Starting a career as a bank officer in India offers excellent prospects for individuals looking to work in the banking sector. Bank officers are crucial in managing various banking operations, ensuring compliance, and providing quality customer service. Let’s go through the process of starting a career as a bank officer in India, with a specific focus on the various bank exams conducted in the country.

Understanding the Role of a Bank Officer

Bank officers hold important positions in Indian banks and manage day-to-day operations, supervise staff, address customer inquiries, and ensure adherence to banking regulations. They also analyse financial data, evaluate loan applications, manage risks, and contribute to the Bank’s overall growth.

Educational Requirements for Becoming a Bank Officer

To become a bank officer in India, you must meet certain educational requirements. Most banks require a minimum of a bachelor’s degree from a recognised university. Some banks may also specify a minimum percentage or CGPA requirement. It is very important to check the eligibility criteria specified by the Bank you wish to apply to.

Key Indian Bank Exams for Starting a Career as an Officer

Several bank exams in India serve as gateways to starting a career as a bank officer. Here are some prominent ones:

Common Recruitment Process for Probationary Officers (PO/CWE)

The Common Recruitment Process (CRP) for Probationary Officers (PO) is a widely conducted exam by the Institute of Banking Personnel Selection (IBPS). It is a common exam for multiple participating banks, including public sector banks (PSBs). The exam assesses candidates on subjects such as English language, quantitative aptitude, reasoning ability, general awareness, and computer knowledge.

State Bank of India (SBI) Probationary Officer Exam

The State Bank of India (SBI) organizes its recruitment exam for Probationary Officers (PO). It consists of preliminary and main exams, a group exercise, and an interview. The exam evaluates candidates on subjects such as English language, reasoning ability, quantitative aptitude, general awareness, and computer knowledge.

Institute of Banking Personnel Selection (IBPS) Exams

Apart from the CRP for PO, the IBPS conducts various other exams for different positions such as Specialist Officers (SO), Clerk, and Regional Rural Banks (RRB) Officer Scale exams. These exams assess candidates on specific skills and knowledge required for the respective positions. Each exam’s syllabus and pattern may vary, so it’s necessary to understand the specific requirements and prepare accordingly.

Regional Rural Banks (RRB) Officer Scale Exams

The IBPS conducts the RRB Officer Scale exams for recruitment in regional rural banks across India. The exams are held for different scales, including Officer Scale-I, Officer Scale-II, and Officer Scale-III. The selection process involves a preliminary exam, a main exam, and an interview.

