Suppose you have the deep intention to develop a career in the banking sector, particularly with the State Bank of India (SBI). In that case, it’s crucial to understand the eligibility criteria for SBI exams. The SBI conducts various exams to recruit eligible candidates for different positions within the bank. Let’s look forward to the requirements, qualifications, and eligibility criteria for SBI exams, providing you with a clear understanding of who can apply and how to prepare for these highly competitive examinations.

SBI Clerk Exam Eligibility

To be suitable for the SBI Clerk exam, candidates must meet the following criteria:

– Nationality: To participate in the exam, you must be an Indian citizen.

– Age Limit: The minimum and maximum age requirement is 20 and 28 years, respectively, although age relaxations may be applicable for specific categories.

– Educational Qualifications: Candidates should have completed their graduation in any subject from an accredited university or possess an equivalent qualification.

SBI PO Exam Eligibility

The SBI PO exam, also known as the Probationary Officer exam, has its own set of eligibility criteria:

– Nationality: Candidates must be Indian citizens.

– Age Limit: The minimum and maximum age requirement is 21 years and 30 years, respectively. Age relaxations are provided for reserved categories.

– Educational Qualifications: The necessary qualification entails obtaining a graduation degree in any field from an acknowledged university.

SBI Specialist Officer (SO) Exam Eligibility

The SBI Specialist Officer exam is conducted to recruit candidates for various specialized roles within the bank. The eligibility criteria for attending the exam are as follows:

– Nationality: Candidates must be Indian citizens.

– Age Limit: The age criteria may vary depending on the specific role and post applied for.

– Educational Qualifications: The educational requirements differ for different specialist officer positions. Generally, candidates must have a graduation or post-graduation degree in a relevant field from an acknowledged university.

SBI Junior Associate (Clerical Cadre) Eligibility

For the position of Junior Associate (Clerical Cadre) in SBI, the eligibility criteria are as follows:

– Nationality: Candidates should be Indian citizens.

– Age Limit: If you want to attend the bank exam, you must be between a particular age limit; the minimum and maximum requirements are 20 years and 28 years, respectively, with age relaxations for reserved categories.

– Educational Qualifications: To meet the requirement, one must possess a graduation degree from an acknowledged university or its equivalent obtained from an acknowledged institution.

SBI Eligibility Criteria for Other Exams

Apart from the exams mentioned above, the SBI conducts various other specialized exams. Here are the general eligibility criteria:

– Nationality: Candidates must be Indian citizens.

– Age Limit: The age criteria may vary depending on the specific exam and position.

– Educational Qualifications: The educational requirements will depend on the nature of the exam and the position applied for.

SBI Exam Pattern: A General Overview

Understanding the exam pattern is crucial for effective preparation and success in SBI exams. While the specific exam patterns may vary for different positions, here is a general overview of the SBI exam pattern:

Phase 1: Preliminary Examination

The preliminary examination is the SBI exam’s first phase. It aims to shortlist candidates for the next phase based on their performance in this stage. The key features of the preliminary examination are as follows:

– Format: The preliminary exam is conducted online (computer-based test).

– Duration: The exam duration is usually one hour.

– Sections: The exam typically consists of multiple-choice questions from three sections.

– Common Sections: English Language, Numerical Ability (Quantitative Aptitude), and Reasoning Ability are commonly included sections.

– Marking Scheme: Each section is assigned a specific number of questions and marks.

– Negative Marking: There is a negative for wrong answers, usually in the form of negative marking, where a certain portion of marks is deducted for each incorrect response.

– Cut-off: for each section, Candidates must score above the prescribed cut-off marks to qualify for the next phase.

Phase 2: Main Examination

The main examination is the second phase of the SBI exams. It evaluates candidates’ knowledge and aptitude in various subjects related to banking and finance. The key features of the main examination are as follows:

– Format: The main exam is conducted online (computer-based test).

– Duration: The duration of the exam varies but is generally longer than the preliminary exam.

– Sections: The exam consists of multiple-choice questions and sometimes descriptive questions as well.

