Imagine being familiar with the diverse laws related to taxation, efficiently handling GST-related features with updates, and constantly updating your knowledge. What if you lack the capability to handle these tasks, or what if you possess these abilities? Let’s discuss another point. Are you familiar with E-invoicing under GST? Do you know what e-invoicing is and how it is applicable under GST? Being well-versed in these concepts can bring you significant career exposure. E-invoicing under GST can be defined as electronic invoicing in accordance with GST laws.

E-Invoicing Under GST

Let’s get the idea in detail. Most clearly, it can be referred to that the e-invoice can be addressed as a system which is introduced by the Indian Government which eases the GST return filing process. It involves the generation of invoices on a central government portal called the Invoice Registration Portal (IRP), which then gets authenticated and verified. This process helps to reduce errors and mismatches, making it easier for businesses to file GST returns accurately and efficiently.

Generally, as in the case of a GST, the registered business generates e-way during the goods and service transportation from one place to another. Like the wise, certain GST-registered businesses can generate e-invoices for Business to Business (B2B) transactions. In more detail, the e-invoice system can be defined as a B2B invoice which is authenticated by GSTN (Goods and Services Tax Network) for further use on the common GST portal. The electronic invoicing system issues a unique identification number against every invoice through the Invoice Registration Portal (IRP), which is managed by GSTN. The process ensures authenticity as well as accuracy while filing GST returns and simplifies invoice processing.

The most considerable aspect of e-invoice is all the invoice information is transferred from the einvoice1.gst.gov.in portal to both in GST portal and e-way bill in real-time. Thus, E-invoicing eliminates the need for manual data entry while filing the GSTR-1 return (GSTR-1 is a type of GST return that needs to be filed by registered taxpayers in India who are all involved in the supply of goods or services) and generating part-A of the e-way bills. The IRP automatically passes the required information to the GST portal, which reduces errors and saves time for businesses. This simplifies the invoicing process, making it easier for businesses to file their GST returns accurately and efficiently.

In September 2016, the GST Council was established. Its 35th meeting is very relevant during a discussion on e-invoice. The 35th meeting decided to implement the GST Council’s decision to implement a system of e-invoicing, covering specific categories of persons, mostly large enterprises. Gradually the implementation will also be covered even medium enterprises as well as small-scale businesses. E-invoicing does not refer to the creation of invoices within the GST portal; rather, it involves the act of uploading a pre-generated standard invoice onto an e-invoice portal.

As per notification no. 69/2019-the central Tax released by the CBIC (Central Board of Indirect Taxes and Customs) in India has notified a set of common portals to enable e-invoice preparation. The system pointed out that business firms can submit the invoice details once, and automation is enabled, which means the details will be automatically used for various reporting requirements. The use of e-invoicing portals helps businesses automate their reporting process and avoid errors in manual data entry.

Applicability of E-Invoice

As per the rules of the Indian GST Act, e-invoicing is mandatory for businesses with a turnover exceeding INR 50 crores in any financial year starting from 1st April 2021. Such businesses are required to generate e-invoices for all B2B transactions, exports, and SEZ supplies. However, certain businesses may be exempted from e-invoicing under specific circumstances as notified by the government. E-invoicing is expected to improve compliance, reduce errors, and facilitate the smooth flow of input tax credits across the GST system.

