The financial industry offers many career opportunities based on your education, experience, skills, and interests. Even though it can be competitive, you can take steps to attract hiring managers and get a job. Once you know which finance roles are right for you, you can start looking and applying for these positions. Still, specific finance career tips need to be known before starting a career in finance.

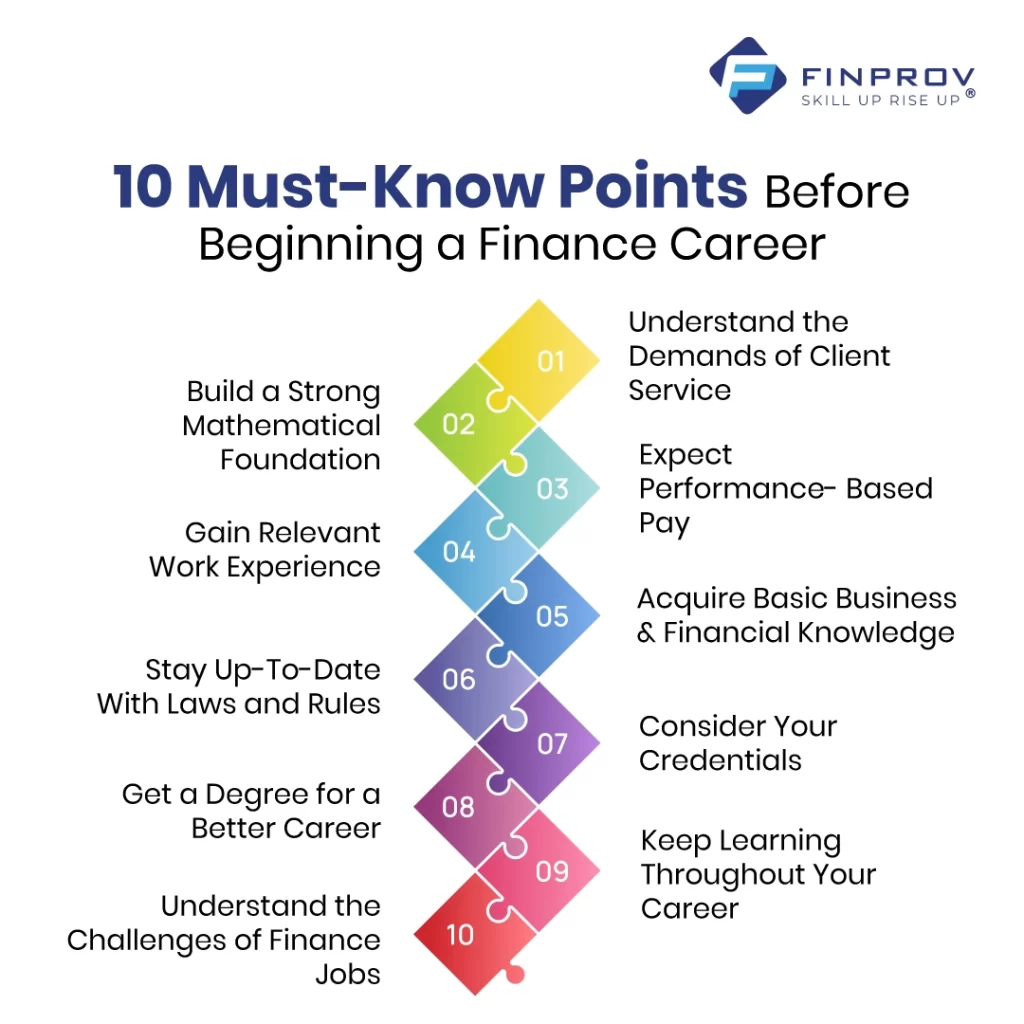

10 Must-Know Points Before Beginning a Finance Career

Let’s read about the top 10 things to know before starting a career in finance;

1. Understand the Demands of Client Service

Working in finance might sound exciting, but most finance jobs involve helping clients. Whether you’re investment banking, wealth management, or consulting, you serve clients. The following directions are essential. Some clients are hard to manage. However, having patience with them makes handling all the clients smooth. Don’t hesitate to work overtime. Clients need numbers at some point.

2. Build a Strong Mathematical Foundation

Some people may be talented at maths, and some don’t have that much talent. But knowing the basics is essential. Basic calculations like addition, subtraction, multiplication, and division are crucial.

You also need to understand basic concepts like compound interest and rates of return. These skills make working with numbers more accessible, and managing financial investments becomes second nature.

3. Expect Performance-Based Pay

Some finance jobs pay you based on your performance rather than a salary. If you work well, you could earn a lot. Many commission-based jobs in this field have no limit on how much you can make. However, your income could decrease if your efforts don’t pay off or the economy or industry suffers.

4. Gain Relevant Work Experience

Before starting a career in finance, you need a solid knowledge base and practical work experience and need to follow finance career tips. Look for internships to gain hands-on experience in finance roles.

You can also work with a financial coach to learn about essential aspects of the job. Remember, work experience will give you an advantage when applying for jobs.

Make sure your resume shows your education and skills in the field.

5. Acquire Basic Business and Financial Knowledge

Basic finance knowledge is essential. Many people understand how the company works, and implementing that knowledge is necessary to improve the company process. Business knowledge is important for improving business performance. The financial industry can be very rewarding, but you need to know how the market works.

To stay competitive, you also need to keep up with current events and trends in the financial industry. There’s a lot at risk in finance. Without understanding the basics, it’s easy to make costly mistakes that can hurt your career.

6. Stay Up-To-Date With Laws and Rules

A career in finance requires staying updated on frequently changing rules and regulations. Knowing and following these rules is crucial because breaking them can lead to big problems. Knowing your company’s financial rules is essential when you get a job.

Stay current with laws and regulations by regularly learning about new ones and using this knowledge in your work. You can stay informed by reading industry news, taking courses, or attending training programs.

7. Consider Your Credentials

Before starting a career in finance, it’s essential to consider your credentials. You’ll need specific certifications, licenses, and degrees to work in finance. With these credentials, you can’t start a career in finance. They vary for each role. For example, you must know tax and corporate laws to be an accountant.

8. Get a Degree for a Better Career

A degree is important to get a perfect job in any stream. At least, having a degree in any stream is important to get finance jobs. Many entry-level finance jobs offer good salaries.

9. Keep Learning Throughout Your Career

The finance world is constantly changing. New stuff like products, rules, and technology keep coming up. So, it’s super important to keep learning. That way, you stay up-to-date and keep your skills functional.

You can learn in school, take classes, or teach yourself. Learning constantly is like investing in your finance career. It’s a challenging field, and getting better constantly is how you succeed.

10. Understand the Challenges of Finance Jobs

Every job has its difficulties. Before deciding to start a career in finance, analyze the particular job. Finance jobs are sometimes stressful, but knowing the basics makes one handle them freely.

To learn more about getting a job in finance, check out Finprov Learning. Finprov offers online finance & Accounting courses with a wide range of programs. Our best online accounting courses cover CBAT, PGBAT, Income Tax, Practical Accounting Training, PGDIFA, DIA, GST, SAP FICO, Tally Prime, MS Excel, and more. Whether you’re a graduate or a professional, our carefully designed courses ensure a thorough learning experience.

At Finprov, we don’t just focus on theory; we provide hands-on practical training to give you real-world skills. Plus, we offer accounting courses in kochi with placement assistance to help you start your career after completing the courses. Contact Finprov today to explore career opportunities in accounting and enhance your knowledge for a brighter future.