– Common Sections: English Language, Reasoning Ability, Quantitative Aptitude, General/Economy/Banking Awareness, and Computer Aptitude are commonly included sections.

– Professional Knowledge: For specialist officer exams, an additional section related to the specific specialization is included.

– Marking Scheme: Each section has a specific number of questions and marks, and they are usually mentioned in the exam notification.

– Negative Marking: Similar to the preliminary exam, negative marking may be applicable for incorrect answers.

– Cut-off: Candidates must score above the respective cut-off marks in each exam section and the overall exam to qualify for the next phase.

Phase 3: Group Exercises/Interview

For certain positions, after clearing the main examination, candidates are further shortlisted for Group Exercises and/or Interviews. This phase aims to assess their communication skills, group dynamics, and overall personality.

– Group Exercises: Candidates are assigned group tasks or discussions where their ability to work in a team, leadership skills, and communication skills are evaluated.

– Interview: Candidates who qualify for the interview round face a panel of experts who assess their suitability for the position through questions related to banking knowledge, current affairs, and personal experiences.

Final Selection: Merit List

Based on the final selection, the candidate’s performance in the main examination and the group exercises/interview. A merit list is prepared, considering the scores obtained by candidates in different phases, and candidates are then offered job positions based on their ranking in the merit list.

It is vital to refer to the official SBI exam notifications for the accurate and updated exam pattern specific to the position you are applying for. The number of sections, marking scheme, and other details may vary for different exams conducted by SBI.