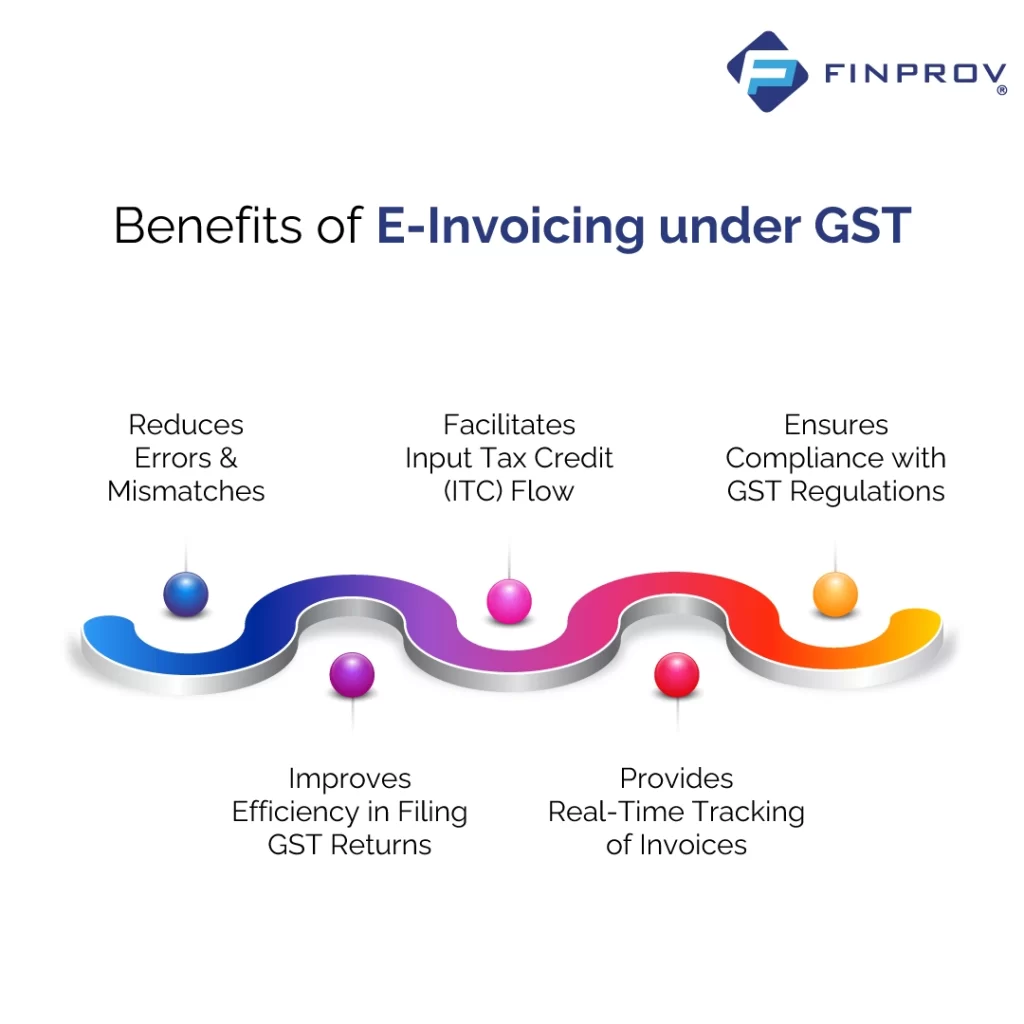

Understanding the Benefits of E-Invoicing under GST

E-invoicing under GST has become a crucial aspect of tax compliance for businesses in India. Let’s explore the benefits of implementing e-invoicing in your business processes.

Reduces Errors and Mismatches

One of the significant benefits of e-invoicing is the reduction of errors and mismatches. Manual data entry can be addressed as a time-consuming process and is prone to errors. With e-invoicing, the data is directly uploaded to the central government portal, reducing the possibility of errors.

Improves Efficiency in Filing GST Returns

E-invoicing has made the process of filing GST returns more efficient. The data is directly transferred to the GST portal, reducing the need for manual data entry. This simplifies the invoicing process, making it easier for businesses to file their GST returns accurately and efficiently.

Facilitates Input Tax Credit (ITC) Flow

The input tax credit is a critical aspect of the GST system. E-invoicing facilitates the smooth flow of ITC across the GST system. With e-invoicing, the data is automatically transferred to the GST portal, making it easier for businesses to claim ITC.

Provides Real-Time Tracking of Invoices

E-invoicing provides real-time tracking of invoices. The unique identification number generated by the IRP lets businesses track the status of their invoices in real time. This helps businesses to manage their cash flows better and improves their overall financial management.

Ensures Compliance with GST Regulations

E-invoicing ensures compliance with GST regulations. The implementation of e-invoicing is mandatory for businesses having a turnover exceeding INR 50 crores. By complying with GST regulations, businesses can avoid penalties and legal hassles.

It is not only E-invoicing under GST, as there are multiple legal regulations and updates related to taxation systems and accounting practices. Keeping oneself up-to-date with these regulations can have a positive impact on one’s career, particularly for those aspiring to work in accounting, taxation, finance, and related fields. It is relevant to continuously update one’s skills and knowledge to stay relevant and updated in the industry.

If you are a job seeker or have a deep enthusiasm for starting a career in the accounting, taxation, or finance industry, Finprov provides an excellent opportunity to elevate your knowledge and skills. At Finprov, you can gain in-depth knowledge about income tax, GST, Gulf VAT, and accounting software such as SAP FICO, Tally Prime, MS Excel, etc. With a comprehensive study pattern and expert faculty, Finprov helps aspirants improve their career prospects.