanced features and functions. This course covers pivot tables, index match, depreciation, sum function, if function, presentation in Excel, and more. By learning these skills, learners can design better spreadsheets and handle accounting processes more efficiently.

Why Select Finprov?

Joining short-term accounting courses allows one to get a better job in the accounting and finance industry. Finprov Learning is a highly regarded institute offering short-term certification courses in accounting. As a leading provider of accounting courses, we provide a comprehensive range of programs such as PGDIFA, CBAT, PGBAT, Income Tax, Practical Accounting Training, DIA, GST, SAP FICO, Tally Prime, and MS Excel, among others. Our course modules are designed to cater to both graduates and professionals, ensuring that they receive practical and theoretical training to help them achieve their career goals in the accounting sector.

At Finprov, we take pride in providing our learners with theoretical and practical training, enabling them to apply their knowledge to real-world scenarios. Moreover, we offer placement assistance to our learners, helping graduates secure their dream jobs and professionals enhance their knowledge and skills. Our tech-enabled learning methodology makes accounting concepts easily understandable, making Finprov an excellent choice for those looking to improve their accounting skills.