Taxes play an important role in generating government revenues and public services. Understanding the complex tax system is essential for individuals and businesses, so understanding the difference between direct and indirect taxes is essential. Let’s learn about the different types of taxes in India and the differentiation between direct and Indirect Taxes.

Importance of Direct and Indirect Taxes in India

The direct and indirect taxes are very important in the economy of India by contributing to generating revenues, economic growth, and the distribution of wealth. Direct taxes are taxes imposed on individuals and businesses. It includes income and corporate taxes for generating revenue for the government. These are major sources of income for the government, which are used for investing in developing infrastructure, public services, and programs on social welfare.

The direct tax can help to reduce the inequality in income by providing a progressive tax structure. So the individuals who have higher incomes have to pay more tax, to ensure a fair distribution of the burden of tax, which helps to bridge the wealth gap and provide social welfare.

The indirect taxes are imposed on the consumption of goods and services instead of on income. The GST implementation has helped to eliminate the different indirect tax systems that existed in India and reduced the cascading effect. GST helped to improve the transparency, simplified the procedure for compliance, and improved the collection of tax.

Indirect taxes can impact the economy of India, as they can influence customer behavior and help to protect the domestic industries. They can be used as a tool by raising the cost of specific goods or services that are harmful or luxurious. Also, the customs impose a tax on the imported goods, which can help to protect the domestic industries, and encourage people to use the local production by reducing the purchase of foreign products.

Overall, for the growth of the Indian economy, the implementation and balance of the direct and indirect taxes are very important, which ensures sufficient revenue collection, reduces the inequality in terms of income, and encourages economic activities.

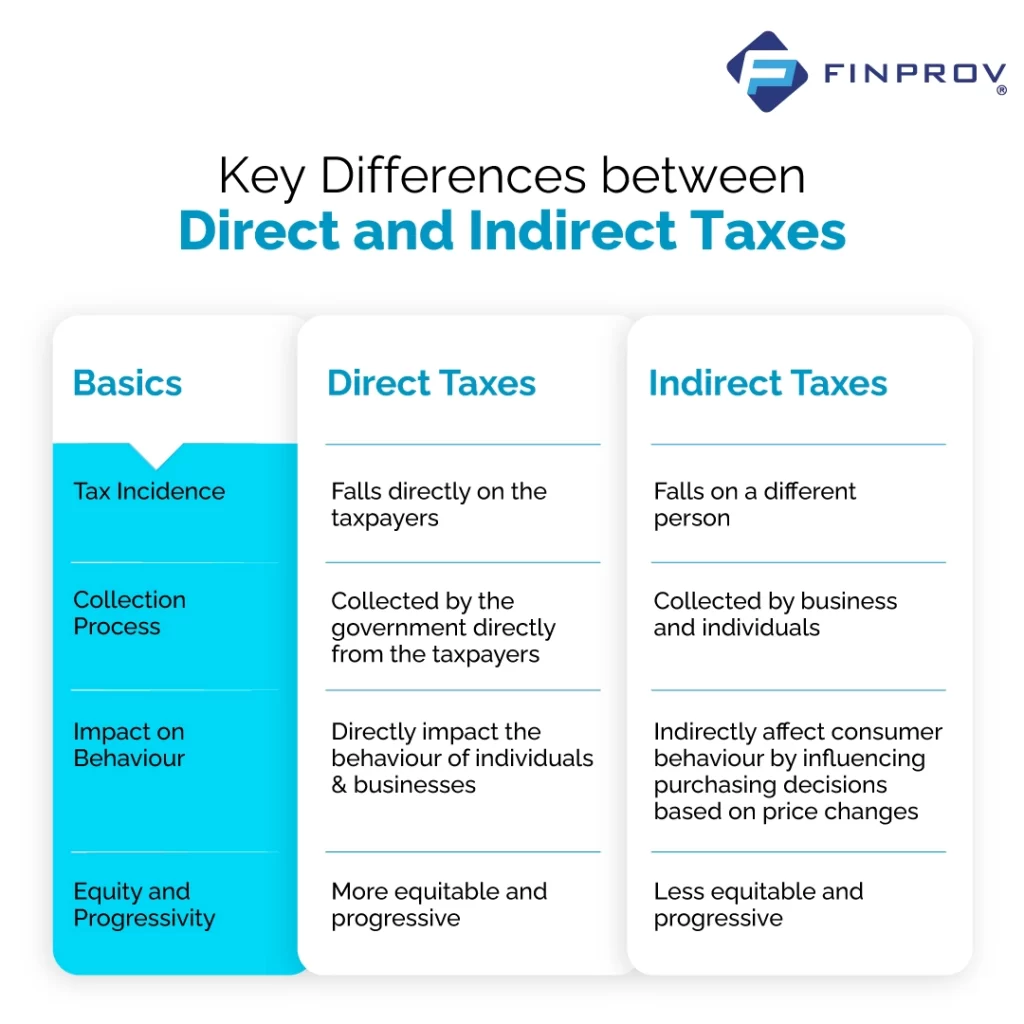

Key Differences between Direct and Indirect Taxes

1. Tax Incidence

One of the major differences between indirect and direct taxes is based on the distribution of the tax among businesses and individuals. The burden falls on the taxpayers directly based on the income tax or corporate tax. They have to pay the tax on their income or salary. In the case of indirect taxes, the taxes are passed to the end customers, and they are added to the final price of the product or service.

