Financial statement analysis is crucial for knowing it in detail. Statements, including balance sheets, income statements, cash flow statements, and trading accounts, reveal the ins and outs of the company’s earnings and spending. These statements also assist in assessing losses and expenses and predicting the organization’s future performance. Stakeholders, including investors, seek a thorough company review, and financial statements provide a clear understanding. Yearly reports simplify complex statements, making them more accessible and understandable.

Knowing where a company stands financially at a given time is essential. The position of financial statement analysis provides a snapshot of the company’s status, while the income statement sheds light on its day-to-day operations. This information is invaluable for managers making financial and other critical organizational decisions. A comparison between the statements from the current and previous years provides a clearer picture of the company’s position. Consequently, it also aids in assessing the financial stability of the business.

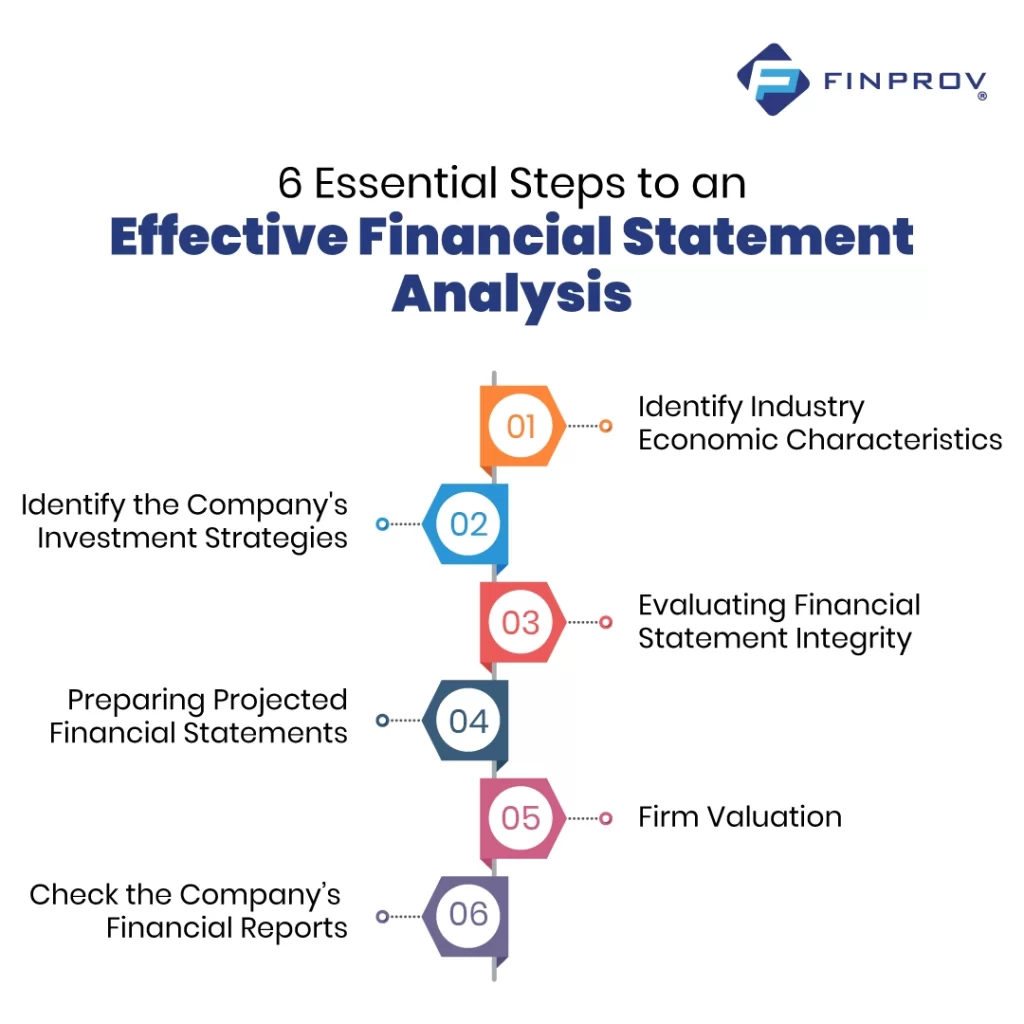

Steps for an Effective Financial Statement Analysis

1.Identify Industry Economic Characteristics

Financial statements analysis serve as a cornerstone for the efficient functioning of any company. By delving into these statements, management gains crucial insights into the company’s performance, encompassing details on profits, losses, solvency, and financial strength.

2.Identify the Company’s Investment Strategies

Understanding a company’s investment strategies is paramount for both management and investors. Investors naturally tend to put their money into profitable organizations, and financial statement analysis is pivotal in providing detailed information. As highlighted in yearly statements, a company’s profitability ratio and earnings per share become vital considerations for equity investors and stakeholders, making a comprehensive understanding of investment strategies essential for all parties involved.

3. Evaluating Financial Statement Integrity

Ensuring that a company’s financial statements adhere to the relevant accounting standards is crucial. This assessment holds significance for internal management and is equally vital for creditors who, as investors, calculate the firm’s solvency ratio through these financial records. Relying on financial statements and yearly reports is essential for everyone seeking to ascertain the company’s ability to repay loans.

4. Preparing Projected Financial Statements

Understanding a company’s financial position involves overcoming challenges, making assumed financial statement analysis necessary. These statements, influencing cash flow and funding, provide insights into the company’s anticipated financial scenario. Professionals utilize the percent of sales approach to craft these statements, contributing valuable perspectives into the company’s future economic landscape.

5. Firm Valuation

Determining the value of a firm involves considering various approaches. The discounted cash flow methodology is widely regarded as the most ideal. The economic value-added approach is the second most favorable method for evaluating a firm’s overall value.

6. Check the Company’s Financial Reports

It’s essential to look closely at the leading financial reports, using the proper rules for money and accounts. When looking at the balance sheet, which lists what the company owns and owes, ensure everything is listed correctly, valued correctly, and put in the correct category. Ask if the balance sheet shows how the company is doing financially. For the income statement, which tells you how much money the company made or lost, the key is to see if the earnings truly show how the business is doing.

Looking at the cash flow statement is also a must. This report shows how the company’s cash changed because of business activities, investments, and financing. It helps you understand where the money came from, where it went, and how the company’s cash situation looks.

Once you’ve finished studying the company and its money reports, some big questions come up. The most important one is: “Can we believe that the numbers they gave us are true?” There are many cases where companies play around with their accounting – they might be too optimistic, manage their earnings, or even report fake numbers. For financial experts, it’s crucial to understand how these tricks work and, more importantly, know how to catch them.

Begin your transformative journey of accounting mastery with Finprov’s accounting courses online. Immerse yourself in a comprehensive selection of purpose-built, job-centric, short-term courses to boost your career progress. Our job-oriented short-term courses, including but not limited to CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, and MS Excel, are meticulously crafted to address the dynamic requirements of learners at different points in their career paths.

The significance of accounting in business cannot be overstated; it is the foundational element of financial management and a critical source of insights into an organization’s economic well-being and strategic choices. Our specialized 6-month online accounting courses emphasize hands-on training, aiming to arm you with skills that you can apply directly in practical scenarios which helps to acquire more career opportunities in the accounting sector.