The Goods and Services Tax (GST) concept had to go through different considerations by several governments in India, and it was implemented on July 1, 2017. The main goal of introducing GST was to establish a ‘One Nation One Tax’ system. GST has fully absorbed, integrated, and replaced all the diverse taxes that existed across the country, and categorised them into:

- Central Goods and Services Tax (CGST) has replaced all central-level indirect taxes, including the principal excise duty, surcharges, cesses, and other indirect taxes imposed by the central government.

- State Goods and Services Tax (SGST) has replaced the state-level taxes like VAT, sales tax, state cesses, surcharges, and other state taxes.

- Integrated Goods and Services Tax (IGST) is imposed on the inter-state supply of goods and services, by ensuring a uniform tax rate for transactions across state borders.

History of CGST

Established under the CGST Act of 2016, the CGST Act replaced several taxes, including the central sales tax, additional customs duties, and other excise duties. CGST is imposed on the interstate movements of goods and services and can be adjusted by another distinct authority. The states can claim the input tax credits while the central government collects revenue using CGST.

Objectives of the CGST

Some of the main objectives of this Act, implemented in 2017, include:

- Before introducing GST, the Central and State Governments imposed different taxes on the same product, leading to double taxation. This was a burden for the manufacturers and supply chain holders.

- Double taxation led to a high rate of tax evasion and cascading effects in the tax system.

- The free flow of trade across the country was hampered by the presence of octroi, entry tax, and checkposts.

- As multiple taxes were imposed, taxpayers faced a heavy compliance burden.

To overcome these obstacles and promote free trade, GST was introduced on July 1, 2017. It included the Central Government imposing taxes in the form of CGST, and the states implemented SGST.

Features of the CGST Act 2017

Some of the notable features of this act include:

- CGST is applied to all intra-state transactions of goods and services.

- It broadens the scope of the input tax credit, ensuring that the taxes are paid on the supply of goods and services.

- The taxpayers can self-assess and check the taxes they owe under CGST.

- CGST conducts audits, which help taxpayers ensure compliance with the regulations of this act.

- CGST has mechanisms that can recover tax areas, including detaining and restricting the sales of goods and properties.

- Provisions in the CGST allow imposing fines or penalties in cases where taxpayers are non-compliant.

- CGST helps to reduce the overall tax burden on several consumer goods and services.

CGST Rules

The common rules under this act include:

- The tax invoices must be issued for taxable goods and services when you are already registered for GST.

- The bill of supply is issued if registration is done under the GST composition scheme.

- All the invoices should have unique serial numbers, and they are noted sequentially.

- When you are already registered for GST, the tax invoices must be issued for the goods and services.

- Make sure that the GST invoices include your name, address, supply place, and GSTIN.

- The SGST and CGST are filed equally, which means that if the GST rate is 18%, the CGST is 9%, and the SGST is 9%.

- IGST must be imposed for the sales involving out-of-state businesses.

- It is advisable to desist from buying goods or services from unregistered dealers.

- Make sure you file GST correctly for intrastate and interstate sales.

- The tax invoice must accompany all sales of taxable goods and services.

- Collect the tax invoices for all your purchases.

- Make sure that your documents include your and the client’s GSTIN.

- Submit all the required documents on time to avoid penalties.

Documents Required for CGST Registration vary based on the category of Taxpayers

For individuals and entrepreneurs:

- Pan card of the owner.

- The Adhard card of the owner.

- Photograph of the owner.

- Residential proof

- Bank account details

For partnerships:

- Deed of the partnership

- PAN card of the partners

- Photographs of the partners

- Aadhar cards of any of the authorised signatories.

- Proof of the LLP Registration

- Bank account details

- Address proof of the business

For the Hindu Undivided Families:

- PAN card

- Family patriarch’s PAN card

- Photograph of the owner

- Proof of the address

For Companies:

- PAN Card of the company

- Incorporation Certificate from the MCA

- Memorandum or Articles of Association

- Appointment Proof of Signatory

- PAN Card of Signatory

- Aadhaar Card of Signatory

- PAN Cards of all the Directors

- Residential Proofs of the directors

- Details of the bank accounts

- Address Proof

For clubs and societies:

- Copy of the Registration Certificate

- Copies of the PAN Card of Associated Partners or Promoters of the Club or Society