2. Collection Process

Direct taxes are directly collected from taxpayers by the government. There are many mechanisms to ensure compliance that include tax return filings and audits. The taxpayers have to calculate their taxable income, find the applicable tax rate, and make payments to the government. On the other hand, the indirect tax is collected by businesses and individuals at the time of purchase of the goods or services. Business entities are responsible for collecting this tax, and they remit it to the government.

3. Impact on Behavior

The direct taxes can directly influence the decisions of individuals and businesses. When the income or profit is high, individuals would feel less motivated to make extra income or make investments. Businesses can also reduce their profits, which can lead to a slowing of the growth plans or expansions.

Indirect taxes do not affect their behaviour directly because they are included in the prices of the goods and services. But sometimes people may change their choices when buying products or services if the prices are high due to taxes.

4. Equity and Progressivity

Direct taxes are considered to be more progressive than indirect taxes. Direct taxes are designed to be progressive, which means that the tax increases with an increase in income. This allows the higher-income individuals to contribute more in taxes. On the other hand, indirect taxes can be regressive as they have more impact on the people who have lower incomes. Since the indirect tax is the same for everyone, it can be a burden for people who have low incomes.

Direct Taxes: An Overview

Direct taxes are imposed on individuals or organizations, and they cannot be shifted to another entity. These taxes are progressive because they increase with the increase in salary or profits.

There are many direct taxes in India, and they include different areas like income tax, corporate tax, wealth tax, and capital gains tax. The income tax is the most common form of direct tax, and it is imposed on the salaries of individuals, Hindu Undivided Families (HUFs), and some categories of firms and companies. On the other hand, the corporate tax is imposed on the profits that are earned by companies and corporations. Even though the wealth tax was abolished in 2015, it was imposed on individuals and HUFs with more wealth. The capital gain tax is charged on the profits or gains obtained by selling an asset like stocks, real estate, or mutual funds.

Income Tax:

Income tax is applied based on the earnings of individuals and companies from different sources, such as salary, investments, or business activities. They are progressive because they increase with the increase in income.

Corporate Tax:

Corporate tax is applied to companies and is organized based on the net profits. These tax rates depend on the turnover of the company and legal structure, such as whether it is a domestic or foreign corporation.

Wealth Tax:

The wealth tax was abolished in 2015. This tax was charged on individuals who have more wealth. The calculation of the wealth tax was based on the market value of the specified assets, such as jewelry, real estate, and investments.

Indirect Taxes: An Overview

The indirect taxes are charged on producing, selling, or consuming goods and services. The burden of this tax is imposed on the end consumer. Examples of indirect taxes in India include Goods and Services Tax (GST), excise duty, and customs duty, which are charged on the manufacturing, selling, or consuming goods and services. This burden is then shifted to the end consumer who pays the price of goods and services.

Some of the common indirect taxes include goods and services tax (GST), customs duty, and excise duty. GST was introduced in 2017, and it helped to replace many indirect taxes like central excise duty, service tax, and value-added tax (VAT). This tax is applied to goods and services throughout India.

Goods and Services Tax (GST):

GST is one of the indirect tax systems in India to replace different state and central taxes. This tax is imposed on the value added at each stagein a supply chain, starting from the manufacturer and ending with the customer. It has helped to simplify the taxation process and made it easy to do business.

Excise Duty:

It is charged on producing and selling goods in the country. This is included with the final price of the product by making it an indirect tax. These tax rates may differ based on the type of goods.

Customs Duty:

Customs duty is one of the indirect taxes that is imposed on goods that are imported into or exported out of the country. This tax is collected by customs, and it is collected based on the value, quantity, and nature of the goods.

Implications and Impact on Individuals and Businesses:

The direct taxes play an important role in the country to reduce the inequality in income and redistribute wealth. These taxes are more progressive because they are imposed based on the individual’s or the company’s income or profits.

In the case of indirect taxes, they affect individuals and businesses uniformly. These taxes are added to the price of the goods and services, so they can impact all customers. This tax can affect individuals who have a lower income, as they are required to pay a major portion of their income for buying required goods and services.

Conclusion

Learning about the differences between direct and indirect taxes is essential to learn how the taxation system of India functions. Understanding the updates in tax can affect career opportunities in the accounting field. If you have knowledge and practice in GST, Income Tax, VAT system, and tax filing, then your job role in an organization is important. So, updating and developing knowledge in this area can help you get a job in the roles you want.

At Finprov, you can get the best practical and job-oriented training that includes real-life case studies in the accounting course. Our expert faculty can help you gain knowledge of different accounting software and accounting concepts. Our team offers effective training in Income Tax, GST, Gulf VAT, SAP FICO, Tally Prime, MS Excel, Zoho Books, and more. We equip candidates with skills to excel in the accounting field.

FAQs

Q1. What is a direct tax?

A direct tax is a tax that is imposed on individuals and organizations. This burden cannot be transferred to another person, and it should be paid by the taxpayer to whom it is imposed.

Q2. What are the goals of a direct tax?

The main goals of a direct tax is to reduce income inequality in the country. These taxes are progressive in nature, and people or businesses with higher income or profits have to pay a higher amount of tax.

Q3. What are indirect taxes?

Indirect taxes are taxes imposed on the production, sale, or consumption of goods and services. This tax is paid by the end consumer with the final price of goods or services.

Q4. What are the taxes under indirect taxes?

The taxes under indirect taxes include GST, excise duty, and customs duty. GST has helped to eliminate multiple indirect taxes, excise duty is applied to manufactured goods, and customs duty is charged on imported and exported goods.

Q5. What makes indirect taxes important?

Indirect taxes are important because they provide a steady revenue for the government. They are easy to collect and are applied uniformly to goods and services across the economy.