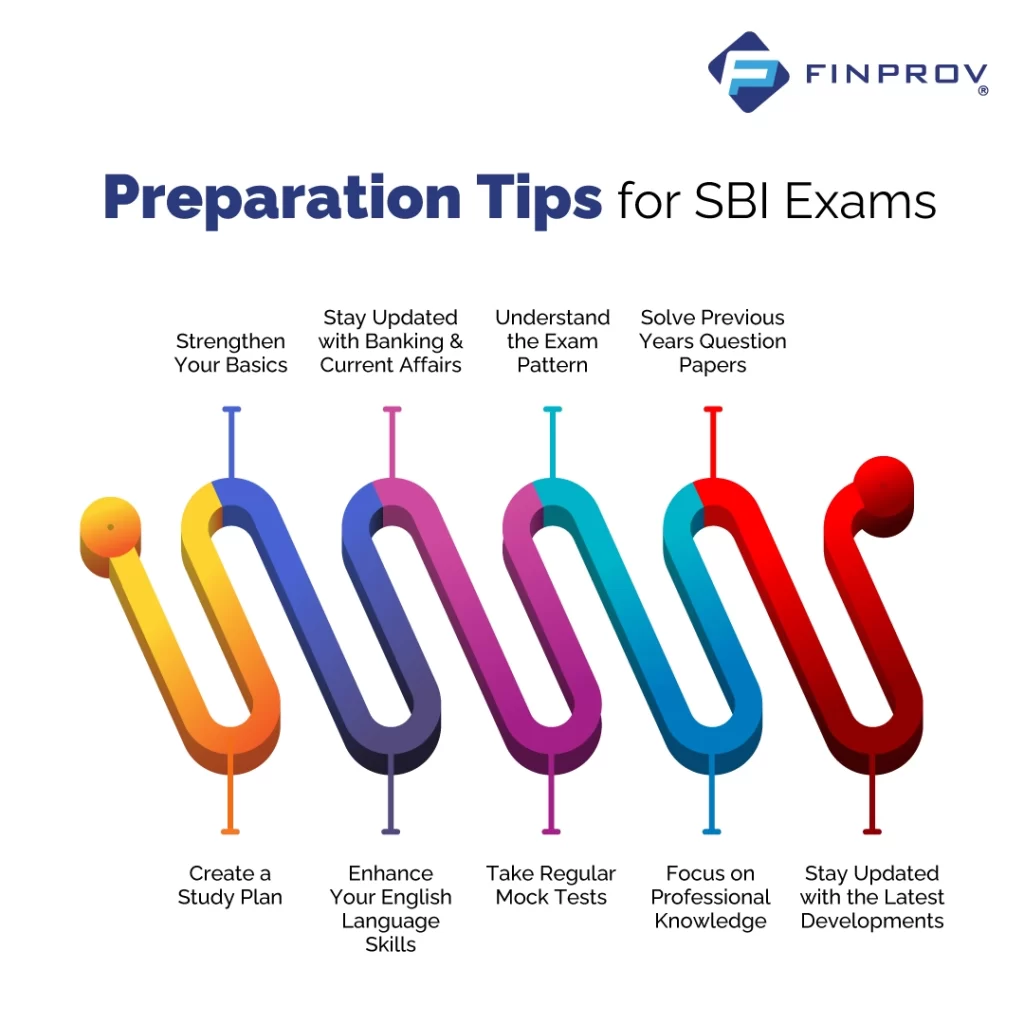

Preparation Tips for SBI Exams

– Create a Study Plan: Design a comprehensive study plan that covers all the subjects and topics included in the SBI PO exam syllabus. Break down your study plan into daily, weekly, and monthly targets to ensure systematic and consistent preparation.

– Strengthen Your Basics: Focus on building a strong foundation in subjects such as Quantitative Aptitude, Reasoning, and English Language. Understand the basic concepts, formulas, and rules associated with each topic and practice a wide range of problems to enhance your problem-solving abilities.

– Enhance Your English Language Skills: Improve your vocabulary, grammar, and reading comprehension skills by reading newspapers, magazines, and English literature. Practice writing essays and letters to enhance your writing skills. Additionally, watch English news channels or listen to English podcasts to improve your listening and comprehension abilities.

– Stay Updated with Banking and Current Affairs: Stay informed about the latest developments in the banking sector, economic news, and current affairs. Read business newspapers, financial magazines, and online portals dedicated to banking and current affairs to keep yourself updated. This knowledge will be beneficial for the General/Economy/Banking Awareness section of the SBI PO exam.

– Take Regular Mock Tests: Incorporate regular mock tests into your study routine to gauge your performance and identify areas that require improvement. Analyze your mistakes, understand the concepts behind them, and work on strengthening those weak areas. Mock tests also help you get accustomed to the time constraints of the actual exam.

– Understand the Exam Pattern: Familiarize yourself with the exam pattern specific to the chosen field of specialization. Understand the marking scheme, the number of sections, and the weightage assigned to each section. This understanding will help you strategize your preparation accordingly.

– Focus on Professional Knowledge: For the Professional Knowledge section, focus on strengthening your understanding of the core concepts, theories, and practical applications relevant to your specialization. Refer to textbooks, study materials, and online resources specific to your field to gain in-depth knowledge.

– Solve Previous Years’ Question Papers: Practice solving previous years’ question papers to get acquainted with the bank exam pattern and the types of questions asked. This practice will aid you in identifying the areas where you need more practice and familiarize you with the level of difficulty.

– Stay Updated with the Latest Developments: Keep yourself updated with the latest trends, technologies, regulations, and advancements related to your chosen field. Subscribe to industry-related magazines, websites, and newsletters to stay informed about the developments in your specialization.

The State Bank of India (SBI) conducts a range of exams to recruit eligible candidates for different positions within the bank. To be appropriate for these exams, candidates must meet certain criteria regarding nationality, age, and educational qualifications. It is essential to thoroughly understand these eligibility requirements before applying for any SBI exam. By ensuring you meet the criteria and prepare diligently, you can elevate your chances of success in these highly competitive exams. Remember, staying updated with the official notifications and guidelines from SBI will provide you with the most accurate and reliable information on eligibility criteria for SBI exams.

In accordance with this being familiar with the exam pattern and syllabus, you must have to take the best training to attain your dream career. At Finprov, the team provides the best bank coaching under inspired facilities. Both the online and offline classes are available in accordance with the convenience of the aspirants. Our team provides extended learning support with advanced practice portals and intense resources. You can grab your bank job through the IBPS, SBI, LIC, NABARD, and RBI, like many of the bank exams, if you have the training from Finprov Learning.