- Bank Account Statement, Crossed Cheque, or the Passbook’s first page copy

- Registered Office Address proof

- The Authorisation Letter that is signed by the Authorised Signatory

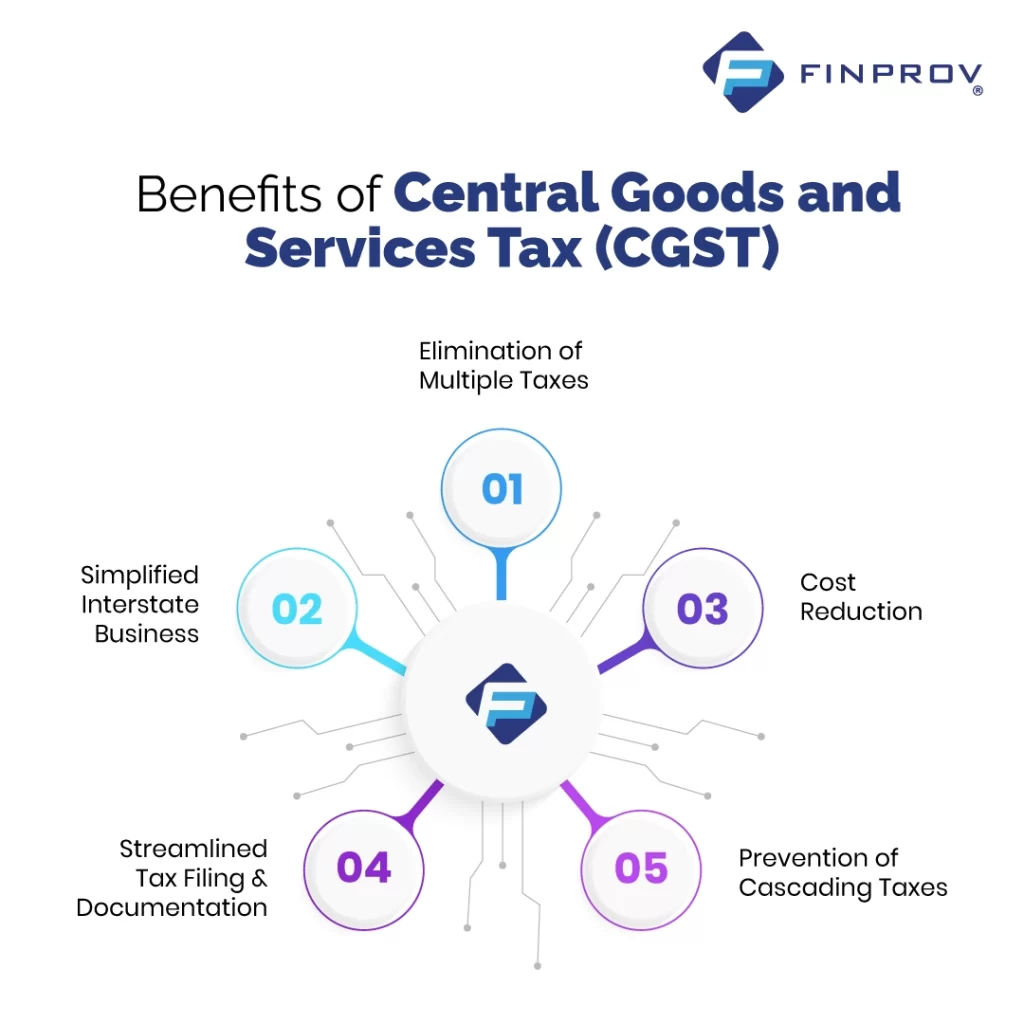

Benefits of Central Goods and Services Tax (CGST)

- Eliminates multiple tax systems: CGST has replaced all the previous tax systems where the Centre and states imposed different tax rates on the same goods and services. This consolidation helped to eliminate the burdens of multiple taxes on goods and services.

- Cost reduction: CGST helped to reduce the cost of goods and services, resulting in consumer savings.

- Simplified interstate business: The uniformity of the CGST across all the states simplified the interstate business operation and eliminated the concerns about varying tax rates.

- Streamlined the tax filing: The CGST helped to streamline the filing of tax and documentation processes, which made the compliance more efficient and hassle-free for businesses.

- Prevention of the cascading taxes: By taxing based only on the margin price, the CGST has helped to prevent the overall tax structure of India.

The CGST has an important role in unifying the tax system of India by replacing the different tax systems that existed across the country. The CGST Act has made compliance easy, reduced the burden of extra taxes on the same products, and improved the intrastate transactions. Along with the SGST, IGST, and CGST, they help to maintain a consistent tax system across the whole nation. Overall, the CGST has helped to strengthen the taxation framework of India by promoting ease of doing business, increasing the government’s revenue, and supporting long-term economic growth.

To effectively understand and apply these GST provisions in practical business scenarios, proper training and professional guidance play an important role. Joining a GST certification course can improve your efficiency in managing the GST accounting software for businesses. Finprov is a reputed institute that offers the GST course that helps learners to get a deep understanding of the GST principles and practices with real-life examples. This course is best for graduates, chartered accountants, company secretaries, finance professionals, tax professionals, and individuals looking for career opportunities.

The GST program offered by Finprov covers a wide range of important topics such as fundamentals of GST, Input Tax Credit, Composition Scheme, GST return filing, E-way bill, Time of Supply, Place of Supply, Reverse Charge Mechanisms, etc. It helps the graduates and professionals expand their knowledge in the accounting and finance field. By choosing Finprov for the GST certification course, you can achieve high-quality and valuable education.

FAQs

1. What is the Central Goods and Services Tax (CGST)?

It is the tax imposed by the central government on the intra-state supply of goods and services. It has helped to replace multiple central indirect taxes, such as excise duty and service tax, and simplified the tax structure of India.

2. What is the main goal of the CGST Act?

The main goal is to eliminate double taxation, reduce tax evasion, and create a unified tax system. It helps to make the tax compliance easier and promote the free movement of goods for free.

3. How is the CGST different from SGST and IGST?

CGST is collected by the central government on intra-state transactions, and SGST is collected by state governments on the same transactions. IGST is applied to the inter-state transactions and imports, ensuring uniform taxation across state borders.

4. Who needs to register under the CGST Act?

Businesses whose turnover exceeds the prescribed GST threshold limit must register under the CGST Act. Registration is also mandatory for certain categories of taxpayers, such as interstate suppliers, e-commerce operators, and individuals liable under the reverse charge mechanism.

5. How can a GST program help in understanding CGST better?

A GST course provides practical knowledge of CGST provisions, GST return filing, input tax credit, and compliance requirements. It helps professionals and students gain hands-on experience with GST accounting software and improves career prospects in taxation and finance.