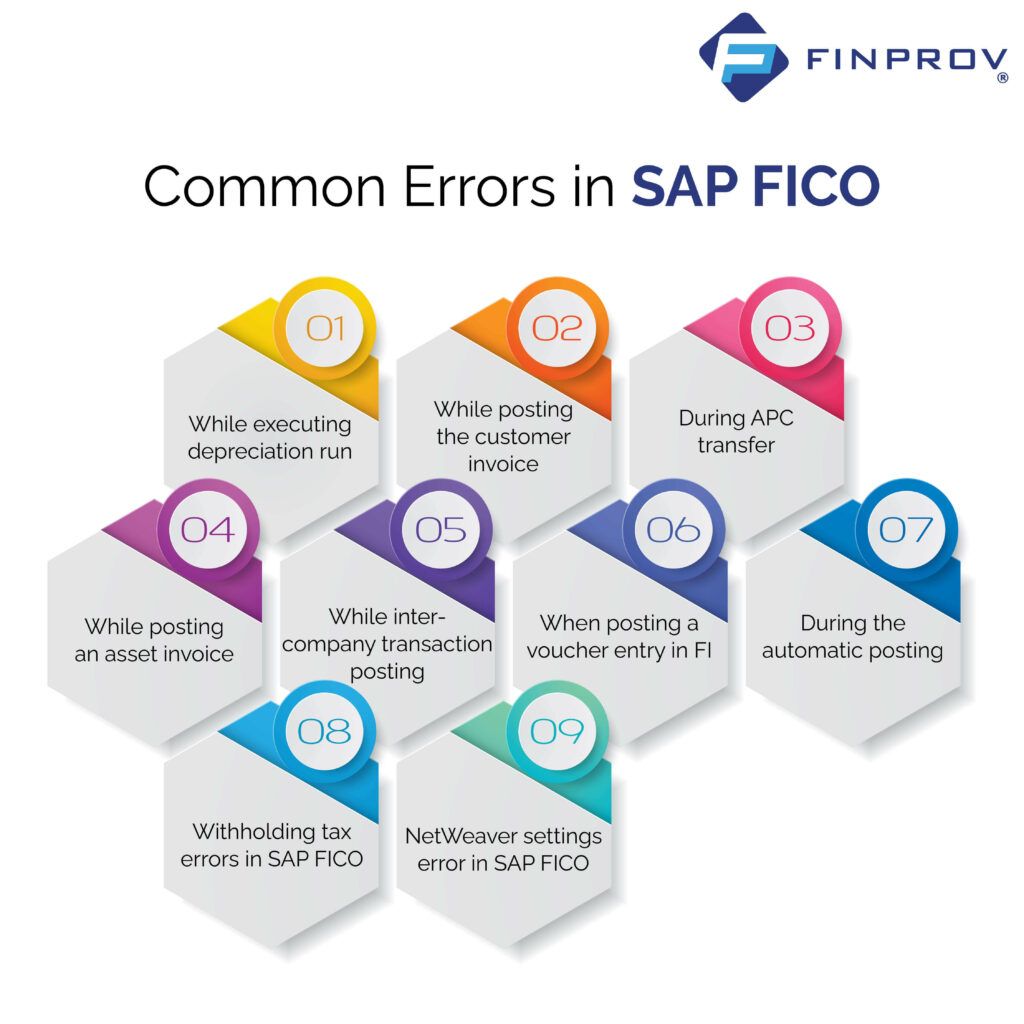

It is common to encounter errors in the testing phase while implementing SAP FICO. SAP FICO consultant must run a trial and error method and check back-end work and configurations to resolve this issue. Below are some SAP FICO common errors you may face while dealing with SAP FICO implementation projects and their solutions. Undoubtedly it will add to your practical knowledge. This knowledge will not only improve your efficiency but also will help you excel in various job interviews.

Why do you need to understand the common errors in SAP FICO?

Errors will occur in the different stages of the configuration and implementation of SAP. While working on this project, you will likely experience such mistakes daily. So you should understand these common errors and derive suitable solutions. To better understand, we have listed below some common errors you will likely face during your project configuration and implementation.

SAP FICO Common Errors & Solutions

Error 1- While executing depreciation run.

The transaction is area NN may contradict the net book-value rule. You will likely get this error while posting value to an asset, like unique or unplanned depreciation. It would give a negative value to the asset’s net book value.

You can rectify this error by going to the depreciation area configuration in the chart of depreciation and changing the values of “all values allowed”. Before changing the layout, make sure that you are in favour of negative net book value. If not, it is better to check your transaction.

Error-2 While posting the customer invoice

For any account, only output tax is allowed. You may experience such errors when you face restrictions on the type of tax codes allotted to GL accounts. In such cases, go to FS00 and check the control data tab/tax category field. If you are still adamant about rectifying the error, you may have to change the tax category.

Error-3 During APC transfer

ASKB is the transaction in SAP used for the timely posting of asset APC values to G/L. You need to maintain the issues and matters that have to be fixed. If you fail to maintain the account determination during configuration, you will get a profit centre balancing error. To solve this issue, check the related depreciation area and verify whether the account determination cost objects have been maintained in ACSET.

Error-4 Client gets an error in SAP FICO while posting an asset invoice.

If you do not maintain the tax code during configuration while posting an invoice, errors like charts of accounts not defined in SAP FICO tables are likely to occur. You can easily resolve this issue by assigning the tax code to the G/L account. You must go to Tcode OB40=> provide chart of account=> transaction=> and assign G/L to the tax code.

Error-5 While inter-company transaction posting

While posting intercompany transactions, you are liable to receive such errors. It occurs when one of the company codes is on extended withholding tax setting, and another is on standard withholding tax setting. To rectify this error, you need to check the setting in IMG. Go to financial accounting, then to financial accounting global setting, company code and activate extended withholding tax. You cannot post a single cross-company code posting. So, you will have to post two entries in each company code. Afterwards, decide whether you want to bring both company codes to extended withholding tax.

Error-6 When posting a voucher entry in FI

If the G/L account is mandatory for cost accounting, i.e. you have to create a primary cost element for the account, you may receive this error message. In such cases, your system will require a cost object(internal order, cost centre, WBS element etc.) while posting, as it has to be done automatically in SAP controlling.

Error 7- During the automatic posting

You will have to manually assign the cost objects when you encounter automatic postings like gain or loss. You have to set a default cost object to the account.

Error-8 Withholding tax errors in SAP FICO

You may face these errors when you assign multiple lines with the same tax type for business transactions. In a business transaction, only one entry is allowed for tax type in SAP. You must create multiple tax types if you have to insert multiple lines.

Error-9 While intercompany transaction posting

You will get these errors if your company code pair has not been set up for cross-company code posting. You can resolve this issue by making a configuration change in OBYA. Your company codes must have the same withholding tax setting, i.e. either classic or extended.

Error-10 NetWeaver settings error in SAP FICO

This error occurs when you have not maintained the conversion factor for the currency pair in the system. To rectify this error check the currency pair in IMG. Go to general settings and currencies and define translation ratios. If the currency pair is not maintained, do it for the pair.

To become an SAP FICO consultant, you must be well-versed in the software. Not only must you have practical knowledge, but you also must be well aware of the common mistakes and errors you encounter while working on it. Remember that you can only learn from your mistakes. So understand them clearly and try to find all suitable solutions. Finprov learning is an ideal solution for all accounting certification courses. Enrolling in an SAP FICO certification course would be a great idea if you have dreams of becoming an SAP FICO consultant. For more details, you can visit their home page.