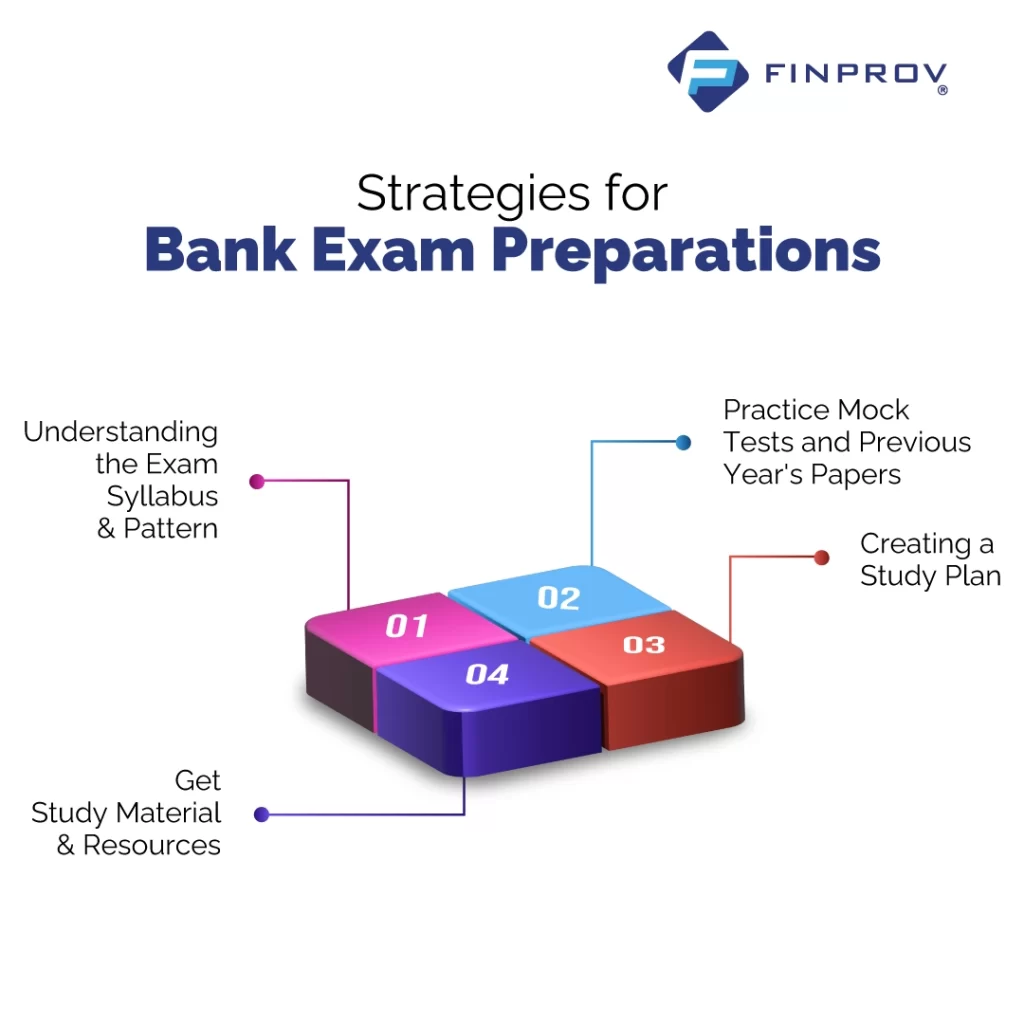

Preparing for Bank Exams

Preparing for bank exams requires a systematic approach and dedicated effort. Here are certain strategies to help you in your preparation:

Understanding the Exam Syllabus and Pattern

Begin by thoroughly understanding the exam syllabus and pattern. Analyse the different sections, topics, and weightage assigned to each subject. This will help you create a focused study plan.

Study Material and Resources

Gather relevant study material and resources for each subject. This may include textbooks, reference books, online study materials, and video tutorials. Make sure to choose reliable and updated resources that cover the exam syllabus comprehensively.

Creating a Study Plan

Design a study plan that suits your schedule and allows sufficient time for each subject. Allocate time for regular study, revision, and practice. Break down the syllabus into manageable sections and set specific goals for each study session.

Practice Mock Tests and Previous Year’s Papers

Attending mock tests and solving previous year’s question papers helps to familiarise yourself with the exam pattern, time management, and question types. This will aid you in gauging your preparation level and identifying areas that require more focus.

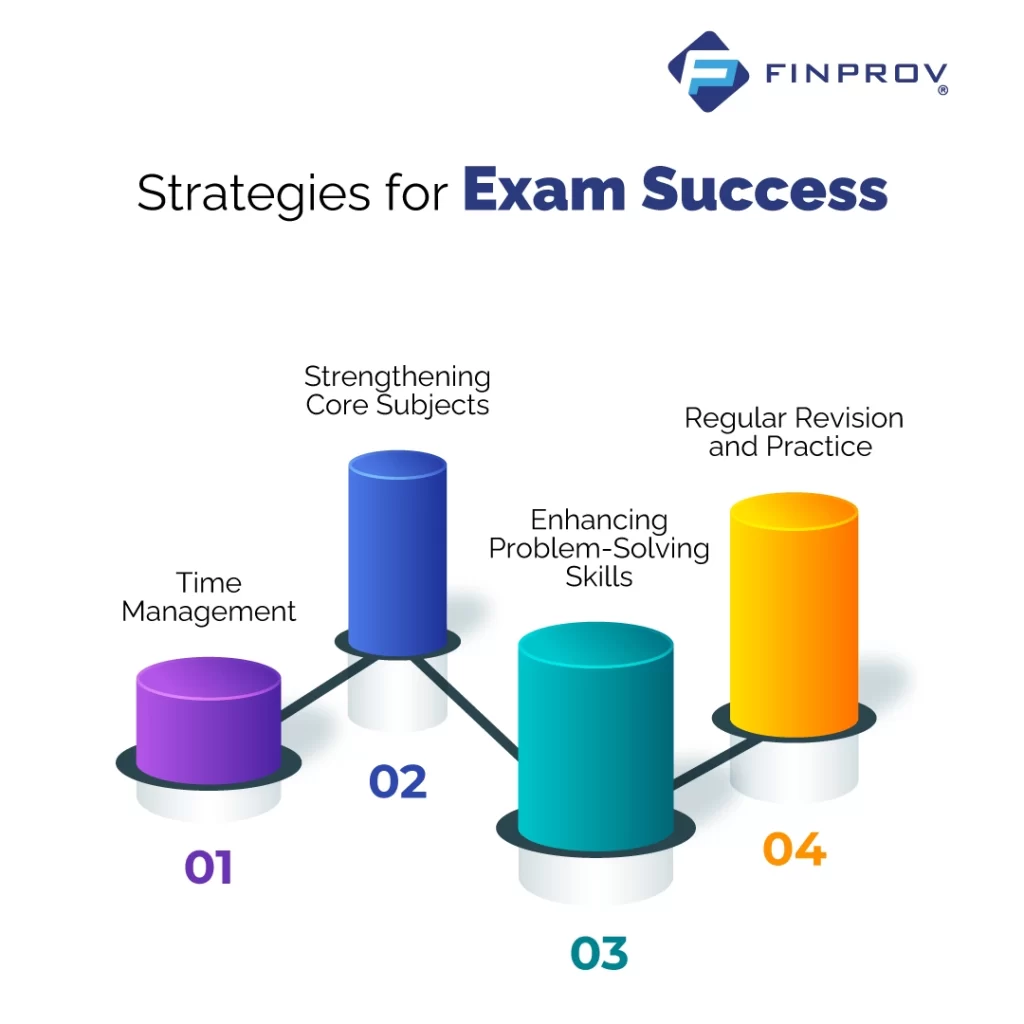

Strategies for Exam Success

To increase your chances of success in bank exams, consider the following strategies:

Time Management

Effective time management is crucial during the exam. Practice solving questions within the given time frame. Divide your time wisely among different sections, ensuring that you allocate more time to areas where you feel less confident.

Strengthening Core Subjects

Identify your strengths and also weaknesses in each subject. Devote more time to strengthening your weak areas while maintaining a solid foundation in subjects you are already proficient in. Regular practice and revision are key to mastering core subjects.

Enhancing Problem-Solving Skills

Develop problem-solving techniques and shortcuts for solving mathematical and logical reasoning questions. Practice solving a variety of problems to improve your speed and accuracy.

Regular Revision and Practice

Consistent revision and practice are essential for retaining concepts and improving performance. Set aside dedicated time for revising important topics and solving practice questions. This will aid you to reinforce your understanding and identify gaps in your knowledge.

Applying for Bank Officer Positions

Once you feel confident in your preparation, you can apply for bank officer positions. Follow these steps:

Online Application Process

Visit the official websites of the respective banks or exam-conducting bodies to find information about ongoing recruitments. Fill out the online application form accurately or precisely and provide the required documents and details as per the instructions.

Document Preparation and Verification

As specified in the application form, keep all your documents ready, including educational certificates, identity proof, and photographs. Ensure that you have both the original and photocopies of the required documents. If shortlisted, you may be called for document verification during selection.

Interview and Selection Process

The interview and selection process may vary depending on the Bank and exam.

Here are certain general tips to aid you in preparing for the interview and selection process:

Interview Preparation

Research the Bank and gather information about its history, services, and recent developments. Stay updated with current affairs related to the banking sector and important economic news. Prepare answers to common interview questions, focusing on your knowledge of banking operations, customer service, and your ability to handle challenging situations. Practise mock interviews with friends or family to improve your confidence and communication skills.

Group Discussion (GD) and Personal Interview (PI)

Some bank officer selection processes include group discussions and personal interviews. In a group discussion, listen actively to others, express your thoughts clearly, and maintain a balanced approach. Practice articulating your ideas effectively and respectfully.

During the personal interview, be professional, maintain good body language, and answer questions confidently. Showcase your knowledge, skills, and enthusiasm for the banking sector. Highlight your relevant educational background, experience, and problem-solving abilities. Be prepared to discuss your strengths, weaknesses, and career goals.

Career Growth and Development as a Bank Officer

Once you successfully begin your career as a bank officer, there are various opportunities for growth and development. Banks often provide training programs and workshops to enhance your skills and knowledge in specific areas such as risk management, financial analysis, or leadership. You can also pursue further education or certifications related to banking or finance, which can boost your career prospects and open doors to higher positions within the Bank.

It’s important to continuously update your knowledge of industry trends, banking regulations, and technological advancements in the field. Networking with professionals in the banking sector, participating in industry conferences, and staying active in professional associations can also contribute to your career growth.

Starting a career as a bank officer in India requires a combination of education, preparation, and determination. By understanding the role of a bank officer, meeting the educational requirements, and preparing for the relevant bank exams, you can set yourself on the path to success. Remember to develop essential skills, stay updated with industry trends, and seize opportunities for career growth.

With dedication and perseverance, you can embark on a fulfilling and rewarding career in the banking sector as a bank officer. Through the best preparation, you can grab your career in a prestigious banking sector. Finprov provides you with the best training with advanced learning facilities. The daily and consolidated test series, under the guidance of expert faculties, helps the aspirants to crack the exam very easily.

FAQs

How long does it take to become a bank officer?

The timeline to become a bank officer can vary. It typically involves completing the required education, preparing for bank exams, and going through the selection process. This process can take certain months or more, depending on individual circumstances.

Are bank exams difficult?

Bank exams can be challenging due to their competitive nature and the range of subjects they cover. However, with proper preparation, dedication, and practice, you can improve your chances of success.

What are the career prospects for bank officers?

Bank officers have promising career prospects. With experience and demonstrated competence, you can progress to higher positions such as branch manager, regional manager, or even executive-level roles within the Bank.

Can I switch banks as a bank officer?

Yes, bank officers can switch banks during their careers. However, you must consider factors such as career growth opportunities, work culture, and benefits before making a decision.